Introduction to Consumer Staples Companies

Introduction to Consumer Staples Companies

Consumer staples companies engage in some or all of the following sectors: they produce a beverage, food, and tobacco products; they manufacture personal and household products (otherwise called hygiene products); they distribute and retail food and staples.

The consumer staples sector is regarded as non-cyclical, meaning demand is always there no matter the economy’s situation. Companies that operate in this sector do not experience business cycles. Another defining quality of consumer staples is price inelasticity, meaning the demand level is barely touched in price fluctuations. It is because staples are necessities that consumers cannot help to stop buying.

This sector comprises six industries under which stocks are classified. First, there is Food and Staples Retailing. Companies under this category are either distributors or retailers of food and staples. They include Wholefoods, Walmart, Safeway, and more. Secondly, there is a Household product category that comprises companies producing and supplying hygiene products.

Then, there Beverage industry that includes brewers of soft drinks like Coca Cola. Food Products is the other category that provides companies with engaging in producing and distributing packaged foods and agricultural products. The last two types are Tobacco and Personal Products. Major companies here are British American Tobacco, Reynolds, Altria Group, and Revlon & Avon.

Why Should You Invest in Consumer Staples?

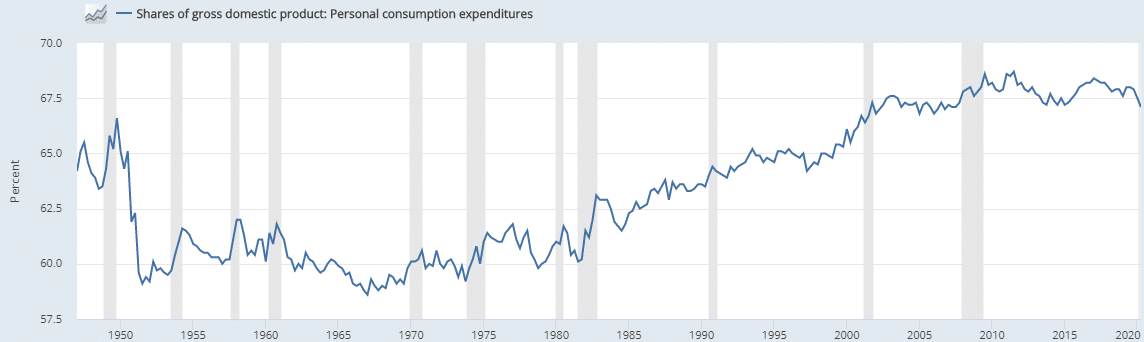

Consumption is the most significant element of a country’s gross domestic product. Personal consumption alone has made up more than 50% of the annual GDP for much of the last seven decades in the United States. The second quarter of 2020 saw personal consumption accounted for 67.1% of US GDP.

Consumer staples, therefore, are ideal for long-term growth. Businesses in the sector do not experience the demand swings resulting from short-term economic cycles, and so their value tends to expand steadily over time. That is why you will often hear investors refer to consumer staples as recession-proof or defensive stocks.

Other than being dependable, consumer staples have a long history of paying generous dividends. The stabilizing effect of consumer staples is excellent for balancing one’s portfolio. Because of the non-cyclical nature of consumer staples, the volatility of the stocks is low.

Besides, demand for consumer staples is almost the same everywhere on earth. As such, companies operating in this sector can develop immense economies of scale. These companies can leverage their products’ repetitive use across the globe to create a steady stream of revenue that can only increase.

Top Consumer Staples Sector ETFs

Apart from consumer staples stocks, you can find more stability in sector-focused exchange-traded funds (ETFs). Top ETFs in this sector include:

Consumer Staples Select Sector SPDR Fund (XLP)

State Street Global Advisors first issued XLP in December 1998. The open-ended fund tracks an index of consumer staples weighted based on market capitalization, and it is the sector’s largest with assets under management worth $14.09 billion. Target consumer staples stocks are picked from the S&P 500 index. The top three include Procter & Gamble Company (17.10%), PepsiCo, Inc. (9.81%), and Coca-Cola Company (9.56%). According to MSCI ESG Fund Rating, XLP scores 67.5%, which is an A-rating.

Vanguard Consumer Staples ETF (VDC)

VDC is the second largest consumer staples ETF with AUM valued at $5.56 billion. A-rated by the MSCI ESG Fund Rating (64.7%), VDC draws its stocks from the entire US market of consumer staples. The fund has 95 holdings, all weighted as per market cap with the weighting for the top ten companies accounting for 64.65% of the total. The three weighty holdings for the fund include Procter & Gamble Company (15.22%), PepsiCo, Inc. (9.35%), and Coca-Cola Company (9.25%).

Fidelity MSCI Consumer Staples Index ETF (FSTA)

FSTA picks its preferred stocks from the US consumer staples sector, all of which are market-cap-weighted into an index. The fund holds interests in 94 consumer-staples shares where the total top 10 weighting is 68.83%. The three most valuable holdings are Procter & Gamble Company (15.72%), Coca-Cola Company (9.29%), and PepsiCo, Inc. (9.06%).

How to Invest in Consumer Staples ETF

ETFs are always the next best asset if you do not feel like investing in single-name stocks. Admittedly, the profit potential of individual stocks trounces that of ETFs. However, the ETFs offer the lowest risk you can wish for while providing comfortable earnings at the same time.

Investing in consumer staples, ETFs are necessary, especially for those who wish to defend their portfolio in recessions. Undoubtedly, the sector offers stability, but one should not assume that this is given. So, it would help if you did not make investments in the ETFs at face value. Instead, you need to do exhaustive background research, especially on the qualities of each of the holdings and their underlying strength.

Each company in a fund’s portfolio has its unique challenges and potential. It would be better if a majority of the holdings show great potential for more substantial growth. Also, always ensure that the relationship between the dividend yield and the expense ratio is logical. The better if the expense ratio is low enough to increase your earnings.

Final Thoughts

Consumer staples make up the largest share of any economy’s GDP. Specifically, personal consumption takes place regardless of the state of the economy, meaning that investing in consumer-staples stocks offers the assurance of long-term value and stability in recessions.

Many of the consumer staples companies are valuable, and their stock is highly liquid. Nevertheless, the activity of picking winners for investment has never been easy. Also, unsystematic risk is higher when you go for single equities. Instead, ETFs offer investors a chance for exposure to a larger share of the sector’s equities. Consumer staples ETFs track an index of stocks in the sector, often weighted as per their market cap.

Introduction to Consumer Staples Companies

Introduction to Consumer Staples Companies