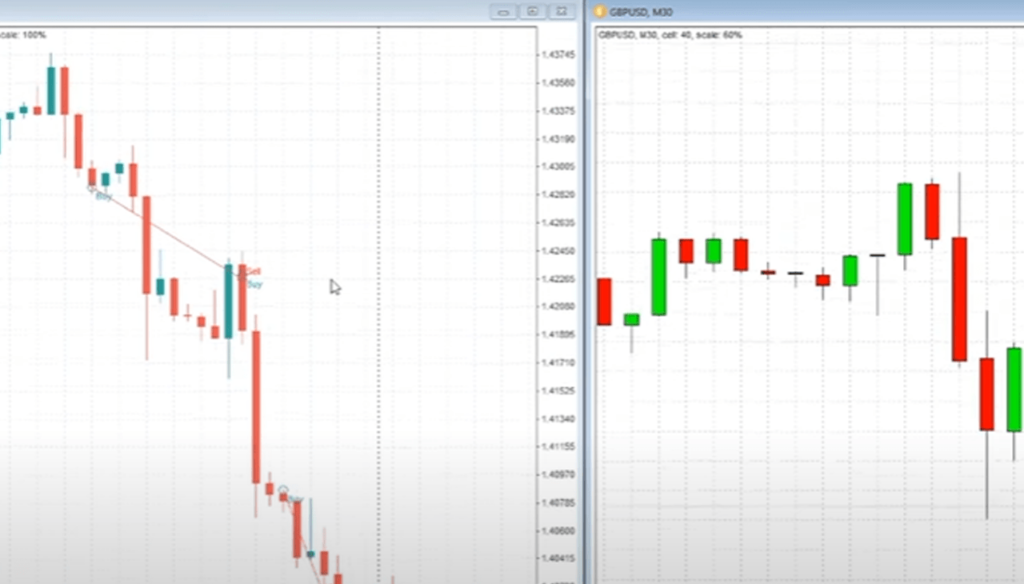

Forex Tester is a popular trading simulator that allows traders to backtest their trading strategies and improve their skills. With its user-friendly interface and extensive features, Forex Tester has become a go-to tool for many traders looking to enhance their trading performance. In this review, we will take a closer look at the key features and benefits of Forex Tester, as well as its limitations, to help you decide if it’s the right tool for your trading needs.

Key Features of Forex Tester

Forex Tester is a popular trading simulator designed to help traders test and improve their strategies. Here are some key features of Forex Tester:

- Historical Data: Forex Tester provides access to historical market data for various currency pairs, allowing traders to test their strategies in different market conditions.

- Multiple Timeframes: Traders can test their strategies on multiple timeframes, from tick data to monthly data.

- Customizable Indicators: Forex Tester allows traders to use custom indicators in their testing, giving them more flexibility in their analysis.

- Backtesting Reports: The software generates detailed backtesting reports that traders can use to analyze their performance and identify areas for improvement.

- Trading Simulator: Forex Tester’s trading simulator allows traders to practice trading in a risk-free environment, helping them gain confidence and experience before trading with real money.

- Strategy Optimization: Traders can use Forex Tester’s optimization feature to fine-tune their strategies for maximum profitability.

Overall, Forex Tester is a powerful tool for traders who want to test and improve their trading strategies. With its rich features and easy-to-use interface, it’s an ideal platform for both novice and experienced traders.

Customizable indicators and strategies

Customizable indicators and strategies are a key aspect of Forex Tester that makes it stand out from other trading simulators. The software allows traders to use custom indicators and strategies in their testing, giving them more flexibility and control over their analysis.

Traders can import their indicators or use the built-in indicator library, which includes popular indicators like Moving Averages, Bollinger Bands, and RSI. They can also create custom strategies using a variety of tools, including technical indicators, price action, and chart patterns.

Once a strategy is created, traders can backtest it using historical market data to see how it would have performed in different market conditions. They can then analyze the results and make adjustments to optimize their strategy for maximum profitability.

With its customizable indicators and strategies, Forex Tester provides traders with a powerful tool for testing, analyzing, and improving their trading performance. By allowing traders to test their ideas in a risk-free environment, Forex Tester helps them gain valuable experience and confidence before they start trading with real money.

Automated trading capabilities

Forex Tester does not have automated trading capabilities. It is a manual trading simulator designed to help traders test and improve their strategies by manually placing trades based on their analysis of historical market data.

While Forex Tester does not provide automated trading capabilities, it does offer a wide range of tools and features to help traders develop and optimize their manual trading strategies. These include customizable indicators and strategies, multiple timeframes, and backtesting reports that allow traders to analyze their performance and identify areas for improvement.

Additionally, by using Forex Tester’s trading simulator, traders can practice trading in a risk-free environment, gain valuable experience, and build confidence before they start trading with real money. This can help them make better trading decisions and improve their overall trading performance over time.

Overall, while Forex Tester does not have automated trading capabilities, it provides traders with a powerful platform to test and improve their manual trading strategies, helping them achieve greater success in the markets.

Risk management tools

Forex Tester provides several risk management tools that traders can use to manage their exposure and protect their capital. Here are some of the risk management tools available in Forex Tester:

- Stop Loss Orders: Traders can set stop loss orders to automatically close out a trade if it reaches a certain price level, helping to limit potential losses.

- Take Profit Orders: Traders can set take profit orders to automatically close out a trade if it reaches a certain price level, helping to lock in profits.

- Trailing Stop Loss Orders: Traders can use trailing stop loss orders to automatically adjust their stop loss as the price moves in their favor, helping to lock in profits while minimizing potential losses.

- Risk/Reward Ratio Calculator: Forex Tester includes a risk/reward ratio calculator that traders can use to calculate the potential risk and reward of a trade before they enter it, helping them make more informed trading decisions.

- Position Sizing Calculator: Traders can use the position sizing calculator to determine the appropriate size of their positions based on their account balance, risk tolerance, and other factors.

By using these risk management tools, traders can better manage their exposure and protect their capital, reducing the risk of significant losses in the markets. Overall, Forex Tester provides traders with a comprehensive set of risk management tools to help them navigate the markets with confidence.

The Review

Summary

Forex Tester is a powerful manual trading designed to help traders test their strategies. It provides traders with a wide range of customizable indicators, strategies, and backtesting reports to help them improve their performance over time. Additionally, Forex Tester includes several risk management tools that can be used to manage exposure and protect capital. By leveraging the features and tools provided by Forex Tester, traders can develop a better understanding of the markets and take their trading to the next level.

PROS

- Test trading strategies with historical data to optimize results

- Includes customizable indicators and strategies for manual testing

- Provides a wide range of risk management tools to help traders protect their capital

CONS

- Does not have automated trading capabilities