Every investor knows that a volatile market can bring both good profit and loss. All risks must be considered and measures are taken before your investment portfolio shrinks to new lows. Diversification is a tool that can help you out in a long investment journey.

What is diversification?

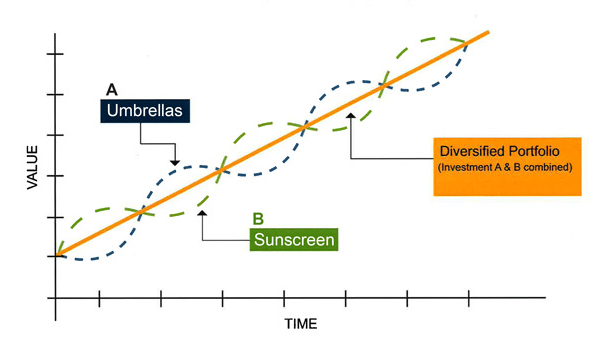

As in financial markets risk usually keeps up with the volatility, diversification is a way to reduce the possible decline of the value of the investments. In layman’s terms, to diversify means to purchase several types of securities, not correlated or connected to each other. The idea is that the price of each responds differently to the current phase of the economic cycle, increasing political or currency risks in a certain geography.

That helps your stock portfolio to grow faster, with less volatility, and to avoid significant drawdowns. Its effectiveness is confirmed by the fact that it is carried out by experienced individual investors, mutual fund managers, investment and hedge funds.

The diversified portfolio can be compared, with a general store in which you will find a wide variety of goods, i.e. the owner is not strongly dependent on the current weather, a month of the year, or purchasing power.

Diversification can take many forms, depending on your investment strategy or risk tolerance.

The basic point is the distribution of your savings among several types of securities, typically:

- Securities with the high potential, but also a higher risk of prices to fall: shares of young companies with new product or service, leveraged ETFs, narrowly focused companies and IPOs

- Securities with the limited growth potential, but also a lower risk of falling prices: large companies with strong cash flow, diversified market presence, strong and stable earnings. Companies, that form the country economy, can be supported by the government in windy times. As well as your portfolio;

- Securities with fixed income and safe-haven assets: this type can hold the lowest risk with growth limited to dividend yield if the stock pays dividends. At the same time, safe-haven assets may not pay a dividend but will grow mostly in a turbulent market environment.

It then depends on how risk averse you are. What part of your savings you will deposit in individual groups of stocks. More “aggressive” investors contribute about 80% of their funds in risky stocks. At the same time, conservative investors, usually have the majority of funds deposited in the last two groups.

5 valuable diversification tips for your stock portfolio

There are many options for diversified risks that are effective in a given situation. Nevertheless, one can single out the five most valuable tips that will be useful to both professionals and novice people for the right investment. Let’s check this out!

Expand your geography and cover different industries

You should consider different industries and regions to reduce risks. Your stock portfolio will benefit from a low connection between assets. The fact is that equities in the same industry are at equal industry risk. It makes sense since a protracted crisis in the field of oil industry, agriculture and any other sector can have a negative impact on all types of companies located in one place. That is why even if you distribute your investments to several companies in one sector, you can suffer losses. Use different industry niches and reduce regional risks. All of this can have a positive effect on future investments.

You should understand that the wide geography of investments also reduces risks. Political and government changes, elections, commodity prices and natural disasters cannot be predicted. But You can reduce your portfolio country risk by investing in different and stable economies. Nevertheless, a large number of investments should be accompanied by a detailed analysis of the market and macroeconomics data. It will be better if you spend some time on this or find a financial adviser for extra money to help you out.

Different rates of returns and risk

Now let’s talk about dividends, blue chips, and conservative consumer stocks in portfolio. The term blue chips define large companies that have a high weight in the stock market in terms of annual turnover and market capitalization. These are usually the flagships of economic indices, such as the S&P 500, Dow Jones, FTSE, or DAX. To be a blue-chip company needs to be highly liquid, strong financially, and usually included in major indices. Such companies usually give more conservative profits comparing to the stock exchange newcomers.

To let your portfolio grow mix conservative investments with more potential tech stocks, IPOs, or narrowly focused companies developing new products to the trending market. Add some dividend stocks or REITs to provide cashflow for to your investment account. Now you have a perfect mix of growth, confidence, and stable cash income.

Use ETFs

Adding ETFs to a portfolio can significantly simplify your goal. ETF stands for Exchange Traded Fund, which is traded as a stock on the exchange and usually composed from major stocks of a specific industry. These fund’s shares can be bought easily as well as securities of major companies. Buying different ETFs may reduce your industry and country risks and even provide your portfolio with dividends.

Here are the main ETFs benefits:

- High transparency,

- Low costs,

- Obtaining an index in one product,

- High liquidity,

- High degree of diversification.

ETFs are the best options if it’s hard to choose the best stock from industry, or there is no time for deep analysis.

Don’t forget defensive assets

Now let’s check the defensive or safe-haven assets. Such investments as shares of utility companies, gold miners, consumer product companies, tobacco and alcohol producers, are expected to retain or increase in value during times of market turbulence. They are able to produce cash in any market environment because of the stable demand for their products. Basically, at least 10% to 30% of the portfolio value should be in defensive assets. Each investor should understand that safe-haven assets are a necessary component for any investment portfolio. First of all, assets that practically do not lose value are most acceptable for saving money in case of market volatility. Gold and precious metals are a also important and consistently popular investment mediums, that save your cash from inflation.

The fact is that “gold” assets are a limited resource that can help to protect your funds from inflation. Alternatively, you can consider the VIX instrument. The volatility index grows when the market falls, but it is highly speculative. Sometimes it is worth to move a part of your portfolio to cash. That will give you a chance to acquire some great assets at low prices when the market drops. In any case, you have a lot of opportunities to diversify risks and use assets with the lowest density and risk for a potential investor.

Rebalance portfolio regularly

Rebalance is a smart technique that ensures that the distribution of your portfolio does not deviate too much from the original, thus maintaining the required risk. The portfolio is rebalanced by the sale of excess shares of a defined category. That can allow you to invest in new market opportunities if the environment has changed. If the portfolio had not been rebalanced and equities had performed well during the period, their weight would have increased and growth would continue to accelerate due to the composing effect. But the risk has also increased.

You may be wondering why excessive risk is a bad thing. If there is a relative increase in the equity component of your portfolio, its value will become more prone to fluctuations. This can negatively affect the achievement of investment goals and the entire investment may become unsuitable in long term.

Performing rebalancing means many operations and some specific knowledge. It is necessary to regularly monitor the development of the portfolio, check whether its distribution did not deviate from the required one and if so, calculate what equities need to be sold and what to buy in order to restore the structure. It may seem like a daunting task – which is why you may need financial advisor services for this.

Final words

Investing can be very tricky if you do not diversify your assets. Summarizing all of the above, you need to choose the most profitable assets at the moment, diversify the risks and find ways to retreat if the market situation is negative. This will be the key to your wealth and financial assets growth.