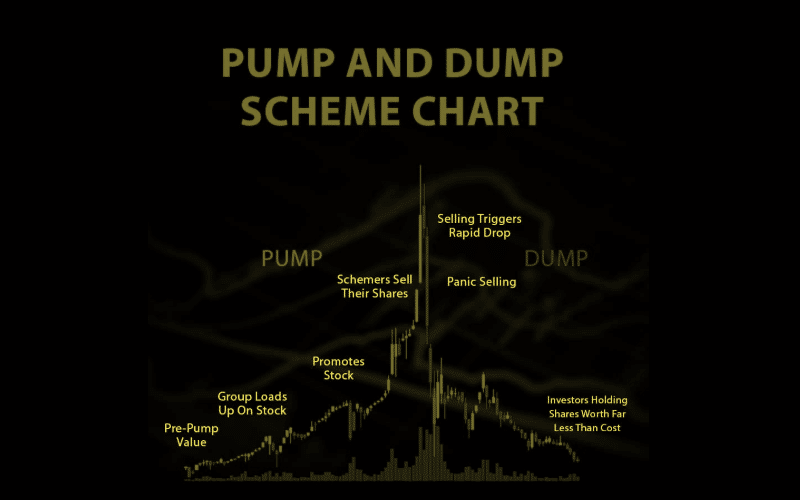

A pump and dump is a coordinated, intentional, short-term increase in the demand of a cryptocurrency which eventually leads to a price hike. Because of the features provided by the anonymity and encryption offered by chat applications such as telegram a discord, the occurrence of such misconduct has grown in the last few years.

Pump and Dump Actors

Organizer

The organizers of these schemes can be individuals or organized groups, typically those who use encrypted chat applications to coordinate the whole process. They have a distinct advantage of possessing insider information and are eventually the biggest beneficiaries of the whole scheme.

Participants

The participants for this scheme are mostly cryptocurrency traders who decide to collectively buy a certain coin after receiving the word from the organizer. The organizer provides complete information on which coin to buy, causing the proverbial “pump” in the price of the coin. This inadvertently causes them to buy coins at an already inflated price and become the ultimate victim of the scheme.

Target Exchange

The target exchange for the pump and dump scheme is the exchange selected by the pump organizer where the scheme will take place. Some exchanges themselves are involved with the pump and dump. A striking example would be Yobit, which has organized pump and dump schemes multiple times. There are three benefits for an exchange to be the primary pump organizer.

- If it acquires coins after a pump, it can profit by dumping those coins at a higher, inflated price.

- Due to the increased trading volume caused by the pump, it earns high transaction fees.

- Exchanges can utilize their first access to user’s order information for front running.

Example Of Typical Pump And Dump Process

Setting up

In the first step, the organizer which can either be an individual or a group can use social media group or channel which anybody can join. They recruit as many members and channel subscribers as possible through invitation links on major forums such as Reddit, Steemit, or Bitcointalk. Once the group obtains enough members (typically 1000), the group is ready to pump.

Telegram channels only allow subscribers to receive messages, but not the post discussions in the channel. To avoid member interference, the group admin usually changes the settings to not allow members to see default post messages.

The Pre-Pump Announcement

The pump organizer then announces details of the next pump a few days ahead, broadcasting the exact time and date of the announcement of a coin which would then precipitate a pump. Other information is also provided, including which exchange it will take place in, as well as the pairing coin. They usually advise the members to transfer sufficient funds into the particular exchange beforehand.

As the time for the pump approaches, the admin can typically send out countdowns to remind group members of the event. He/she can emphasize the pump rules where the pump members should observe the maximum profit.

Rules of Thumb for Pump and Dump Schemes

The typical rules for any pump and dump scheme include

- Making sure to buy fast

- The pumped coin on the exchange is shilled or promoted through social media to attract outsiders.

- The coin is “HODLed” for several minutes to provide outsiders the time to join in.

- The coin should be sold in pieces and not in a singular chunk

- The coin should only be sold at a profit and never below the current price.

The admin can also give members a pep talk to boost confidence and encourage their participation.

Coin Announcement

When the time comes, the admin announces the coin. This is typically done in the format of an optical character recognition proof image to prevent machine reading. After this, the admin urges members to purchase and hold the coin in order to inflate the price. The coin thus typically surges, increasing in the first minute of the scheme.

The Dump

The coin price eventually reaches its peak, usually in a few minutes. While the admin vehemently instructs to buy and hold in the channel, the coin price cannot stop falling after a point. Participants will typically start panic selling the moment the first fall in price appears. At this point, the price might be rebooted by the second wave of purchasers buying the dips. However, the price cannot help but bounce back to the start price or even lower in some instances. The decline of the coin price is an indication that the dump is ending. Most investors prefer to hold the coin rather than selling it at a loss.

The Role Of Exchanges

Pump and dump schemes usually take place within the confines of an exchange. Historically, exchanges such as Binance, Bittrex, Yobit, and the now-defunct Cryptopia have all been used by pumpers. While these exchanges have different volumes, markets, and audiences, they all have their own appeal to pumpers. Exchanges that have a larger user base, such as Binance can attract a large number of users to the exchange the moment there is an abnormal price hype.

On the other hand, smaller exchanges have a tendency to host smaller esoteric coins that possess low liquidity. The prices of these can easily be manipulated in comparison to major coins.

There have been instances where exchanges themselves are directly associated with the scheme. Yobit has been guilty of openly organizing pumps several times. The advantages of exchange to participate in a pump and dump scheme can include the high transaction fees due to increased trading volume or simply the profit earned by selling coins at a higher price.

Final Thoughts

Pump and dump schemes are one of the few things that have been plaguing the cryptocurrency space for quite some time now. All the signs point towards the admin or pump organizer profiting the most from such schemes. As an investor or trader in the cryptocurrency space, you must be aware of what characterizes a pump and dump scheme and should avoid it at all costs.