A Real Estate Investment Trust (REIT) is a company that makes money by buying or financing properties. The REIT industry was established in the 1960s with the goal of helping ordinary people invest in real estate. Today, there are more than 158 publicly-traded REITs in the US with a combined market cap of more than $1 trillion.

REITs vs other stocks

REITs are different from other companies like Microsoft, Walmart, and Google. This is because these firms need to meet several conditions to qualify as REITs. Some of these conditions are:

They must distribute at least 90% of their income as dividends to shareholders every year. Other companies don’t have to meet this requirement.

- At least 75% of their total assets must be invested in real estate. Other firms don’t need to do this.

- At least 75% of their income must come from rents on property or interest on mortgages.

- A REIT must be governed by a board of trustees.

- 50% of a REIT must not be held by 5 or fewer investors.

People invest in REITs for several reasons. First, because of the mandate to return 90% of their income every year, REITs usually have a higher dividend. In most cases, the dividend yield of public REITs is about 3.57%, which is higher than the S&P 500 average of 2%. Second, REITs are not correlated to the overall market. Third, like other publicly traded stocks, REITs are highly liquid assets.

There are several types of REITs, which include lodging, healthcare, office, cell towers, shopping centres, farmlands, self-storage, and data centres, among others. Healthcare, cell towers, and apartments are the biggest sectors in REITs, with a total market value of more than $144 billion, $156 billion, and $112 billion, respectively.

Equinix

Cloud computing is one of the fastest-growing sectors in the world. Indeed, the coronavirus pandemic has made many companies to realize the importance of transitioning their workloads to the cloud. According to Hosting Tribune, the cloud computing industry is expected to reach more than $623 billion of revenue in the next three years.

Cloud computing firms like Microsoft, Alibaba, and Amazon are well-known because of the products they provide. Unknown to many is that these companies rely on REITs to host their data centres worldwide. Equinix is the biggest data centre REIT in the US with a market cap of more than $66 billion. It has m ore than 200 data centres in 25 countries. It is also expanding its locations fast to deal with the rising demand.

The company provides data centre services to almost 50% of the Fortune 500 companies and about 35% of all Fortune 2,000 firms in the world.

The firm yields about 2.2%, which is above the S&P 500 average. It also has an AFFO ratio of about 44% and a credit rating of BBB-.

To starters, AFFO stands for adjusted funds from operations and is a common metric used in valuing REITs. To get it, you first calculate the FFO, which is the net income plus depreciation plus amortisation minus gains on sales of property. After getting the FFO, you subtract the capital expenditure.

Therefore, by investing in Equinix, you are investing in the biggest brands in a fast-growing industry. You are also investing in a company with excellent cash flows and a well-managed balance sheet.

Equinix has outperformed the S&P in the past five years

Digital Realty Trust

Digital Realty Trust is another excellent REIT you can invest in today. The company is the second-biggest data centre REIT in the world after Equinix. It has more than 155 data centres around the world. It serves hundreds of the biggest companies in the world. Among its top-ten biggest clients are IBM, Microsoft, and Facebook.

The only major difference between Equinix and Digital Realty is that the latter focuses mostly on colocation services. This is where it provides infrastructure while companies bring in their data equipment. It also focuses mostly on companies that prefer using hybrid computing approach. Hybrid is the fastest sub-section in cloud computing.

Digital Realty has a yield of about 3.09%, a credit rating of BBB, and an AFFO payout ratio of about 67%. To be fair, because of its growth, Digital Realty is not a cheap stock. The company’s shares trade at a price to FFO multiple of about 25, which is above that of other REITs. But it also means that investors are willing to pay a premium to own the company.

Therefore, in summary, you should invest in the firm because of its colocation approach, its scale, which helps it get discounts from utilities, and its healthy balance sheet.

Digital Realty vs S&P 500

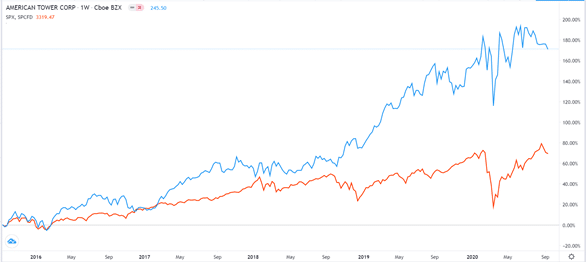

American Tower Corp

American Tower is the biggest REIT in the United States with a market cap of more than $108 billion. Like the data centre REITs, the company is not well-known among ordinary people in the countries it operates in. But millions of people use their products every day.

The company owns more than 41,000 communication towers in the United States and more than 136,000 around the world. As a result, it serves most communication companies in the world, including T-Mobile, AT&T, and Vodafone.

A key benefit of investing in the company is its moat. For one, it already has the infrastructure and relationships with the biggest firms in the industry. Also, the industry is relatively difficult to disrupt because of the high cost of setting a tower. In the United States, it costs between $200k and $300k to build a tower.

Most importantly, the consumption of data around the world is increasing, especially in the transition to 5G and Internet of Things (IoT). The firm also has strong recurring revenue, low churn, and is also recession-proof.

S&P 500 vs American Tower

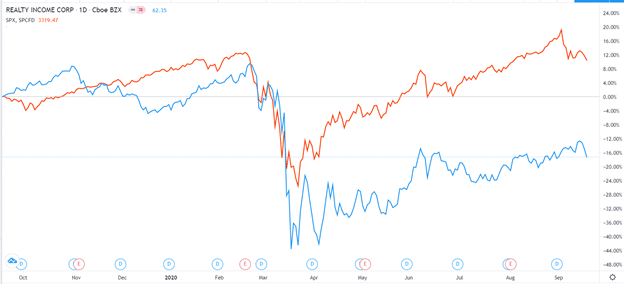

Realty Income

Realty Income (O) is one of the best-known REITs in the United States. It has a market cap of more than $21.5 billion, more than $1.5 billion in annual revenue, and a net income of more than $437 million. The company is also highly diversified, with property in the retail, industrial, office, and agricultural sector.

In 2020, the company’s share price has underperformed the major averages because of the retail and office sectors. See, the retail sector has more than 6,000 properties and accounts for more than 83% of income. Similarly, it has 43 office locations. Due to COVID, many companies have had to shrink their office spaces.

However, the company is a good REIT to invest in for several reasons. First, it is a dividend aristocrat that has increased its dividends in the past 92 consecutive quarters. Second, the firm operates a triple-net type of lease. Its initial length of the lease is 15 years with the average remaining average term of more than 10 years. It also has high occupancy rates, which help to guarantee sustained income. Finally, the firm has a strong balance sheet and a dividend yield of 4.5%.

Realty Income vs S&P 500

Final thoughts

Investing in REITs is a great way to build your wealth for the long-term. The companies, especially those in the data centres, towers, and healthcare sectors, have stable sources of income. They also operate in industries that have limited competition and large moats that make it difficult for new competitors.