What Is Banking?

Banking- an industry that handles not just cash, but credit, and different financial transactions also while providing a safe way to store people’s extra money. Banks offer different types of accounts where people can deposit funds for savings, which the banks use to provide loans. The loans typically include auto loans, home mortgages, and business loans. Banking is one of the main drivers of the economy of the world. It also offers the required liquidity a family or a business needs for its growth and future.

How Do Banks Work?

Banks are safe places for monetary deposits such as excess cash. The deposits are protected and insured by the Federal Deposit Insurance Corporation (FDIC). They also pay their customers an interest. Banks earn their money by charging higher interest rates on their loans than what they pay their customers for their deposits.

Breakdown of Main Banking Services:

Banks offer several services starting from offering distinct banking accounts for different types of savings and expenses as well as loans and lending of money.

The main types of accounts are:

- Savings Account

- Checking Account

- Money Market Account

- Certificate of Deposit (CD)

Some of the advantages of having bank accounts include being able to go cashless with debit cards and being able to borrow money through credit cards for instant money or emergencies.

Credit Cards

Credit Cards are a viable alternative for you when you do not have much money or cash. Cards can be used for needs such as shopping, dining, holiday, and filling fuel among other requirements

Features & Benefits of Credit Cards

- One Time Bonus

- Opportunity to build credit

- Earning rewards in form of cash back or points

- Safety – prevents losses from frauds

- Flexible payment

- Add-on facility available

- Balance Transfer

- Global customer services

- Universal Acceptance

- Insurance

- Grace period

Although credit cards have a lot of benefits, usually they supply cardholders with the most expensive interest rate credit, among the debt banking products.

Savings Accounts

Just like the name suggests a savings account helps to save money. A savings account is where you store money that helps you to prepare for times when you want to purchase expensive things. The account allows your money to grow by accruing interest with time. Interest is the sum of money you charge the bank for letting them store your funds. This is usually a percentage we call the interest rate.

You can consider opening a regular savings account which is very simple to set up at any bank of your choice and sign up in person. But it may have a higher daily minimum balance requirement. If you are younger or more into the tech and its convenience then you can always opt for online savings accounts that can be accessed from anywhere while acquiring higher interest rates. Online banking is the new way of simple banking.

Checking Accounts

A checking account is also known as a transactional account because they are designed for everyday expenses or buys. When you put in money in a checking account you don’t deposit with the intention of any savings. It is entirely for transactions and payments. This type of account comes with checks and debit cards for an easier spending process. When you compare this account type with other accounts you will realise checking accounts don’t typically pay interest. But you must be careful when it comes to its balance. Maintain a healthy balance because most banks charge an overdraft fee for expenses that exceed your balance.

Unlike savings accounts, checking accounts are available for use at any time. You can either use your debit card or deposit checks or use your bank’s ATM to access the money. It aims to keep your money safe in case your debit card gets stolen.

Money Market Accounts

What is a Money Market Account? A Money Market Account and savings account function in quite a similar manner. When you deposit money in the account, you earn interest on your balance. The only thing distinguishing them is the fact that Money Market accounts earn fairly higher in interest than traditional savings accounts.

In Money Market Accounts you need to maintain a certain sum of money in the account or you will be charged a fee. At the moment MMAs have a higher minimum balance requirement, often in thousands, to earn the top APY. Now, this makes it less convenient and accessible for younger customers like college students.

Another distinguishing factor between a savings account and MMA is that the interest in a Money Market Account depends on the financial markets, hence fluctuates. The interest rate is much higher; therefore you gain more if you pay more. Some accounts allow withdrawal of funds using checks.

Certificate of Deposit

A Certificate of Deposit (CD) account lets you save money at a set rate for a defined period. Even though a CD account is used to save money it is quite different from a savings account. Through this account, you don’t get access to the money you are saving throughout the life of the certificate. The lack of access is the reason why CD accounts acquire higher interests than compared to savings accounts.

What happens with a CD account is that the money you fund is stored there for ages while the money multiplies. The lifespan of the certificate can last over years and years or even just a few months but without any access to the money. So if you plan on considering a CD account, ensure that you will not need to withdraw money before the certificate’s period ends. This is crucial because withdrawal beforehand may lead you to face penalties and pay fees.

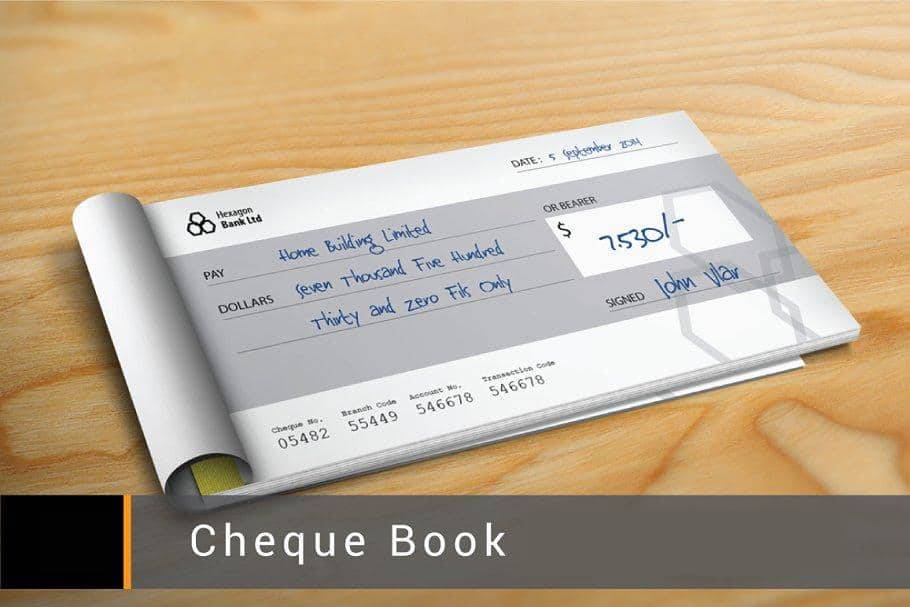

Bank Statements and Checkbook Balance

Bank statements are records of your transactions. This record helps to make your life much easier by keeping a track of your expenses along with other details including lists of deposits and withdrawals. Bank statements are available online or via emails.

How to Balance a Checkbook?

When you receive your bank statement thoroughly read it. Then take your checkbook and check off all the items present in the statement. Followed by that, you need to make some additions and subtractions. Add any interest your bank has paid you while subtracting any fees the bank has charged and any bounced checks. Ensure that the numbers add up. If not, then call up your bank and ask the important questions.

Balancing your checkbook is crucial because the last thing anyone desires is the bank calling to inform them about a bounced check or any inconsistency in your account that you did not predict.

Summary

Knowing the basics of banking is critical for all, especially young people. This is because finance can be a boon or a bane depending on how one handles it and how much they know about finances and banking. So, make sure you grasp the basics thoroughly because banking is a brilliant way to multiply your money even if you have very little of it. Money grows with time and saving it in the right place means gaining interests as well as access to large sums of money during a time of need.