Environmental, Social, and Governance (ESG) investing has become one of the fastest-growing fields in recent years. In a report published in August, Morningstar found out that assets in ESG funds had surpassed $1 trillion for the first time on record. And the trend is growing fast. According to Deloitte, the number of investors seeking exposure to ESG funds has grown from 48% to 75%.

The ESG investing fund is also substantially large. For one, defining companies that promote ESG takes many forms. In the environment, it can take both solar-generating firms and fossil fuel firms that are showing strong progress on cutting emissions.

Ideally, investors use two main approaches in ESG investing: negative and positive screening. In negative screening, they avoid companies in industries they completely disagree with, such as tobacco and fossil fuels. In positive screening, investors attempt to generate significant returns by maximizing the number of companies that meet the three ESG principles. Let us now look at the best ESG funds to invest in.

Vanguard FTSE Social Index Fund Admiral Inst (VFTAX)

- Assets – $8.93 billion.

- Dividend yield – 1.30%

- Expense ratio – 0.14%

VFTAX is an ETF that tracks the performance of the FTSE4 Good index, which is one of the biggest index funds in ETFs in the world. Ideally, this ETF invests in companies that meet the ESG principles. For example, it excludes companies in industries like fossil fuels, adult entertainment, nuclear power, and tobacco. It also excludes firms that don’t meet key diversity issues.

With demand in ESG investing rising, the fund has grown its assets under management from less than $5 billion in 2018 to more than $8.9 billion. This performance is also partly because of its low fees since it has a 0.14% expense ratio. Its performance has also been better. In the past 12 months, it has grown by 21.22% compared to the S&P 500 average performance of 17.05%.

VFTAX is made up of domestic companies in all sectors. Technology firms make up 28.43% of its constituent companies. They are followed by healthcare, consumer cyclical, and communication firms, that account for 14.78%, 13.42%, and 12.88%, respectively.

Among the biggest firms in the fund are Apple, Microsoft, Amazon, Procter & Gamble, Visa, Tesla, among others.

VFTAX vs. S&P 500

iShares MSCI Global Impact ETF (SDG)

- Assets – $223.8 million

- Dividend yield – 1.00%

- Expense ratio – 0.49%

The SDG ETF is an ETF that aims to align itself with the recently-passed Sustainable Development Goals by the United Nations. Some of these goals include boosting education, ending hunger, clean water, and mitigating climate change. The ETF tracks the MSCI ACWI Sustainable Impact Index.

It has invested in about 130 companies, has a dividend yield of 1.0%, and has an average price-to-earnings ratio of 19.50.

By composition, industrials are the biggest constituents of the ETF, making up about 23.81%. They are followed by consumer defensive, healthcare, and consumer cyclical sectors.

Among the biggest investments in the ETF are NIO American Depositary Shares, Vestas Wind Systems, Tesla, P&G, and Johnson Matthey. Other companies are Umicore, Central Japan Railway, and Gilead Sciences, among others. Therefore, unlike VFTAX, this ETF is also composed of international companies.

In general, while the index performance lagged the broad market a few years ago, it has passed the S&P 500 index this year.

SDG vs. S&P 500

iShares MSCI KLD 400 Social ETF (DSI)

- Assets – $2.1 billion

- Dividend yield – 1.30%

- Expense ratio – 0.25%

The DSI ETF is an index that seeks to invest in companies that meet strict environmental, social, and governance criteria. It does this by excluding key sectors like alcohol and tobacco, civilian weapons, and adult entertainment. For example, on civilian weapons, it excludes all companies that both manufacturers and retailers of weapons like guns. The index tracks the MSCI KLD 400 Social Index.

The DSI has had significant returns in the past few years, which has seen its assets grow to more than $2.1 billion. Most of the constituent companies are American technology companies, which make up about 26.35% of the portfolio. They are followed by communication, financials, consumer cyclicals, and health care.

Among the biggest constituent companies in the ETF are Microsoft, Facebook, Alphabet, P&G, Visa, and Tesla, among others. It also has an MSCI ESG rating of AA, which is a leg below the highest level of AAA.

While it is not as expensive as the SDG, DSI is not relatively cheaper either, with its expense ratio being at 0.25%. However, its performance has been relatively stronger than the S&P 500, as shown below.

DSI vs. S&P 500

Parnassus Core Equity Fund (PRBLX)

- Assets – $19.97 billion

- Dividend yield – 1.30%

- Expense ratio – 0.86%

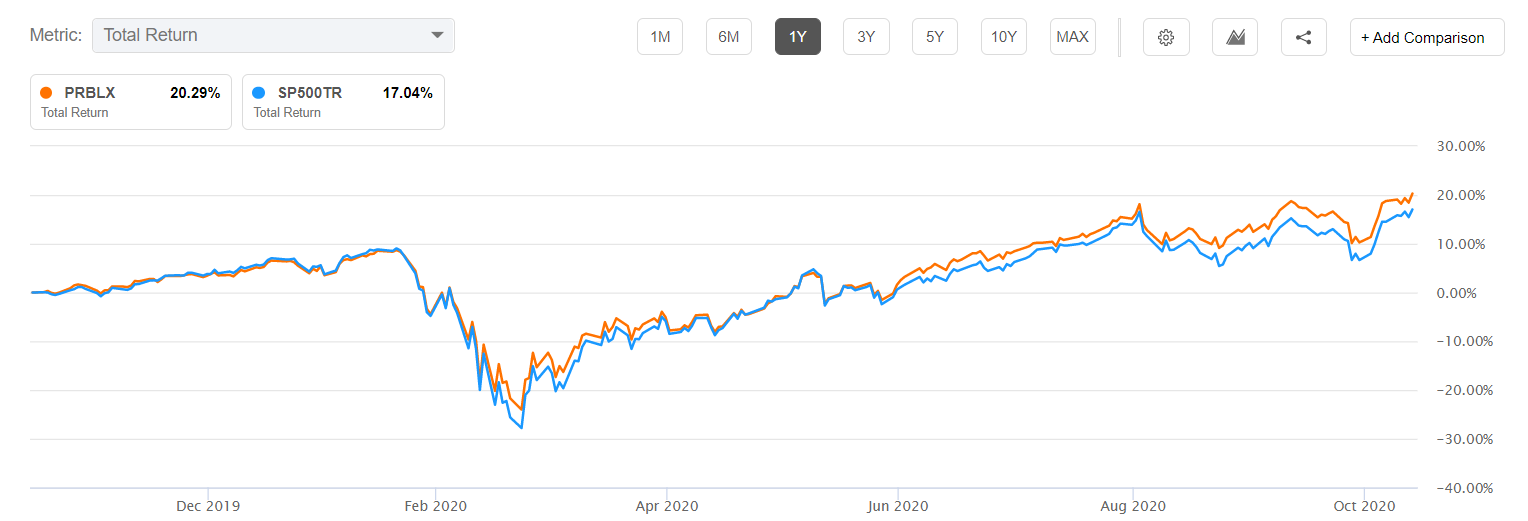

The Parnassus Core Equity Fund (PRBLX) is not necessarily an ESG fund as the other three funds mentioned before. In fact, it has existed for more than a decade, in an era when investors were not talking about ESG as much. However, the ETF invests in companies that have a positive performance on ESG criteria.

The fund has grown its assets into more than $19.97 billion because of its overall performance and the fact that it requires a minimum investment of $2,000. It also has a relatively higher expense ratio of 0.86%. It tracks the performance of the S&P 500.

PRBLX is strongly weighted towards its ten biggest holdings. In fact, the top ten companies in the ETF are responsible for 41.4% of the entire fund. Most constituent firms are in the technology sector (26.50), followed by industrials, communications, health care, and consumer cyclical. The biggest firms in the fund are Microsoft, Amazon, Danaher, and Comcast.

PRLBX vs. S&P 500

iShares Global Clean Energy ETF (ICLN)

- Assets – $2.1 billion

- Dividend yield – 1.30%

- Expense ratio – 0.60%

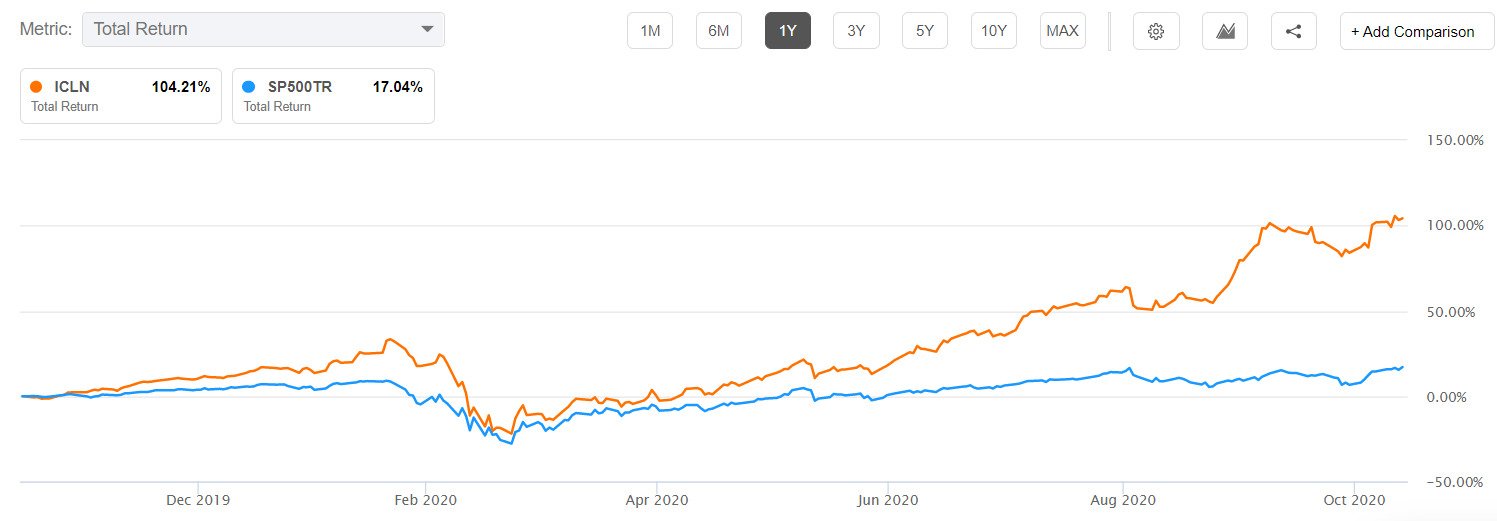

The iShares Global Clean Energy ETF is tilted towards the environment part of ESG. The fund typically invests in firms that produce energy from renewable sources like solar, wind, and other sources. It tracks the S&P Global Clean Energy Index.

It is also a global ETF, made up of companies from countries like the United States, China, and Japan, etc. Its only sectors are utilities, technology, industrials, and energy. Among the biggest constituent companies are First Solar, Xinyi Solar Holdings, Meridian Energy, and Verbund, among others.

Therefore, if you believe that renewable energy is the future, especially in the Joe Biden presidency, then ICLN is among the best funds to invest in. Indeed, as shown below, the index has had a relatively strong performance.

ICLN vs. S&P 500

Final thoughts

ESG investing is just getting started, judging by recent announcements by large fund managers. While some have questioned the industry, we recommend that retail investors should allocate some of their assets in these funds.