Introduction

A bond refers to a corporate debt unit issued by companies. It is considered as a fixed income instrument and is securitized as tradable assets. Entities such as states, municipalities, companies, and even sovereign governments use bonds to finance operations and projects.

The primary difference between a bond and a stock is that the former is a debt instrument issued by companies. At the same time, the latter is a financial asset with ownership rights issued by a company.

Compared to stocks, bonds are more conservative as they involve much less risk and tend to pay stable, regular interest to their investors.

Variety of Bonds

Bonds come in various types for investors, typically differentiated by attributes such as the type or rate of interest or coupon payment, among other things.

- Convertible bonds: These bonds are debt instruments that provide an option to bondholders, allowing them to convert their debt into stock or equity at a future date, depending on certain conditions.

- Callable bonds: The issuing company can call back the bond before it reaches its maturity, making it riskier for the bond buyer.

- Zero-Coupon bonds: These bonds are issued at a discount generating a future return after the bondholder is paid the full face-value upon reaching maturity.

- Puttable bond: This bond can be sold back to the company by the bondholder before it reaches its maturity.

Who Can Issue Bonds and What Is The Purpose?

When it comes to bonds, their issuers can be categorized into four primary types. Apart from this, some international corporations or governments may also issue foreign bonds on some platforms.

- Government (sovereign bonds): These bonds are a kind of debt security issued by a national government to support government obligations and spending. They are generally considered low-risk investments since they are backed by national governments. They are also known as sovereign bonds. Government bonds may be issued as inflation-protected, such as TIPS, as well as savings bonds with small denominations for ordinary investors.

- Agency bonds: Various organizations that are government-affiliated issue these bonds. Examples include Freddie Mac or Fannie Mae.

- Municipal Bonds: States and municipalities issue municipal bonds to investors, some of which offer tax-free coupon income.

- Corporate Bonds: Companies issue corporate bonds as an alternative financing option to bank loans. This is mainly because the bond markets offer lower interest rates and more favorable terms.

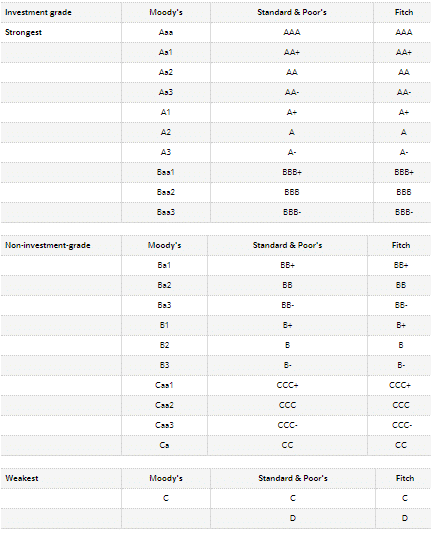

Similar to the credit reports assigned to each individual, each bond issuer is also evaluated by rating agencies to assess creditworthiness. Standard & Poor’s, Moody’s, and Fitch are the three major rating agencies that assess bonds and give them credit ratings. All of these agencies research the financial health of each bond issuer and assign ratings accordingly. Generally, bonds with a rating of Baa3 on Moody’s and BBB- on the Fitch and Standard & Poor’s scale are considered as “investment grade” bonds. Debt with a higher rating usually provides low fixed income. In comparison, bonds with a lower rating are referred to as “speculative” and can afford investors high-yield income with a lower quality issuer.

Bond Yield

The term Bond Yield refers to the return an investor receives from a bond. Bond yields tend to fall when bond prices increase. Bond ratings, which are usually dependent on a company’s ability to make interest payments and repay the loan, can directly affect the bond yield. Typically bonds that are lower-rated offer higher bond yields to compensate for the additional risk taken by investors.

For instance, many investors tend to limit their purchasing of bonds to only “investment grade,” which corresponds to the Baa in Moody’s and BBB in Standard & Poor’s. This is because financial institutions such as bands are permitted by law to invest only in securities which are rated “investment grade,” providing a fair margin of safety for investors. However, there are some instances where bond funds are misleadingly advertised as “investment grade” to imply they are of extraordinarily high quality.

What Is A Junk Bond?

Junk bonds refer to bonds issued by companies that carry a higher degree of risk by default. They usually represent bonds issued by financially struggling companies, which are rated lower than the “investment grade.” These bonds are thus riskier because the chances that the issuer will experience a default is high. To entice investors, despite such a higher degree of risk, the investors holding these bonds receive higher interest rates, which is why they are also called high yield bonds. Once a bond’s rating falls below the BB category, it falls into the junk bond category. Other bonds with speculative ratings include D, C, and CCC.

Bond maturity

The time during which the bond owner will receive interest payments on the investment is known as a bond’s term to maturity. The principal is repaid once the bond reaches maturity. Based on the terms of maturity, bonds are categorized into three broad categories.

- Short-term bonds – 1 to 5 years

- Intermediate bonds -5 to 12 years

- Long term bonds – 12 to 30 years

Additionally, there is a class of bonds called perpetual bonds, which have no maturity date. These bonds are not treated as debt, but rather as equities. Issuers do not have to redeem the principal amount and can pay coupons on perpetual bonds forever. The perpetual bond issued by the Dutch water board of Lekdjik Bovendams in 1648 is the oldest example of a perpetual bond.

Difference Between Bonds and Notes

The US federal government offers investors and consumers three categories of fixed income securities, namely, Treasury bonds, Treasury notes, and Treasury bills. There are significant differences between a bond and a note, as is highlighted in brief below.

Treasury bonds, also called T-bonds, often take the longest time to mature among all government-issued securities. They are typically offered in terms of 30 years to maturity to all investors. Investors receive a fixed interest payment every six months when they purchase T-bonds.

Treasury notes or T-notes, on the other hand, are offered in terms ranging from 2 years to under ten years. Investors get interest payments twice a year. But they offer lower yields as the terms offered by them are less than bonds. The ten year T- note is an example of a closely watched government bond, which is also used as a benchmark rate for banks when calculating mortgage rates.

Make Money Investing in Bonds?

There are many reasons why investing in bonds is advantageous as compared to other options. Some of these reasons are mentioned in the brief below.

Fixed Income: Investors are attracted more towards bonds because of the certainty they provide through fixed interest payments and a fixed lump sum when it reaches maturity. They do not suffer from higher volatility as stocks

Selling Bonds Before Maturity: Bonds are typically held to maturity by investors. However, selling a bond before it reaches maturity can have a far different pay-out amount. While bondholders may have to sell at a discount if interest rates have risen, they have the potential to gain profits if the interest rates have fallen. Bondholders, in this case, can sell the bond at a premium above par.

Priority in Terms of Repayment: Holder of bonds usually enjoy a more considerable measure of legal protection than stockholders, especially if a company goes bankrupt. It is evident from past instances that in such cases, bondholders still receive a recovery amount while the company’s equity stock goes worthless.

In addition to the above reasons, the popularity of bonds as an investment can be attributed to the fact that an investor can get the full principal amount if they wait till the maturity date, which is not possible in stock trading.