Breaking Equity is an online trading platform that offers advanced features, educational resources, and regulated security. It provides traders of all levels the ability to optimize their investment returns with powerful automation tools, technical indicators, backtesting, and a customizable user interface. In this review, we will explore the benefits of using Breaking Equity, provide a step-by-step guide to setting up an account, and discuss how to manage your investments and cash on the platform. We will also cover the pros and cons and offer an overall rating of Breaking Equity.

Features

Breaking Equity offers a variety of features that make it a competitive online trading platform. Here are some of the key features:

- Advanced Trading Features: Breaking Equity provides advanced trading features, such as algorithmic trading, technical indicators, and a customizable user interface that allows traders to analyze trends and optimize their investment returns.

- Demo Accounts: Traders can use demo accounts to practice their skills without risking real money. It’s a great way for beginners to get familiar with the platform and learn trading strategies.

- Educational Resources: Breaking Equity offers educational resources, including articles, videos, and webinars, to help traders improve their skills and stay up-to-date with market trends.

- Regulated Security: The platform is regulated by the Financial Conduct Authority (FCA) in the UK, which ensures compliance with strict rules and regulations to protect investors. Customer funds are also kept in segregated bank accounts for added security.

- Wide Range of Assets: Breaking Equity offers a broad range of assets for trading, including stocks, ETFs, forex, indices, and commodities.

- Customer Support: Breaking Equity provides customer support via live chat and email to help traders with questions or concerns they may have regarding their investments on the platform.

Overall, Breaking Equity’s combination of advanced trading features, educational resources, and regulated security makes it a well-rounded trading platform for traders of all levels.

What is Breaking Equity and How Does it Work

Breaking Equity is an online trading platform that allows users to trade a variety of assets, including stocks, ETFs, forex, indices, and commodities. The platform offers advanced features, such as algorithmic trading, technical indicators, backtesting, and automation, to help traders optimize their investment returns. Users can set up an account with Breaking Equity and fund it using various payment methods. Once the account is set up and funded, users can start trading assets on the platform.

Breaking Equity’s features are designed to provide traders with valuable insights into market trends and reduce the risk of errors caused by human emotions. For example, traders can use technical indicators to analyze market trends and make informed investment decisions. Additionally, automation tools can help execute trades based on predetermined rules, reducing the risk of mistakes caused by human error.

Breaking Equity’s user-friendly interface allows traders to customize the platform according to their preferences. Traders can view real-time updates on their investments and track their performance over time. The platform also provides educational resources, including articles,, and webinars

Exploring the Features of Breaking Equity Platform

Breaking Equity is an online trading platform that offers a variety of features to help traders optimize their investment returns. Here are some of the key features of the platform:

- Advanced Trading Features: Breaking Equity provides advanced trading features, including algorithmic trading, technical indicators, and backtesting. These features allow traders to analyze market trends and make informed investment decisions.

- Wide Range of Assets: Breaking Equity offers a broad range of assets for trading, including stocks, ETFs, forex, indices, and commodities. This allows traders to diversify their portfolios and minimize risk.

- Demo Accounts: Traders can use demo accounts to practice their skills without risking real money. This is a great way for beginners to get familiar with the platform and learn trading strategies.

- Regulated Security: Breaking Equity is regulated by the Financial Conduct Authority (FCA) in the UK, which ensures compliance with strict rules and regulations to protect investors. Customer funds are also kept in segregated bank accounts for added security.

- Customizable Interface: The platform’s interface is customizable, allowing traders to view real-time updates on their investments and track their performance over time.

- Educational Resources: Breaking Equity provides educational resources, including articles, videos, and webinars, to help traders improve their skills and stay up-to-date with market trends.

- Customer Support: Breaking Equity provides customer support via live chat and email to help traders with questions or concerns they may have regarding their investments on the platform.

Overall, Breaking Equity’s combination of advanced trading features, a wide range of assets, and regulated security makes it a well-rounded and reliable trading platform for traders of all levels.

The Different Fee Structures for Breaking Equity Users

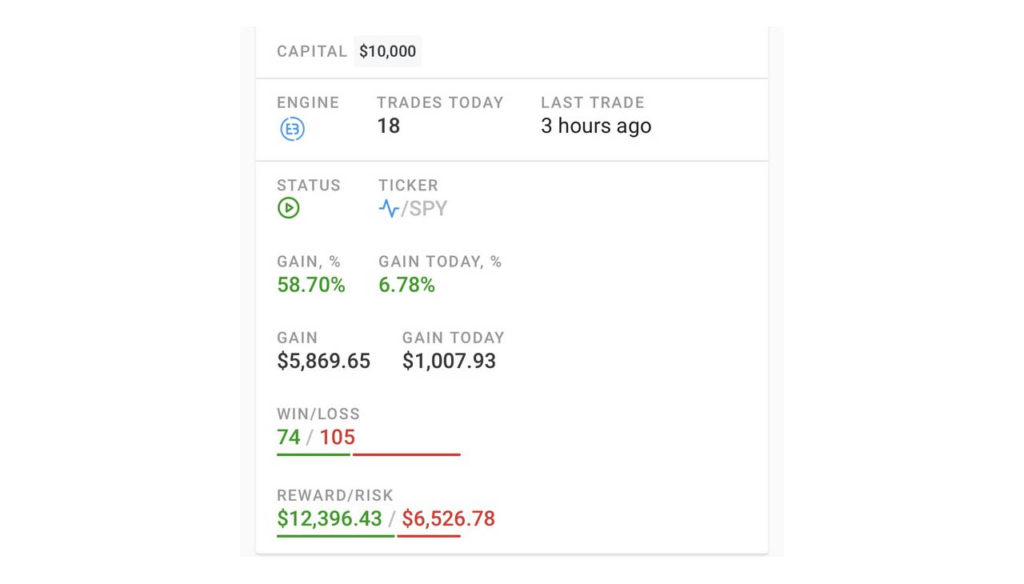

Breaking Equity charges different fees depending on the services used by the users. Here are the different fee structures for Breaking Equity users:

- Commission Fees: Breaking Equity charges a commission fee of 0.5% per trade. This fee applies to all trades executed on the platform.

- Funding Fees: Breaking Equity does not charge any fees for funding an account using a bank transfer or debit card. However, there is a 3.5% fee for funding an account using a credit card, which is higher than the industry average.

- Withdrawal Fees: Breaking Equity charges a withdrawal fee of £15 for bank transfers and £25 for international wire transfers. There are no fees for withdrawing funds to a debit card, but a fee of 2.5% of the withdrawal amount is charged for withdrawals to a credit card.

- Inactivity Fees: Breaking Equity charges an inactivity fee of £50 if there have been no trades made on the account for six months or more.

- Overnight Fees: Breaking Equity charges overnight fees for holding open positions overnight. The overnight fee varies depending on the asset being traded.

It’s important to note that Breaking Equity’s fee structures are subject to change, and users should always check the platform’s website for the most up-to-date information. Nonetheless, although Breaking Equity offers advanced features and trading tools, some users may find its fees higher compared to other trading platforms.

The Review

Summary

Breaking Equity is an online trading platform that offers advanced features, a wide range of assets, and regulated security. It charges different fees depending on the services used, including commission fees, funding fees, withdrawal fees, inactivity fees, and overnight fees. Some users may find these fee structures to be higher compared to other platforms. However, Breaking Equity provides an array of trading tools and educational resources to help traders of all levels maximize their investments. For these reasons, Breaking Equity is a reliable choice for any trader.

PROS

- Advanced trading features

- Wide range of assets

- Regulated security

- Customer support

- Educational resources

CONS

- Higher fee structures than other platforms

- Limited payment options for funding accounts