Financial instruments can be volatile as investors and traders react to various developments and jostle for opportunities. Wild price swings that come into play make it extremely difficult to pinpoint the ideal time to open a position, let alone close one.

While fundamental and technical traders leverage various strategies to identify entry and exit levels, it is never easy. However, there is a smart way to invest when unsure of the right time to open a position in the capital markets.

What is Dollar-Cost Averaging (DCA)?

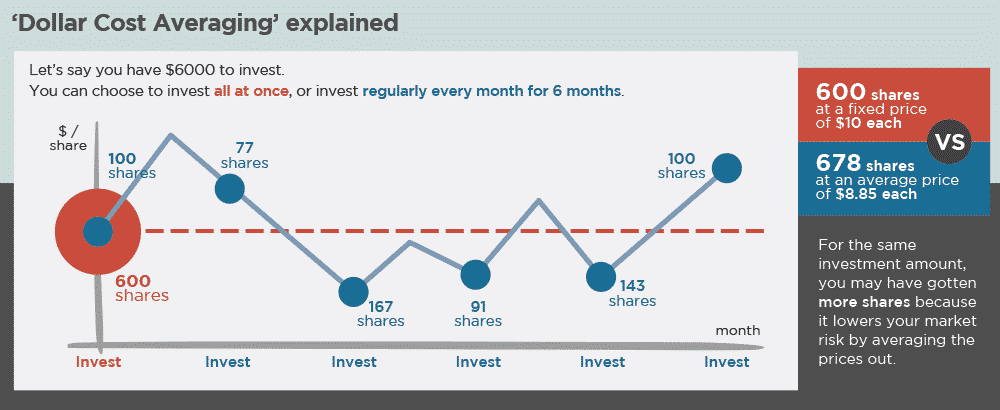

It is unlikely that an investor would always be accurate in timing the market. Dollar-cost averaging takes care of the timing dilemma by providing a framework for investing small amounts of money rather than going big in one trade.

The strategy entails investing a small fixed amount of money on a schedule rather than going big. The strategy is based on the fact that price does not always move in one direction. Therefore, it works by providing an opportunity to take advantage of the small pullbacks and bouncebacks that come into play as the price oscillates from one level to another.

How Dollar-Cost Averaging works

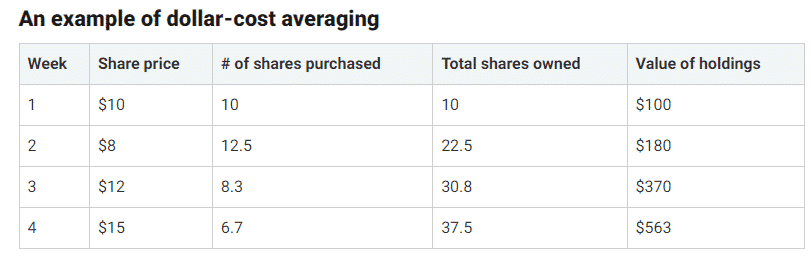

One does not have to place one large order with the dollar-cost averaging strategy. Instead, one can invest a fixed amount of money on a schedule. Rather than place a $1,000 order, one can choose to invest $100 per month.

By dividing the purchases and making multiple entries, it becomes easier to take advantage of new opportunities that crop up as price oscillates. In addition, it becomes much easier to pay a lower price thanks to pullbacks and bouncebacks. In addition, it helps in allowing money to work consistently, a key ingredient for successful long-term investing.

Investing in intervals allows one to take advantage of the various swings that come into play as price moves from one level to another. If the market is trending up, the pullback will provide an opportunity to buy at a discount.

Once the price pulls back significantly, one could buy more to take advantage of the decline. However, price moving up would call for the opening of small trades. The strategy works best with brokerage firms that allow fractional shares.

The investment strategy works by investing at both lows and highs of the market. Conversely, investments are averaged out so that one is not affected by extreme volatility in the market, which could be the case with one large order.

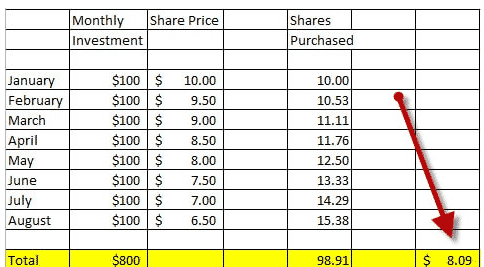

The first step to implementing DCA is setting the amount of money that will be invested as the price of an underlying financial instrument oscillates from one level to another. The amount will be invested regardless of where the market is.

How effective is Dollar Cost Averaging?

Dollar-cost averaging is an effective investment strategy for novice traders who can’t time the market accurately. The strategy averts the pitfalls of having to contend with one large order that could go south and result in significant losses. It also takes the emotion out of investing.

The strategy stands out as it allows investors to test the market with smaller amounts, thus averting the risk of significant losses with one large order. Once the first order pans out well, a trader could add another position to try and profit from the trend.

However, a correction that comes into play resulting in a loss in the first trade will be a warning sign to be extremely cautious. Consequently, a trader would know in advance that the first trade was wrong and wait for a good entry point.

There is no doubt that investing large amounts of money all at once increases the prospects of maximum gains in case everything goes right. However, in case the timing was wrong, the risk of losing big is also high. DCA is a proven strategy that allows traders to avoid major losses. The strategy also eliminates the fear that comes with relying on one large order to pan out correctly.

When is the Dollar-Cost Averaging most effective?

The strategy works best when an investor does not have huge amounts of money to invest at a go. With smaller amounts, you can get into the market and try to profit from the small swings that come into play instead of having to wait until you have a large sum of money to invest.

The strategy also works best in the stock markets as it provides a leeway for investing when the market is down. With one large order, your only hope is that the stock price will continue moving up to make profits.

However, with DCA, small positions can be triggered whenever the market experiences a short correction and pulls back, presenting an ideal entry-level on the risk-reward.

In the table above, the trader bought shares at an average of $8.09 due to the dollar-cost averaging strategy whereby small amounts of money are used instead of placing one large order.

In addition, the strategy works well whenever one is not sure of how the market is going to react in the future. Instead of going all out with one single trade, which could be wrong, DCA provides an opportunity to test the market.

The risks

The dollar-cost averaging strategy provides favorable results in trending markets. The price must move in one direction with small corrections in between to make significant returns. In case of an uptrend, it will provide favorable results whenever there are small pullbacks from where one can open new buy orders to profit on further upswings. As the pullbacks come into play, new positions are opened.

However, the risk of accumulating significant losses is high should the market correct from an uptrend to a downtrend when more than three trades are in play. Therefore the strategy cannot protect investors against the risk of losses when the market changes course from a predefined direction.

Bottom line

Dollar-cost averaging is an effective trading strategy for novice traders who don’t have the experience to test the market with one big order. It provides a framework for investing small amounts of money over a prolonged period, therefore, reducing risk exposure in the market.