ETFs are growing popular passive investing vehicles in the United States and other developed countries. The total assets held in ETFs have grown to more than $6 trillion, and analysts expect the figure will rise to more than $12 trillion in the next few years. In this article, we will look at everything you need to know when investing in ETFs.

What is an ETF?

The term ETF stands for Exchange-Traded Fund. An ETF is simply an investment vehicle that invests in various assets like stocks, bonds, and commodities. The fund is usually listed on a major exchange like the New York Stock Exchange (NYSE) or Nasdaq. The goal of ETFs is to allow investors of all sizes to access a basket of assets at the lowest cost. Some of the most popular funds are Invesco QQQ (QQQ) and the Vanguard S&P 500 ETF (VOO).

Types of ETFs

Broadly, there are three main types of exchange-traded funds.

Passive ETF

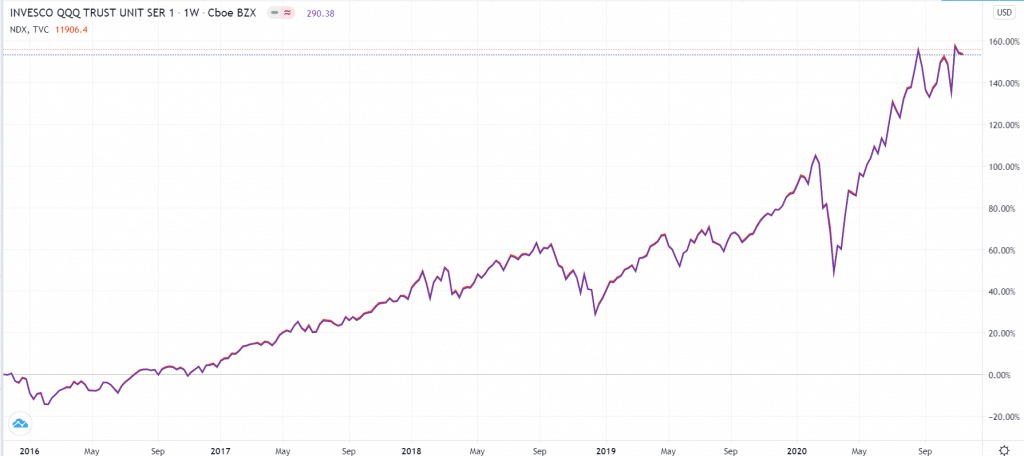

A passive fund is one that tracks an already-existing index fund. For example, the Invesco QQQ tracks the Nasdaq 100 index that is made up of the biggest tech firms in the US. Similarly, the Vanguard, Schwab, and iShares S&P 500 ETFs track the companies in the S&P 500. Indeed, these ETFs have a similar performance to the underlying ETF, as shown below.

Nasdaq 100 vs. S&P 500 index

So, if the two indices track one another, why not invest in the index itself? That is a commonly-asked question. The answer is that it is not possible to invest in an index itself. They are not even offered by any brokers.

Active ETF

An active ETF is one that is managed by a panel of experienced financial professionals. The team will regularly change the composition of an ETF as they attempt to beat the overall market. As a result, their performance tends to be uncorrelated with the overall market. Examples of such ETFs are the JPMorgan Ultra-Short Income ETF (JPST) and PIMCO Enhanced Short Maturity Active (MINT).

Within this category, there are two other types of ETFs: semi-transparent and non-transparent. As the names suggest, the non-transparent ones don’t reveal all their holdings and transactions to investors. The semi-transparent funds reveal partial information about their transactions.

Leveraged ETF

A leveraged ETF is an often-risky form ETF that uses debt to increase the eventual returns. The idea is relatively simple. A fund that invests $10 million will make more money than one that invests $1 million. So, the creators of the fund use borrowed money and other derivatives to amplify returns.

When it works well, a leveraged ETF can be an excellent asset. However, when things go wrong, losses can be significantly large. Examples of leveraged ETFs are ProShares UltraPro QQQ (TQQQ), Direxion Daily Technology Bull 3X Shares (TECL), and ProShares UltraPro S&P 500 (UPRO), among others.

Who creates the ETFs?

ETFs are generally created by large investment companies and banks. This is because these companies have the financial resources and networks to raise and manage their funds. To create an S&P 500 ETF, for example, a company needs to buy stocks in all companies in the index, which can be relatively enormous. The biggest creators of ETFs are:

- Vanguard. This company has more than $6.2 trillion in assets under management and an average expense ratio of 0.10%.

- Blackrock. This is the biggest fund manager in the world, with more than $6.9 trillion of assets.

- JP Morgan. The investment arm of JP Morgan, the biggest bank in the US, has more than $2.9 trillion in assets.

- Schwab. It is a large manager that recently combined with TD Ameritrade to create a $3.25 trillion fund.

Other leading creators of ETFs in the United States are State Street, Invesco, and WisdomTree, among others.

Key terminologies in ETFs

As an investor in ETFs, you will encounter several terms that you need to understand their meaning. Some of those you need to know are:

- Expense ratio. ETF issuers make money through an expense ratio, which can range from between 0.01% to as high as more than 1%. If a fund has a ratio of 0.45%, it means that it will charge you $4.5 annually for every $1,000 you invest. As such, you should mostly go for one with a low ratio.

- Dividend yield. This is essentially the amount of money the fund returns to investors through dividends. You simply divide the dividend per share with the price of the fund. Please note that not all funds pay a dividend.

- Beta. This is a measure of how the ETF is expected to move every day. If the ETF has a beta of 1, it means that it will often move in the same direction as the overall stock market.

- Inverse ETF. This is an ETF that makes money when the overall market declines.

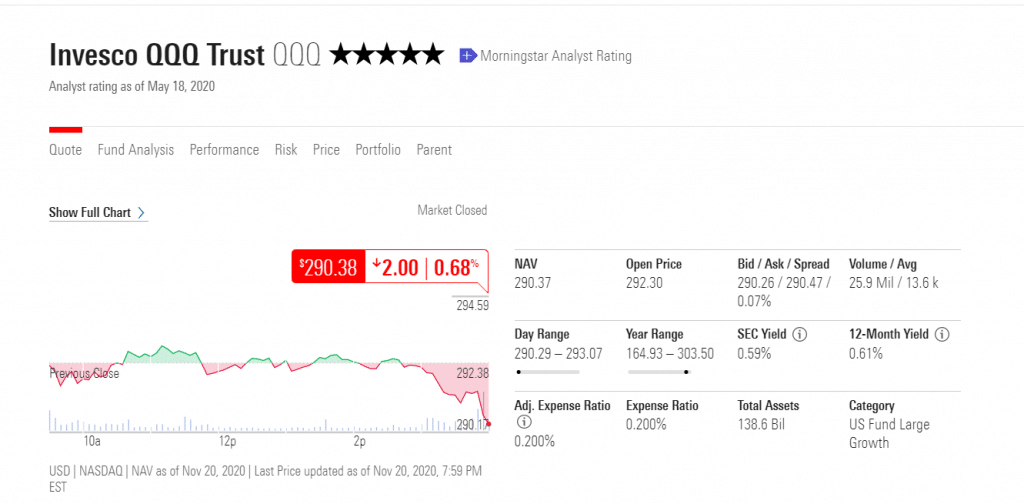

- Morningstar rating. This is a rating created by Morningstar that provides a snapshot of the safety of ETFs. For example, QQQ has a five-star rating.

Invesco QQQ MorningStar rating

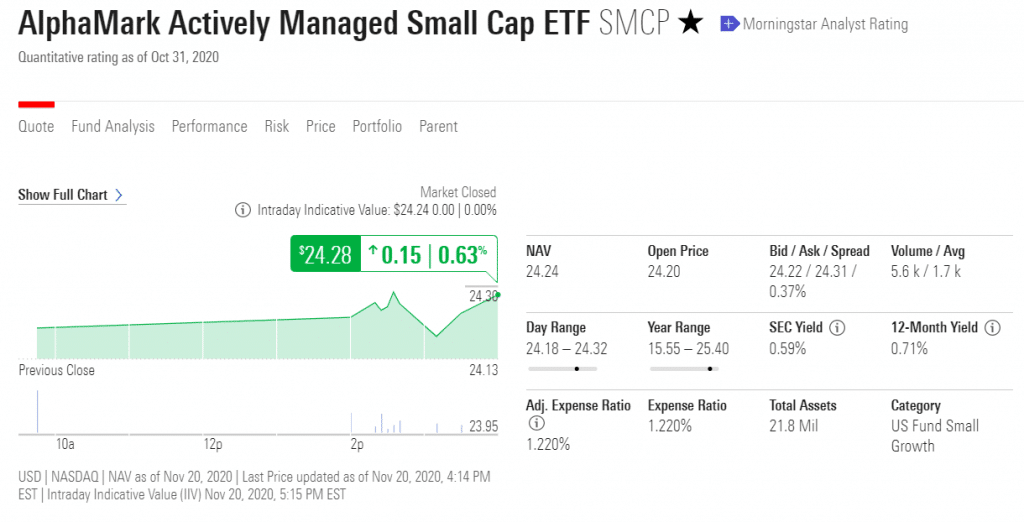

On the other hand, the AlphaMark Actively Managed Small-Cap ETF (SMCP) has a one-star rating, making it a relatively risky fund to invest in.

AlphaMark Actively Managed Small-Cap ETF (SMCP)

How to invest in ETFs

The process of investing in ETFs is relatively simple. If you have invested in stocks before, this process will actually be easier.

First, find a good online broker such as Robinhood, Schwab, or Interactive Broker, open an account, and deposit your money.

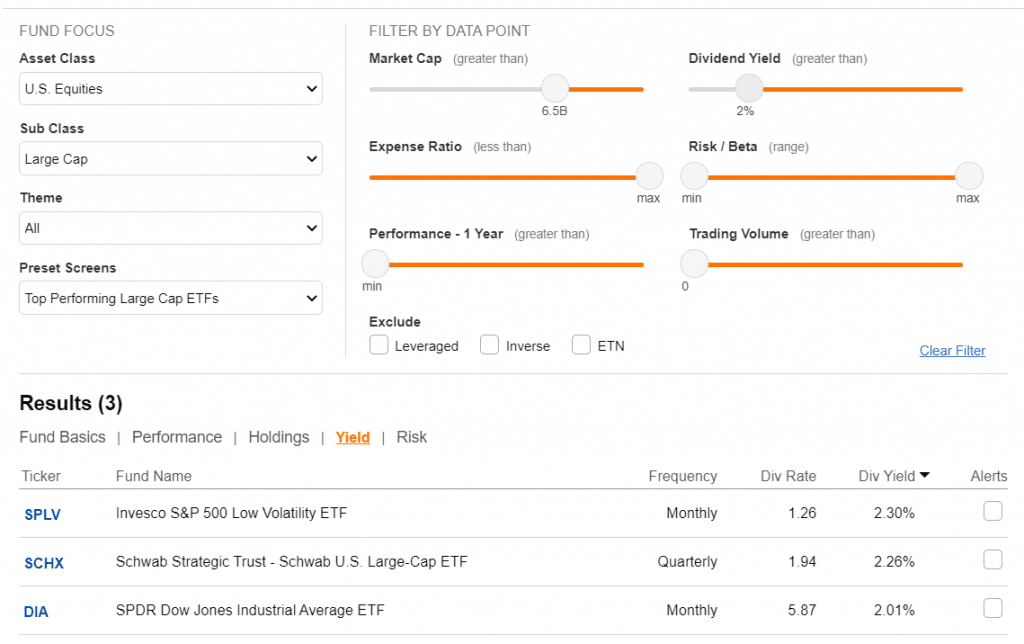

Second, select an ETF and analyze it. The best way to do this is to use an ETF screener such as the one provided by Seeking Alpha. For example, using the screener below will bring you US large-cap ETFs with a market cap greater than $6.5 billion and with a dividend yield of 2% and more.

Finally, read more about the ETF and then invest in it. We recommend that you invest in an ETF you are comfortable holding for decades to come. Also, as part of your passive ETF, you should invest in a basket of ETFs instead of just one.

Final thoughts

In this dummy’s guide to ETFs investing, we have looked at what ETFs are, their types, how they are created, their largest providers, and how to invest in them. Still, there’s a lot we have not covered, which means that you should spend some time reading more about them. To do that, some of the best books you should read are ETFs for the long run by Lawrence Camel and The ultimate guide to ETFs by Don Dion.