- The US dollar shrugging off disappointing US jobs data is the catalyst pushing GBP/USD and Gold lower.

- US equity markets edged higher last week as the disappointing jobs data report eased concerns of the FED tightening monetary policy

- Cryptocurrencies are struggling to bounce back after the sell-off of the past week.

The British pound is under immense pressure at the start of the week against a resurgent US dollar. GBP/USD is seen dropping towards the 1.4100 level as the dollar bounces back after Friday’s sell-off on a disappointing Non-Farm Payroll report continues to gather steam. The report showed the US economy added 559,000 jobs against an expected gain of 671,000.

After facing strong resistance near the 1.4200 level, the GBP/USD has turned bearish, with the four-hour chart signaling increased sell-off.

The 1.4100 is the immediate support level offering support to a potential bounce back after a recent sell-off. A breach of the support level could result in the pair edging lower, probably to the 1.4088 level.

The uninspiring May US employment figures are the only catalyst to support GBP/USD bouncing back after a recent sell-off. However, with US yields edging higher, a strengthened US dollar looks set to curtail any upside action in the pair.

The focus is on the UK April GDP data later on Friday, expected to impact the pound sentiments in the market significantly. The reopening of shops and outdoor hospitality could lead to a decent monthly growth that could support the pound.

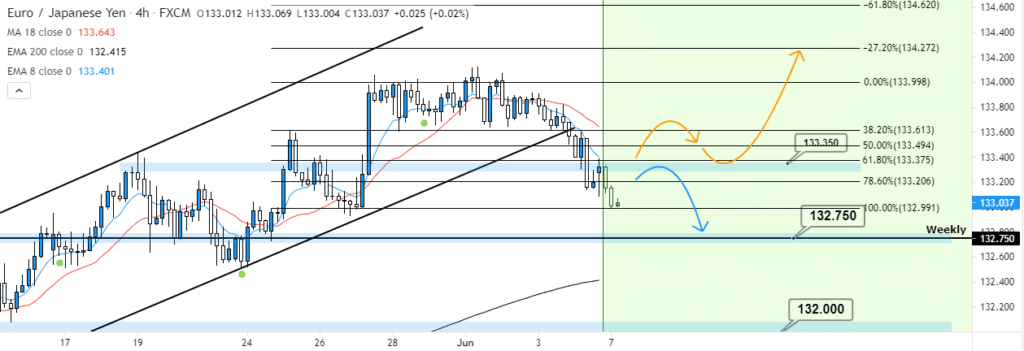

Euro weakness

The euro is also under pressure at the start of the week, losing ground against the dollar and the Japanese yen. The EUR/JPY pair shows signs of edging lower, retreating from three-year highs amid weakness in the common currency.

After failing to hold above the 134.00 level, EUR/JPY has slid to the $133.00 level amid weakness in the euro. A break below the 133.12 level could open the way for the pair to slump towards the 131.15 level.

A confirmation that German factory orders unexpectedly fell in April is one factor weighing heavily on euro strength. Contracts for goods made in Germany came in at -0.2% vs. 1.0% expected, signaling that manufacturing in Europe’s economic powerhouse is still yet to recover from the pandemic.

Gold consolidation

In the commodity markets, gold is also under pressure as traders struggle to keep Friday’s recovery on dollar weakness going. The risk-off mood in the market continues to put a safe-haven bid under the greenback, piling pressure on the XAU/USD pair.

Gold is struggling to rise past the $1885 level as a bounce-back yield continues to fuel dollar strength.

The disappointing jobs data in the US has cooled off concerns about the FED tapering, helping cool off reflation fears. US treasury secretary Janet Yellen suggesting higher rates are suitable for the Fed also weighs heavily on the precious metal.

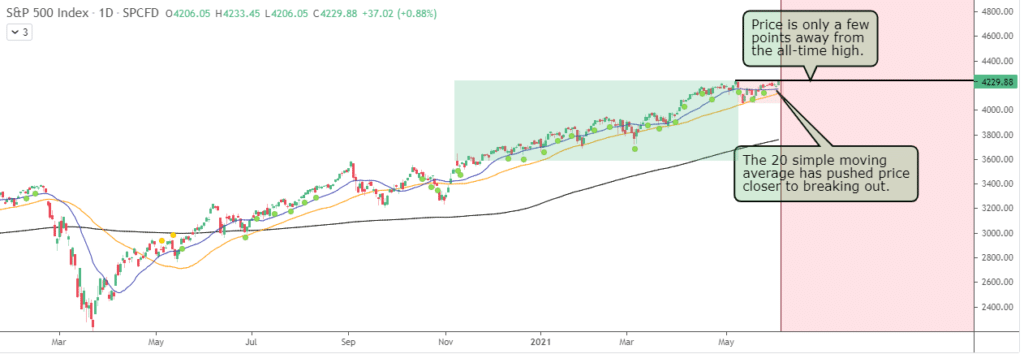

US indices rally

Major US indices jumped higher on Friday, helped by a Non-Farm Payroll report that eased concerns of the Fed hiking interest rates sooner or engaging in tapering.

The Dow Jones Industrial Average rose 0.52% to 34,756, as the S&P 500 rose 0.88% to 4,229.89. Tech-heavy NASDAQ was the biggest gainer rallying 1.5% to 13,814.49.

The disappointing jobs report was interpreted as bullish for the equity markets as it averted concerns that the FED will move to remove the pandemic era monetary support.

The $120 billion a month asset purchase plan has been one factor that has helped fuel the bullish momentum in the equity market.

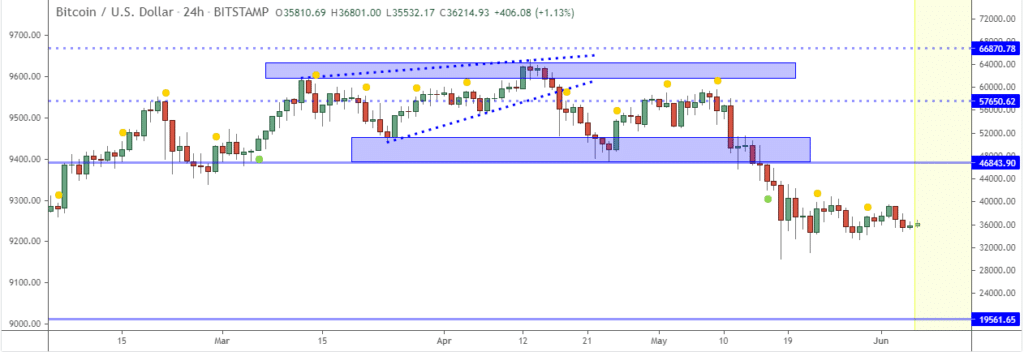

Cryptocurrencies under pressure

Meanwhile, cryptocurrencies remain under pressure failing to register any substantial gain after the recent sell-off. Bitcoin appears to have firmed around the $36,000 level, with any upside action attracting immediate sell-off.

Cryptocurrency crackdown in China and the Crypto conference in Miami failing to impact sentiments positively continue to curtail any upside action. BTC/USD is looking increasingly bearish below the $37,000 level.

A break below the $35,000 could trigger further slides, probably to the $30,000 level, a crucial support level.