- US dollar retreats from one-year highs.

- USDJPY holds firm amid yen weakness.

- GBPJPY rallies to 4-month high on pound strength.

- Oil prices rally amid inventories drawdown in the US.

- US equities bounce back amid economic growth optimism.

The US dollar remains on the defensive after falling from one-year highs on Wednesday on US Treasury yields dipping from four-month highs. The sell-off comes even on the inflation data showing prices rose solidly last month and FOMC meeting minutes confirming the Federal Reserve is on course to taper before year-end.

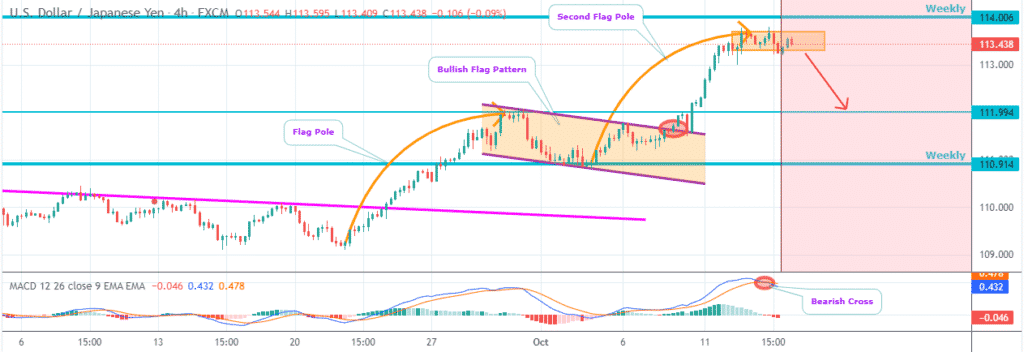

USDJPY bullish bias

With the dollar pulling lower from one-year highs, the Japanese yen was one of the biggest winners, as depicted by the USDJPY pair dipping to four day low of 113.16. However, the pullback was short-lived as the pair has since bounced back on the yen, coming under pressure amid concerns about Japan’s economy.

As it stands, USDJPY remains well supported for further upside action after bears failed to take out the 113.00 support level. Above the psychological level, the pair looks set to eye higher highs. On the flip side, a breach of the support level could trigger a pullback to lows of 111.94.

The Japanese yen remains under pressure against the dollar on a senior member of the new Prime Minister Fumio Kishida government reiterating that yen weakness is beneficial for the economy. Bank of Japan policy member Asahi Noguchi has also reiterated that Japan’s economic recovery will only become clear at the end of the year.

Additionally, a positive tone in the equity markets undermines demand for safe-haven Japanese yen, all but exacting some pressure against the greenback. That said, bullish biases on USDJPY remains intact as the FED moves to taper.

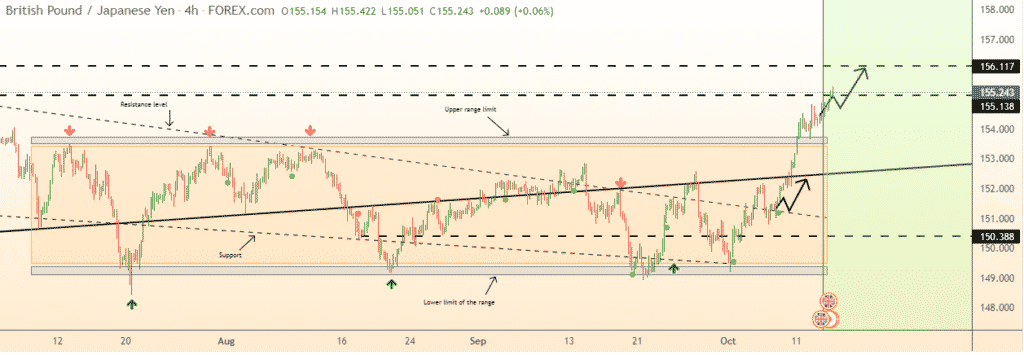

GBPJPY at 4-month highs

Meanwhile, the Japanese yen continues to lose ground against the British pound, with the GBPJPY pair powering to four-month highs. A push above 155.30 has once again opened the door for bulls to steer the pair to highs of 155.96 ahead of 156.00.

The British pound has remained resilient against the yen, despite recent economic releases missing estimates. Immediate data shows the UK’s economy grew by 0.4% in August against an expected 0.5% growth. Increasing bets that the Bank of England could hike interest rates next year has also continued to fuel pound strength against the yen.

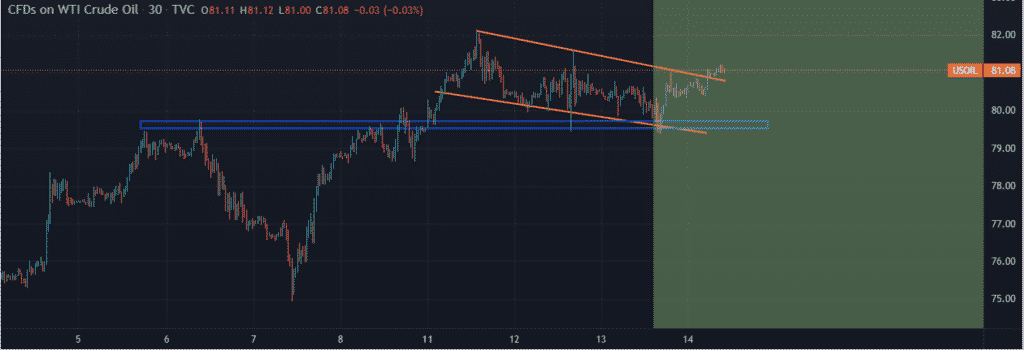

Oil prices bounce back

In the commodity markets, oil prices resumed their upward trajectory on Thursday, helped by improving demand in the US. Data showing better than expected US gasoline and distillate stocks drawdown is the catalyst fuelling a spike in prices.

Brent crude was up by 0.6% to highs of $83.70 as US West Texas oil rose 0.7% to $80.96 a barrel. Oil looks set to continue edging higher on OPEC+, sticking to an existing pact for a gradual increase in output. As some countries struggle to reach their output, quota supply looks stretched and set to remain tight amid growing demand, supporting higher prices.

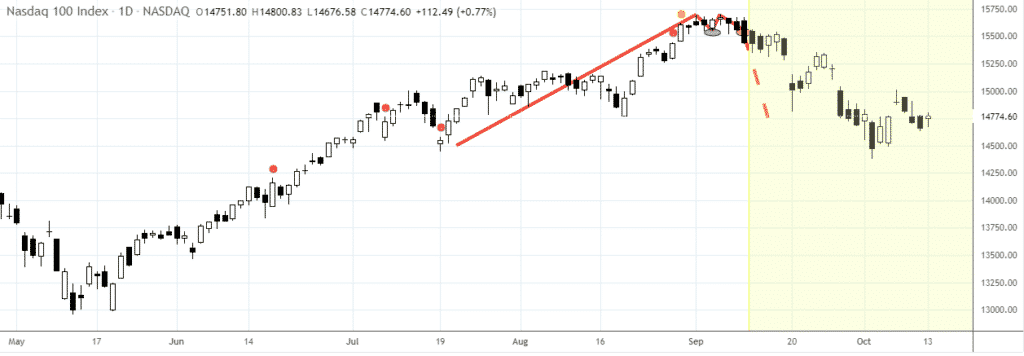

US indices recover

Major benchmark indices edged higher on Wednesday in the equity markets as optimism about economic growth strengthened investor sentiments. S&P 500 reversed losses to gain 0.30% as the NASDAQ jumped 0.7% and Dow Jones Industrial Average ended flat.

The rally in the equity markets came even as inflation data signaled the Federal Reserve could start reducing the crisis-era monetary policy. The tapering push comes at a time when the US economy is expected to grow at its fastest pace in decades.

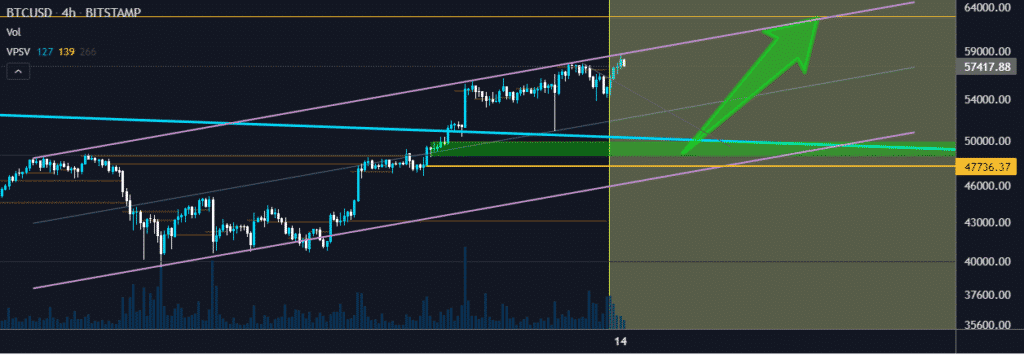

Bitcoin & Ethereum eye record highs

Meanwhile, Bitcoin and Ethereum are once again edging high as bulls-eye all-time highs. BTCUSD is above the $57,600 level, with the next stop as part of the upward trajectory being $59,400, where the pair faces strong resistance.

While Ethereum is above the 3,600 level, bulls are staring at strong resistance near the $3,700 above which the pair could make a run for the $3,900 level.