Climate Change Investment Trend

The looming danger of climate change, combined with other factors such as natural-resource scarcity, has presented significant challenges that require our immediate attention. The impact of climate change has been worsened by the high rates of urbanization, especially in developing countries. The efficient management of natural resources, along with funding of adaptation measures and mitigation, can remedy this situation.

The lack of environment-friendly funding for projects such as clean energy, water management, and clean transportation is felt all over the world. This is where Green Bonds come into play. They are a conservative, fixed-income financial instrument that offers a lucrative and viable financing option.

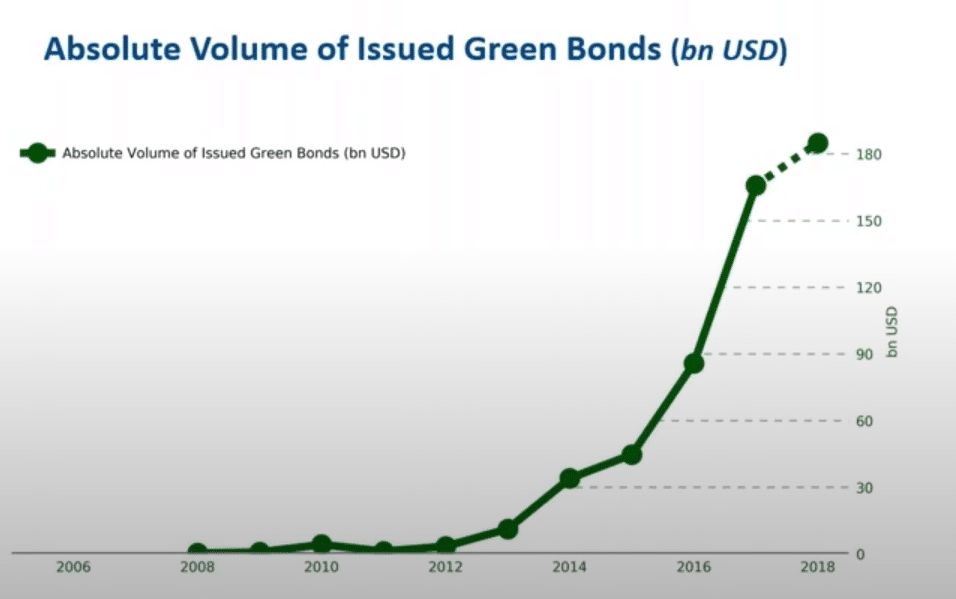

Green Bonds can thus be defined as designated bonds, intended to encourage sustainability, providing a way for investors to get behind climate and environmental-related projects. Investors can invest in green bonds to support and finance projects aimed at providing energy efficiency, pollution control, sustainable agriculture, recycling, clean water, water management, etc. The year of 2009 marks the primary time when the world bank issued the first green bond for investors.

What is a Green Bond?

As mentioned before, green bonds are designated bonds providing investors a way to finance climate-based and other sustainability projects. Green bonds are also intended to provide a financing option for the cultivation and expansion of environmentally friendly technologies. They generally come with incentives such as tax credits and tax exemption, which can entice more investors, when compared to other taxable investments.

According to the green bond principles, projects have to fall into certain categories to be considered a green bond. We list some of these categories below.

- Pollution Prevention and Control: includes companies that deal with greenhouse gas control, waste prevention, soil remediation, etc

- Energy Efficiency: includes companies involved with refurbished buildings, district heatings, energy storage, etc

- Renewable energy: includes production transmission, product, and appliances.

- Clean transportation: includes industries such as multi-modal transportation, clean energy vehicles, etc.

- Climate change adaptation: includes climate observation and early warning systems.

- Green Buildings: real estate that meets national, regional, or international criteria for standards and certification.

- Eco-efficient and circular economy adapted products and technologies: This includes resource-efficient packaging and distribution of goods and the production of environmentally sustainable products.

Green Bond Principles

In 2014 a group of 13 major investment banks created the guidelines named “Green Bond Principles”. It is focusing on providing transparency and disclosure when issuing environment-friendly debt instruments. It provides issuers with the recommendations they need when launching a credible Green Bond.

Project Evaluation and Selection rules: The green bond issuers are required by law to communicate the following information to investors.

-

- The process by which the issuer determines the eligibility of green projects.

- Objectives that are related to environmental sustainability.

- Any other related eligibility criteria, including any exclusion criteria which focus on managing potentially social and environmental risks associated with the project.

Additionally, issuers are required to provide the above information in the context of the issuer’s strategy, policy, objectives, and processes related to environmental sustainability. Any green standards or certification which is referenced in the project selection should also be included.

Use of proceeds: All projects designated as green projects are required to provide clear environmental benefits that are assessed and quantified by the issuer. Issuers are also required to provide an estimate of the share of refinancing vs. financing, in case part of the proceeds is used for refinancing. Green Projects can also include supporting expenditures for Research and Development, which can be related to more than one environmental objective or category.

Management of proceeds: According to directives, an amount equal to the net proceeds is required to be credited in a sub-account and moved to a sub-portfolio. It should be tracked and attested to by the issuer, following a formal internal process, as mentioned in the directives. The balance of tracked net proceeds is required to be periodically adjusted to match the allocations to eligible green projects if the green bond is outstanding. Information regarding the intended types of temporary placement for the balance of net proceeds should be carefully communicated by the issuer to the investors. Since the Green Bond principles require and encourage a high level of transparency from their projects, it is recommended that the management of proceeds should be allocated to an auditor or a similar third party. The auditor can verify the internal tracking methods and allocation of funds for the project.

Reporting: Issuers are required to maintain and keep readily updated information related to the use of proceeds. The information should be renewed every year until there is a total allocation of funds. Time and frequency may depend if there are any material developments involved. Information regarding where green bond proceeds have been allocated, as well as a brief description of each project, should all be included in the annual report.

Green Bonds Tax benefits for investors

Several types of tax incentives are put in place by policymakers to support green bond issuance.

- Direct subsidy bonds: Here, the bond issuers are entitled to get cash rebates from the government, which subsidize the net interest payable by issuers. Both the Qualified Energy Conservation Bonds (QECBs) and U.S. federal government Clean Renewable Energy Bonds (CREBs) use this structure.

- Tax Credit Bonds: Investors of the bonds receive tax credits rather than interest payments and are not required to pay interest on the issuance of green bonds.

- Tax-exempt bonds: Here, investors of bonds are not required to pay income tax on interest from the green bonds in their possession. As a result, issuers receive a lower interest rate.

Conclusion

Green bonds offer investors the ideal investment option when they’re looking to diversify their portfolio, based on both environmental based and income based decisions, despite not yielding the highest returns.