Copper is one of the most popular base metals in the world. It is used in the electrical industry because of its high conduction, malleability, and ductile characteristics. Copper is also widely-traded in the financial market. In this article, we will look at some of the best ways of investing in copper.

Copper price performance

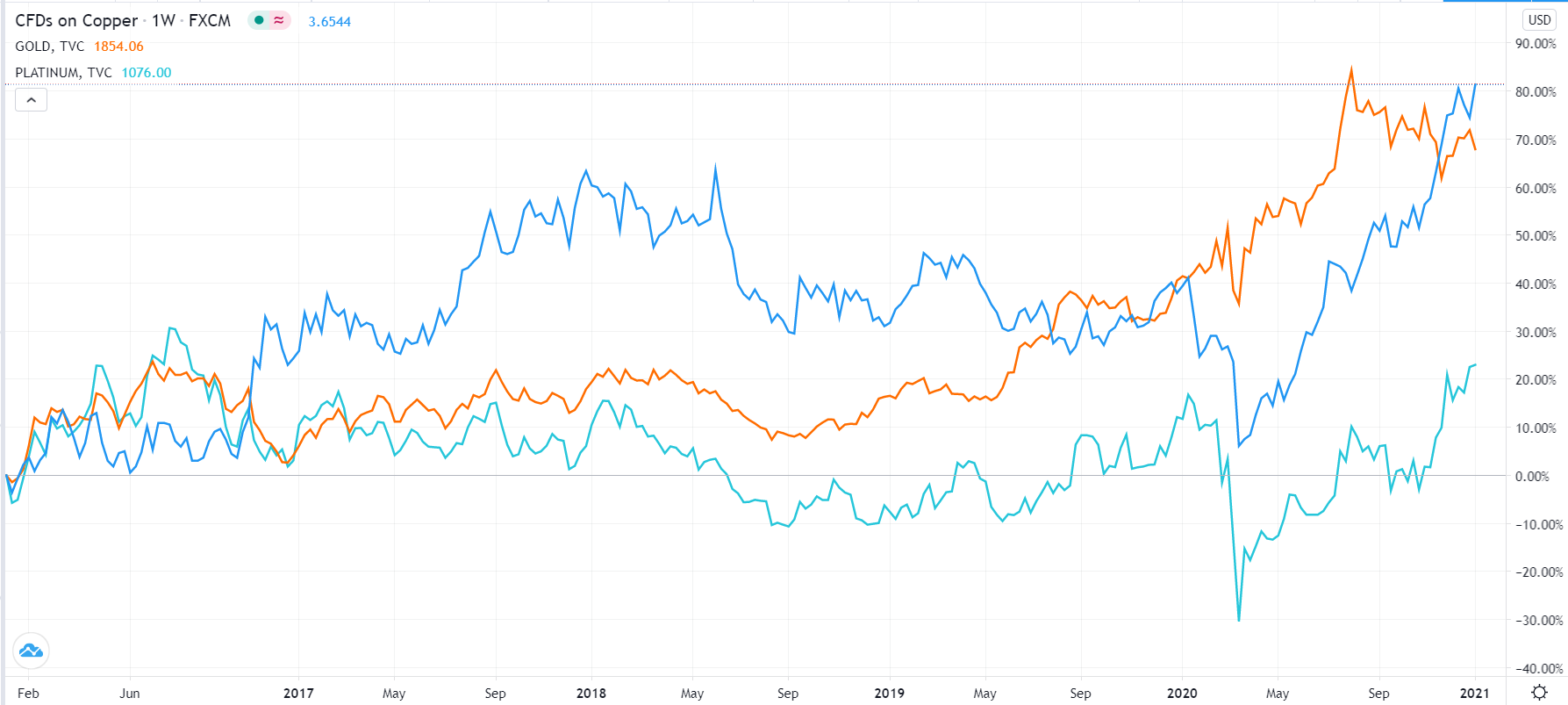

Before we look at the top ways on how you can invest in copper, let’s look at how the metal has performed recently. Since 2020, the copper price has been on a strong upward trend.

At the time of writing, the metal is trading at $3.65 per ounce, which is a 32% increase in the past 12 months. In the past five years, the metal has jumped by more than 80%, making it a better performer than gold and platinum.

This performance has been caused by the strong economic growth, the relatively weaker US dollar, and demand constraints because of the coronavirus pandemic.

Copper vs. Gold and Platinum

What moves copper prices?

Copper prices are affected by several factors. First, the value of the dollar tends to have an impact on how it performs. Ideally, copper rises when the dollar is weak and vice versa. That’s because a weaker dollar usually increases its demand.

Second, copper is often viewed as a barometer of the world economy because of its use in the vital electrical industry. Therefore, its price usually does well when the economy is strong or when there are signs of a global recovery.

Third, the price of copper also reacts to supply issues. In the past few years, the price has rallied in reaction to strikes in Chile, the biggest copper producer. Other factors that move copper are geopolitical issues, the strength of the Chinese economy, and the weather.

Let us now look at the various ways of investing in copper.

Investing in copper mining companies

One of the most common indirect methods of investing in copper is to buy shares of copper miners. Fortunately, there are many publicly-traded companies that mine and supply the metal globally.

Ideally, these companies do well when the price of copper is rising. Obviously, when the metal’s price rises, they make more money and vice versa.

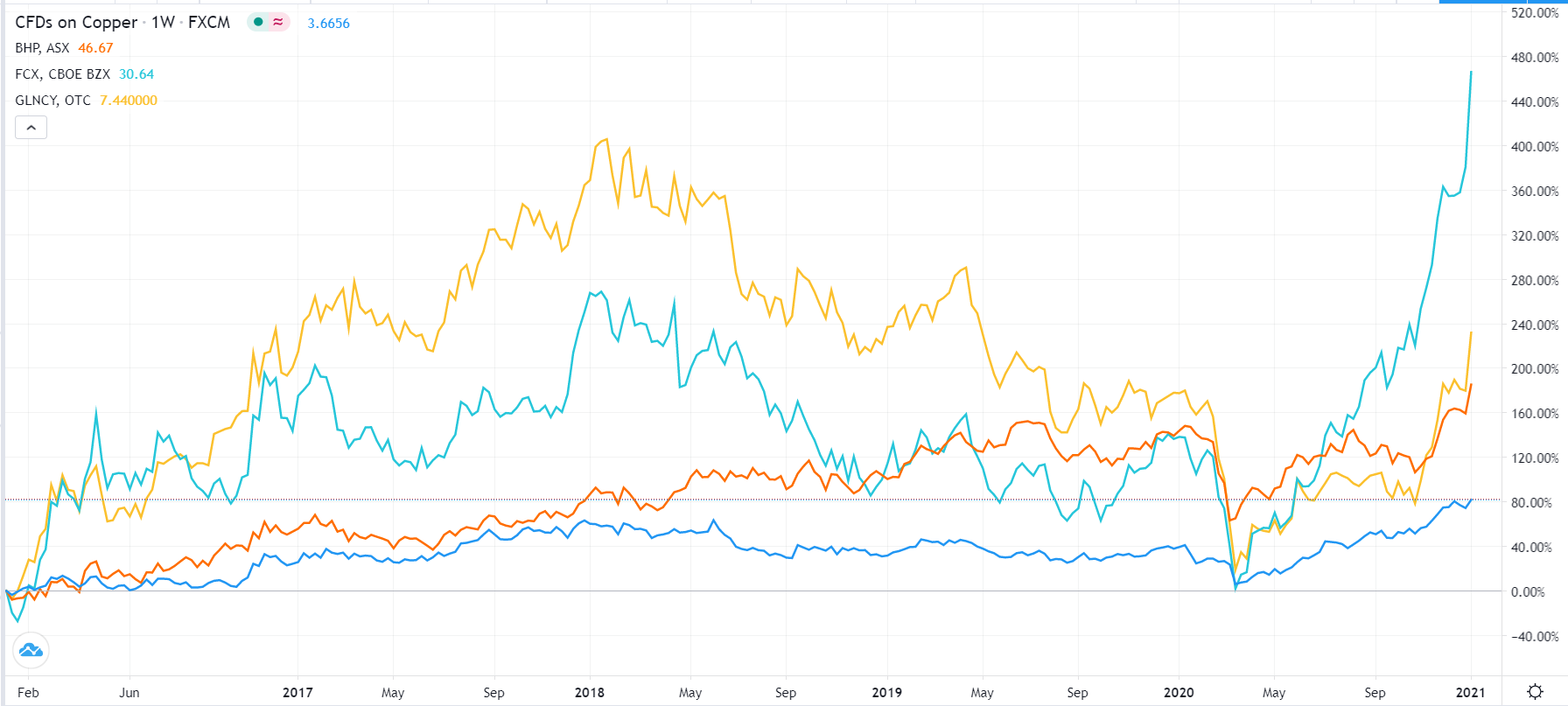

Some of the biggest copper mining companies that you can invest in are Freeport-McMoran, BHP Billiton, Glencore, Rio Tinto, Southern Copper, and Antofagasta. The chart below shows that the share prices of these firms tend to rise when the copper price rises.

Copper vs. miners

There are two primary benefits of investing in copper mining companies. First, unlike copper itself, you can make money in two ways. You can make a return when the share price rises. Also, you can make money through dividends.

However, there are also risks for investing in copper mining companies. First, in addition to the overall price of copper, there are other things that move the stocks. For example, a company could be having poor management, falling cash flows, and higher debt. The industry could also be out of favor from investors.

Investing in copper ETFs

Another way you can invest in copper is through exchange-traded funds (ETFs). These are funds that seek to track other assets. Ideally, there are two main types of copper ETFs that you can invest in.

First, you can invest in funds that track the price of copper. Two of the biggest funds that do this are the United States Copper Index Fund (CPER) and the iPath Series B Bloomberg Copper Subindex (JJC). These two funds are listed in American exchanges, and you can buy them directly through your brokerage.

Second, you can invest in copper miners ETFs. These are funds that track the biggest copper mining companies in the world. As you will find out, most of these ETFs also have companies that mine other metals like gold and silver. As such, if you are only interested in silver, the approach will be highly dilutive.

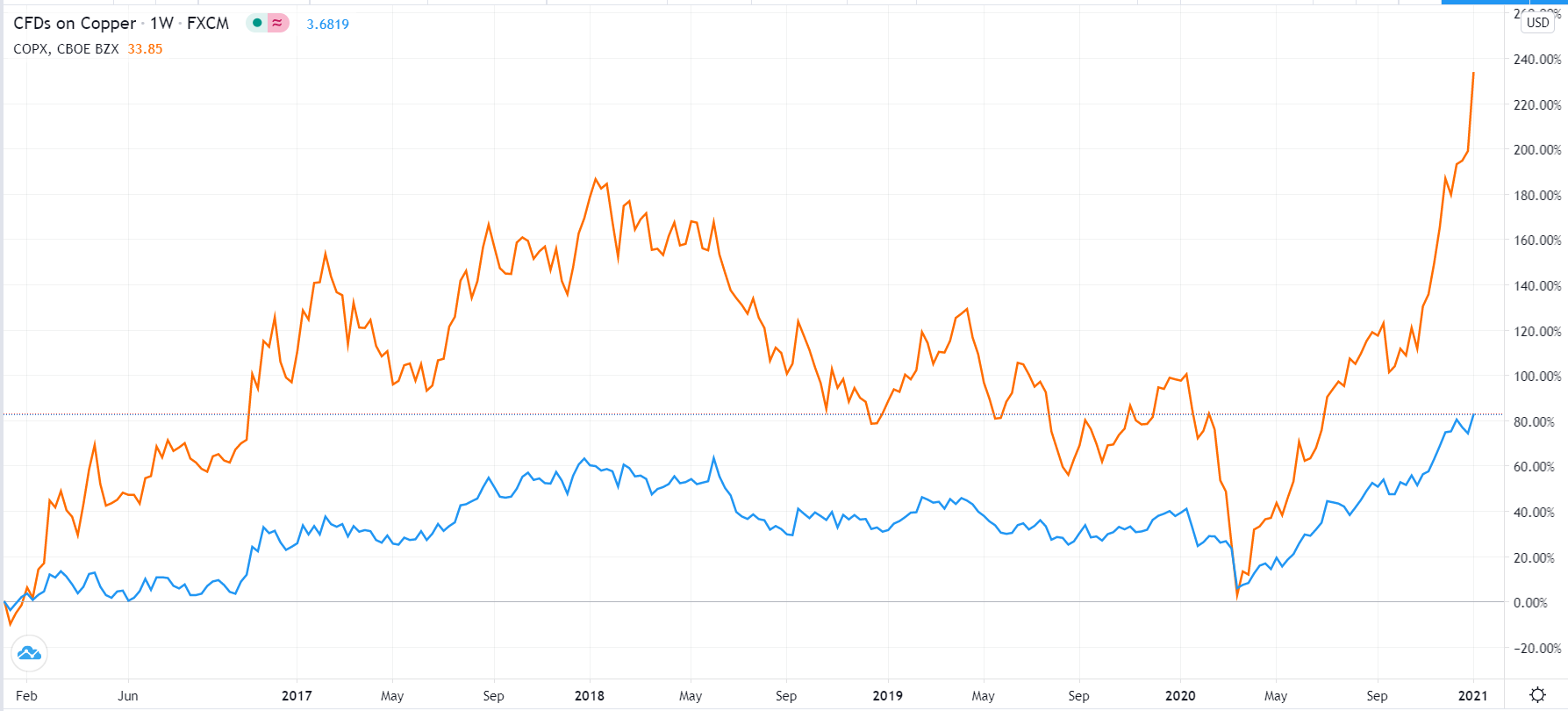

The most direct copper mining ETF is the Global X Copper Miners ETF (COPX) that has more than $269 million in assets. The biggest constituent companies in the fund are Vedanta, First Quantum, Freeport McMoran, and Glencore. The chart below shows the relationship between the metal and the ETF.

The copper ETF has outperformed copper.

The other mining ETFs that will give you a small exposure to copper mining companies are SPDR S&P Metals & Mining ETF (XME), iShares MSCI Global Select Metals & Mining Producers (PICK), and VanEck Vectors Rare Earth/Strategic Metals ETF (REMX).

Invest in copper futures and CFDs

Another way you can invest in copper is through futures, which are offered by the leading brokers like E*Trade, Fidelity, and Schwab. For starters, futures contracts are financial assets that deal with the delivery of an asset in the future.

The futures are mostly listed at the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE).

Another option for investing in copper that is similar to futures is the contracts for difference (CFDs). Companies mostly offer these products outside of the United States, and they help you buy and sell copper. CFDs track the price of copper futures.

There are several benefits of investing in copper using CFDs and futures. First, it is the most direct method of buying or selling copper in the financial market. Second, you can buy when you believe that the price will rise and short when you believe that the price will fall. Third, you can use leverage to maximize your gains.

Final thoughts

There are several benefits of investing in copper and assets linked to the metal. For example, unlike other base metals like nickel and lead, there is a lot of information available about copper. This information will help you make decisions about whether to invest or go short.

Second, copper is one of the most liquid metals in the financial market. This means that you can buy and sell it at any time without added costs. Third, copper analysis is relatively easier than that of most assets.