Real Estate Investment Trusts (REITs) are unique companies that are involved in the property market in the United States. They are special because of how they are structured and the rules they must follow to qualify as REITs.

The concept of REITs started in the 1960s when congress wanted to allow small investors to invest in the vast real estate sector. That is because of how costly it is for a single person to build a property and make money from them.

Since then, the REITs industry is one of the biggest sectors in the United States. There are more than 200 public REITs that have a market capitalisation of more than $1 trillion. At the same time, research shows that more than 87 million Americans have invested in REITs.

Qualities of REITs

REITs are special types of companies that meet a certain criterion to qualify as such. This criterion was set in the Cigar Excise Tax Exception bill that led to their creation. As such, a REIT is significantly different than other firms like Microsoft and Google.

Here are the key qualities that all REITs must have:

- Where they invest – A REIT must invest at least 75% of its assets in either real estate, cash or treasuries.

- Profit distribution – REITs must distribute at least 90% of their annual income to their shareholders every year.

- Income sources – REITs must derive their income from real estate or other fixed properties.

- Board of trustees – A REIT must have a board of trustees that are answerable to all shareholders.

- Number of shareholders – A REIT must have a minimum of 100 investors in their first year.

- Taxation – REITs do not pay corporate tax.

Therefore, as you can see, a REIT is a unique company that operates differently from other firms. For example, a company like Microsoft has no limit on where it can invest or how it can distribute its earnings.

Types of REITs

There are three broad ways of categorising REITs:

- By type of asset – This is a method of grouping REITs based on the type of assets that they invest in. For example, there are healthcare REITs, mall REITs, office REITs, and data storage REITs.

- By the way they are listed – In this, there are public REITs that are listed in major exchanges like Nasdaq and New York Stock Exchange. There are also private REITs that are not open to the public.

- By type of investments they make – In this category, a REIT can be classified as either equity or debt.

Benefits of investing in REITs in the U.S.

There are several reasons why long-term investors would consider investing in REITs. Among these reasons are:

- High returns – REITs have higher returns than average companies. That is because they do not pay income tax, and they are required to distribute at least 90% of their income to shareholders. For example, while the average dividend yield for companies in the S&P 500 is about 1.9%, REITs have an average yield of more than 5%.

- Diversification – Investing in REITs is a good way to diversify your portfolio.

- Liquidity – Like other stocks, REITs are highly liquid, meaning you can buy and exit your investments with ease.

- Backed by real assets – Unlike most stocks, REITs are usually backed by real assets like properties and cell towers.

Examples of REITs sectors in the U.S.

REITs operate in various sectors in the United States.

Here are examples of key REIT sectors and companies in the industry:

- Healthcare REITs – These are companies that own hospitals, medical facilities, and nursing homes. Examples are Welltower, Ventas, and CareTrust.

- Timberland REITs – These firms invest in forestry and other land assets. Examples are Weyerhaeuser and CatchMark Timber Trust.

- Mall REITs – These companies own various types of malls in the U.S. Examples are KIMCO, Ceder Realty Trust, and Realty Income.

- Residential REITs – These firms own residential homes and make money by leasing them. They include Equity Residential Properties Trust, Independence Realty Trust, and Camden Property Trust.

Other types of REITs you can invest in are self-storage REITs like Public Storage and Life Storage, infrastructure REITs like Landmark Infrastructure Partners and Uniti Group, and data centre REITs like Equinix and Digital Realty.

How to Invest in REITs

Generally, you can invest in REITs in two main ways. First, you can invest in individual REIT stocks like Ventas and Uniti. Second, you can invest in REIT exchange-traded funds (ETFs). ETFs are special funds that invest in tens of REITs companies. Examples of these funds are Vanguard Real Estate VNQ), iShares Core U.S. REIT (USRT), iShares Global REIT (REET), and Fidelity MSCI Real Estate Index (FREL), among others. The key benefit of investing in REIT ETFs is that they are diversified across different sectors and geographies.

There are three main steps you need to follow when you are investing in REITs:

Find a good broker

A broker is an intermediary who connects you with REITs that are listed in the New York Stock Exchange (NYSE) or the Nasdaq. Fortunately, there are several credible brokers in the U.S. that don’t charge commissions. Some of these brokers are Robinhood, Charles Schwab, E*Trade, and Interactive Brokers.

Consider the industry you want to invest in

If you are new to REITs, you should consider the industry you want to invest in and those to avoid. For example, the coronavirus pandemic has pushed away people from malls leading to retail bankruptcies. As such, you might want to avoid mall REITs. At the same time, the pandemic has led to more demand for data centres. Therefore, you may consider data centre and cell tower REITs, which are in high demand.

Conduct more research

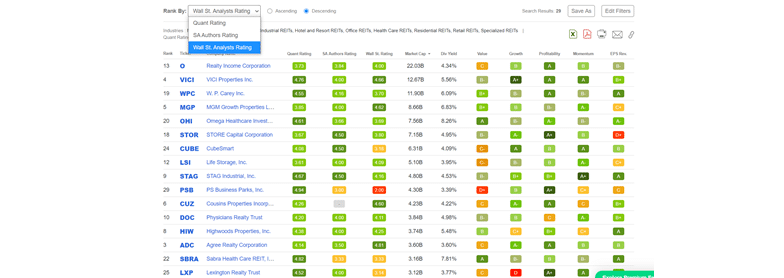

Since REITs are perfect for long-term investing, you should consider doing a lot of research before you invest in a company. A good way to start is to use the REIT screener feature that is provided by Seeking Alpha. This tool provides REITs based on their profitability, growth, momentum, dividend yield, and analysts’ forecasts.

REIT screener

After you identify a REIT that you like, we recommend that you read more about them. Read their annual reports, their recent earnings statements, and conference calls to find out their edge. You should then invest in the REIT after doing this type of research.

Final thoughts

REITs are among the most popular stocks among long-term income investors because of their stability and high dividends they provide. However, like all assets, investing in REITs requires a lot of due diligence to avoid costly mistakes. For example, many investors have lost money by investing in department store REITs as the world moves to online shopping.