The forex market can be an overwhelming place, especially for novice traders who lack the technical know-how and experience to be successful straight away. The foreign exchange market can be a world of opportunity if one plays his/her cards right but can be quite complex if one lacks the proper understanding. This is where Forex Signals come into play.

Forex signals refer to online trading alerts, providing the latest information about the market and trading opportunities for major foreign currency pairs. Signal services allow the trader to follow or copy the trading actions taken by leaders in the Forex market, or the top-performing analysts.

Getting started with Forex signals is simpler than many people think. No matter where one receives forex signals from, there are some basic steps that one has to take to ensure he/she is on the right path.

Understanding the Types of Forex Signals Available: Before one begins working with forex signals, a complete understanding of the different types of forex signals available is required. While some providers focus on long-term setups, others might focus solely on scalping the market, or on technical analysis. There are two types of forex signals that are available.

- Automated Signals: Automated signals are analytical in nature and are used by trading software and robots to find trading opportunities in the market.

- Manual Signals: Manual signals are generally distributed by Forex signal providers, generally generated by human traders working on their behalf to analyse the market. Manual signals are ideal for more experienced traders who can use them to fine tune their own trading strategy to produce favourable results.

Receiving Forex Signals: A forex signal service involves the sending of signals to the traders constantly. It’s up to the traders when and how they use it. Signal providers may send signals to traders in the following three ways.

- Mobile Platforms: Due to the popularity of mobile devices on a global level, there are many foreign exchange apps that come with their set of live forex signals.

- Desktop platform: Signals received on a desktop platform provides traders complete information regarding key pairs and indicators.

- Web-Based Platforms: Web-based platforms are arguably the most popular as they can work with various devices such as desktops, PCS, tablets, smartphones, etc.

Traders have to select a convenient and accessible option based on their own preferences and trading style. MetaTrader 4 is a well-known trading platform which is highly recommended and has more than a million users worldwide.

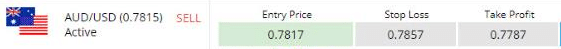

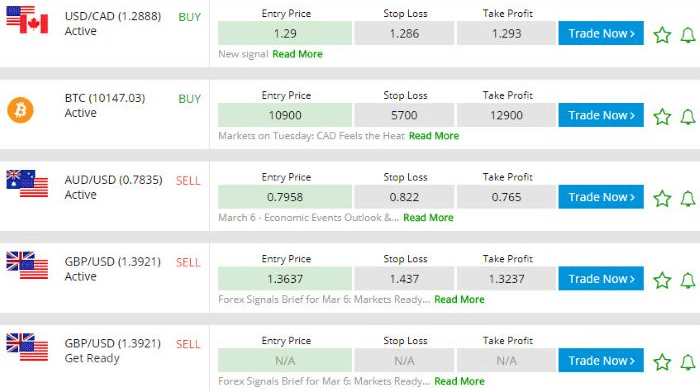

Reading the Forex signals: A typical trading signal consists of information on a particular currency pair, its action, stop loss and take profit. It may also come with a status that notes the timing. For example, in the case of a signal for AUD/USD, it contains either a BUY or a SELL function and the stop loss is automatically set to close the trade if a certain amount is lost. Alternatively, the take profit function is also set to automatically take the profit after a certain amount is reached.

In case of a trader following a complex day trading strategy, he/she might not need to use the stop loss or take profit functions. Instead, he/she relies on their skills and knowledge. However, in the case of a forex signal, both stop loss and take profit is used to build a consistency to help new or novice investors in the market. New traders should thus refrain from adjusting stop losses and take profit points, as it may interfere with the trading strategy in place.

A “trailing” stop loss maybe employed by some strategies and forex signalling services. It’s quite an advanced strategy used to maximise profits and minimize losses.

Placing Trades Using the Signals: Due to the myriad of trading platforms available, traders can choose various web based and mobile device-based apps. When inputting the trade, traders need to be accurate. It is normally recommended that the trader find the currency pair and make the move to purchase or sell. Then they can simply copy both the take profit and stop-loss boxes into the trading platform he/she is using. There are some particular forex signals that can automate the accounts on the trader’s behalf.

Generally, trading signals concentrate on major pairs such as the USD/GBP, AUD/USD or USD/JPY. However, there several other trading signals that can take advantage of unconventional pairs. Once the copied information has been checked for consistency and accuracy, the trader can initialise the trade in real-time.

The Foreign exchange market is fraught with complexity and volatility. Forex signals offer the much-needed consistency, allowing traders to generate calculated returns rather than employing high-risk trading strategies. As a trader, it is always advised to read the terms and conditions of the signal provider he/she is choosing. In such a risky environment, forex signals offer beginner investors the opportunity to substantially reduce the risk involved, if properly used.