Want to succeed in your forex trading venture? Knowing the right trading technique can make or break your entry into the forex world. And, in Forex, this means knowing the basics of forex analysis. Don’t get confused by the different analytic methods and other trading jargon. This guide will help you discern the fundamental analytic strategies and walk you through the different categories and their significant role.

What Is Forex Analysis?

Before we delve into the methods used by newbies and experts alike, let us see what analysis denotes in relation to forex. The system is a means for traders to make their sell or buy choices regarding currency pairs.

You can find over 150 currencies, of which USD, GBP, AUD, NZD, CAD, and EUR are popularly sought-after forex currencies. Since the changes in the political, economic environment, and now the pandemic influence the currencies, it is necessary to analyze them meticulously.

With the analytic methods, you try to foretell the increase or decrease in a currency’s value. For instance, if you find from the analysis that a particular currency pairing is strong, you can buy or sell it if you find it is weak (decrease in value).

Let us take the example of the USD/EUR currency pair. If the American dollar is decreasing or weakening compared to the Euro, you can sell the pair. In case you expect the US dollar to increase in value, you can buy. The initial currency in a pair is called directional currency. If it increases, it implies the exchange value is increasing, and if it falls, the exchange value is on the downward trend.

Types of Forex Analysis

Now that you know what forex analysis is let us look into the major types that traders prefer. Fundamental, technical, and sentiment analysis are the three key systems used by forex traders.

1. Fundamental Analysis

As the name suggests, this analysis is about fundamental factors that influence a currency pair, such as economic conditions or political changes related to the country that the currency belongs to. The social structure also influences the demand and supply of a particular currency.

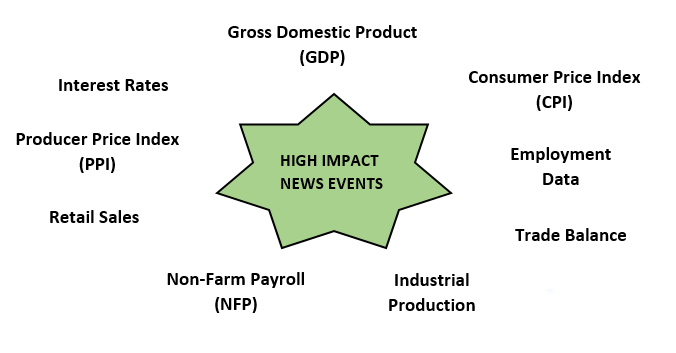

Basically, you have to keep track of the news related to a country’s economy. For instance, in a , there is a high demand for currency of the country with a strong economy. It results in increased price, but then, what kind of news should you be looking for?

The monetary policy or the decisions taken by a centralized bank on increasing or decreasing interest rates can alter the demand of the currency. Other tools that traders prefer for this analysis include the economic calendar.

You need to update yourself on the financial events related to banks, treasuries, and more. Besides interest rates, corporate profits, unemployment, GDP changes, wages/income, and inflation are other factors that can change the economy and hence are used for this analysis.

Geopolitical tensions, such as conflicts and wars, can impact the price movement. And, weather and other seasonal changes can be an influencing factor. In short, you need to keep track of the current news events so you are one step ahead in your predictions and profit from them.

An important fact to note here is that you must remember that this analysis is effective for the long term mostly and you cannot apply it exclusively for assessing the price movement in the short term.

2. Technical Analysis

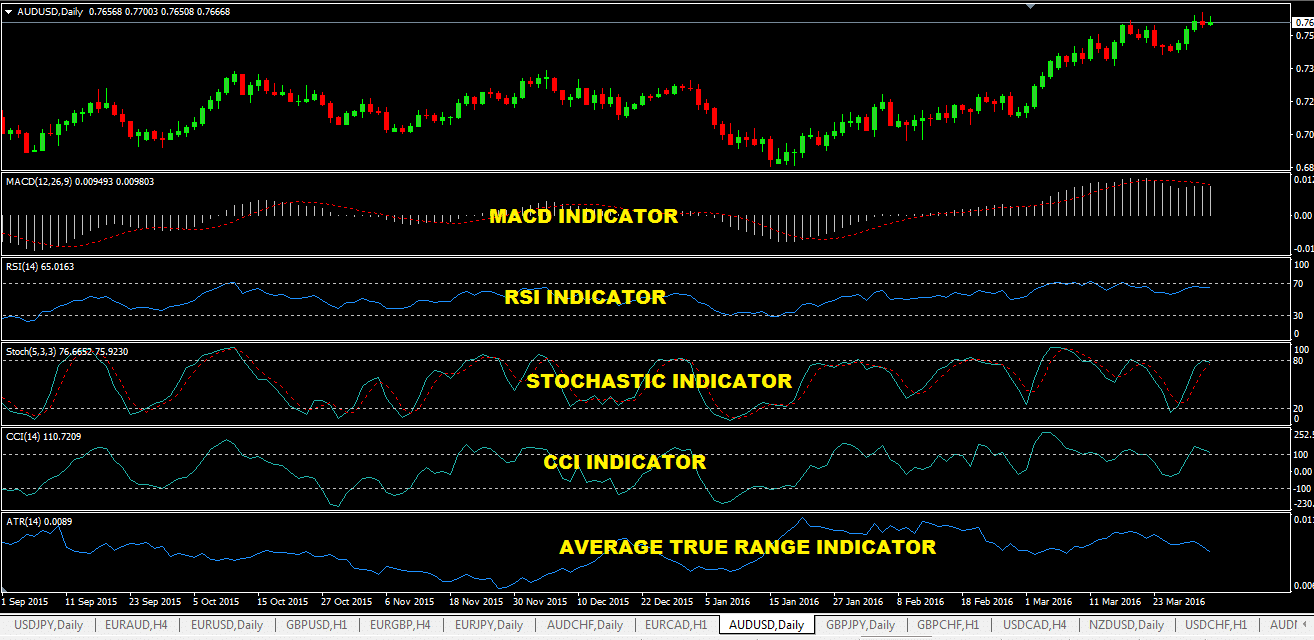

For traders who find patterns and indicators as more solid evidence for predicting the price movement, the technical forex analysis is ideal. Price charts are used to identify specific patterns and future movements are predicted using them. Just like the indicators used for equity and stock trading, forex trading has its own set of indicators. Some common ones include MACD, RSI, and Bollinger Bands.

Many traders prefer this analysis type as the indicators are easy to predict a trade’s entry point and exit point. In essence, this analysis is basically a trader capitalizing on the predictability of traders as they enter or exit a specific trade.

Unlike the fundamental analysis, you need to know how to use the indicators and read the charts. Even with experience, it is difficult to read the charts as a single chart can be interpreted in opposite ways by traders. Hence, technical indicators are used to interpret the chart patterns and reduce risks considerably. Technical analysis is preferred as it is ideal for long- and short-term price predictions.

3. Sentiment Analysis

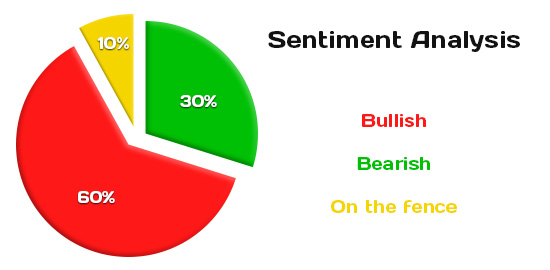

This analytic model helps traders assess whether a market is net long or short. It uses the market trend or how people trade in a specific currency to predict the price movement. In other words, it uses crowd psychology.

For instance, a trader using this analytic model will use a big investment in a specific currency to trade. A huge investor number can increase the future sellers of the currency. This will reduce the buyers and result in price reversal, making the buyers sell.

Which Is Best For Forex Trading?

Trading with just a single analytic tool is not a prudent strategy to use. This is true for forex trading too. The best way is to combine the three main analysis models. Here is what you can do.

To identify long term price movements, make use of fundamental analysis. For instance, if there is an increase in interest rates in the US, the USD will be in demand with more traders or investors willing to purchase the currency.

Identify the right entry points using the technical indicators and charts, such as RSI or MACD.

Use sentiment analysis as a final checkpoint before you decide on your trade. The sentiment analysis can be done by taking into account the total short or long trades or identifying the difference in the long and short movements.

Bottom Line

The above analysis models are not the only tools that forex traders use. You have plenty of economic indicators as well as private reports for evaluating your forex strategy. The key factor you should keep in mind is that instead of focusing on the numbers, understanding how they came about, and their impact on a country’s economy. By using the analysis models optimally, you can have an immensely valuable forex trading tool in your hands.