Forex trading requires so many tools for technical analysis. Some of these tools are relatively easy to use and are recommended for beginners. In this article, we will look at the top four forex trading tools that advanced traders use.

Pine Editor and MetaEditor

Algorithmic trading is the process of using software tools, also known as robots, to identify entry and exit positions. These bots are usually developed by traders with advanced computer programming knowledge and experience.

To build these bots, most of the traders use several programming languages and platforms. The most popular ones are the Pine Editor, which is provided by TradingView, and MQL5, provided by MetaQuotes. MetaQuotes is the developer of MT4 and MT5.

To use the two platforms well, you need to have several years of experience in the trading and software development industries. As a trader, you will need to have a well-defined strategy that you have used successfully for many years. You will then translate this strategy into a robot and then use the strategy to test it well. The chart below shows the Pine Editor tool in the TradingView.

Pine Editor tool

Schiff pitchfork tool

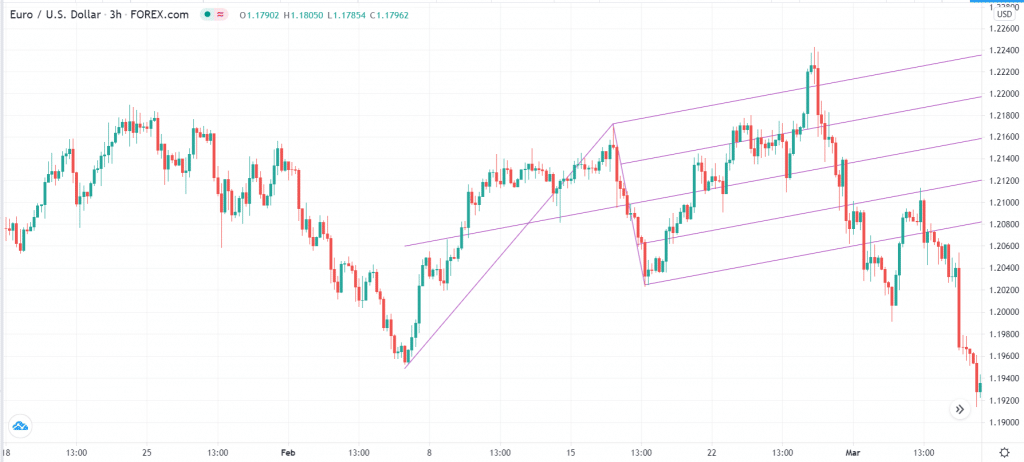

The Schiff pitchfork is a tool that is derived from the Andrews pitchfork indicator. While most beginners don’t know about it, it is one of the most useful tools. It is made up of five lines. The middle line is usually surrounded by two upper resistance levels and two lower support levels. The pitchfork is drawn by connecting a lower side with an upper side of the asset with another significant low, as shown below.

Using the Schiff pitchfork is a smooth and straightforward process. After joining the lower, upper, and lower sections, you simply look at the middle line, which is known as the median level. If the price is falling, a move below the median level is usually a confirmation that the downward trend will continue. Similarly, if the price is rising, a cross above the median line is a confirmation of the trend.

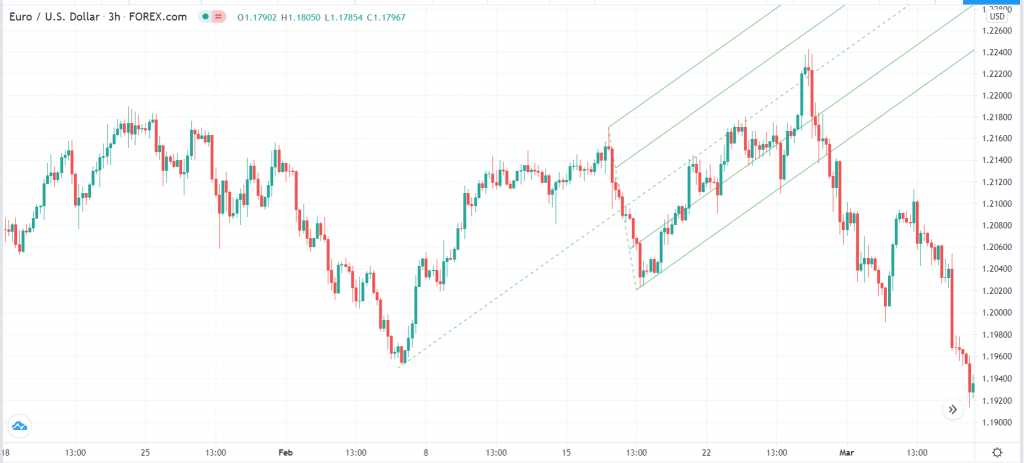

The Schiff pitchfork is a variation of the original Andrews Pitchfork tool. The two tools are applied in a similar manner and are usually good pointers to support and resistance. The chart below shows the same chart as the one above but with the Andrews Pitchfork. Indeed, the Andrews pitchfork tends to be a better pointer of support and resistance.

Andrews pitchfork example

With the two pitchforks, the price will always remain in a bearish position so long as it is below the median line. Similarly, it will always remain bullish so long as it is above the median line.

Elliott Wave tool

The Elliott Wave tool is offered in TradingView and in MetaTrader 5. It is based on the Elliott Wave model that was developed by Ralph Elliot and is one of the advanced tools used by forex traders.

The idea behind the Elliot Wave is easy to use. It basically explains how trends form in the long term. In general, the process is relatively simple.

At first, the price of a currency pair rises as some buyers become interested in it. After a modest rally, the price declines as the existing buyers rush out of their trades and some sellers come in. These sellers push the price slightly lower, and then the buyers come back in and push it substantially higher. This is the third wave of the Elliott Wave pattern and is usually the longest.

After rallying substantially, the price then drops slightly as buyers rush for cover. After this corrective wave, the price then continues to rally and moves above the original high.

In general, the Elliot wave pattern has several rules. First, the second wave of the pattern should not retrace the first wave completely. Second, the third wave is always the longest. Third, the fourth wave should not fully retrace the third wave. And the fifth wave should not fully retrace the fourth wave. In general, this original pattern is known as an impulse wave.

Elliot wave example

The Elliot wave is one of the most popular tools used by traders to identify the stage a currency pair is in. It is widely used by combining with the Fibonacci Retracement tool. For example, the second wave should not move below the 50% Fibonacci retracement level.

Fibonacci retracement tool

Another tool used by advanced forex traders is the Fibonacci retracement tool. Indeed, it is used by most traders to help them identify the key support and resistance levels. The tool is provided by all trading platforms, including the Ninja Trader, MetaTrader 4 and 5, and TradingView.

For starters, this tool is developed by the concept of the Fibonacci sequence, which is an ancient Japanese concept. In general, the sequence is developed by adding the last two numbers.

In forex, the Fibonacci sequence has several important levels, including the 23.6%, 38.2%, 50%, 61.8%, and 78.6% levels. Therefore, traders pay closer attention to when a currency pair passes each of these levels.

For example, in the USD/SGD pair below, we see that it reached a high of 1.4648 and then started falling. Therefore, if the price passes the 23.6% Fibonacci level, it increases the possibility that it will move to the next 38.2% retracement level. Suppose it moves below that level. It will likely move to the next one and so on.

Fibonacci retracement example

The Fibonacci method is used in most situations. For example, it is widely applied when using the Andrews and Schiff pitchfork and in combination with other tools like the Cypher, Elliot Wave, and the XABCD patterns.

Summary

There are many tools that advanced day traders use in the market. In this article, we have looked at just four of them. Some of the other tools we have not mentioned are the ghost feed, Elliot double combo wave, Gann fan. Pitchfan, and Fib channels.