Exchange-traded funds (ETFs) are financial assets that track a group of stocks, bonds, and commodities. The funds are an important part of the financial market today, with estimates putting the total assets held in ETFs at more than $5 trillion. In this report, we’ll look at some of the best ETFs to invest in in 2022.

Invesco QQQ (QQQ)

The Nasdaq 100 index is made up of the biggest technology companies in the United States. Some of its popular constituent companies are Microsoft, Tesla, and Apple. In the past decades, these technology companies have formed the foundation of the American and global economy.

For example, Microsoft and Amazon are now the world’s leaders in cloud computing, while Tesla is the market leader in the electric automotive industry. As a result, the Nasdaq 100 index has a long history of beating the stock market.

The best way of investing in the Nasdaq 100 index is to use the Invesco QQQ ETF. Started in 2002, the ETF has become one of the biggest ETFs in the world, with more than $159 billion in assets. The ETF composition mirrors that of the Nasdaq 100, with its biggest constituents being Microsoft, Apple, Amazon, Tesla, and Facebook.

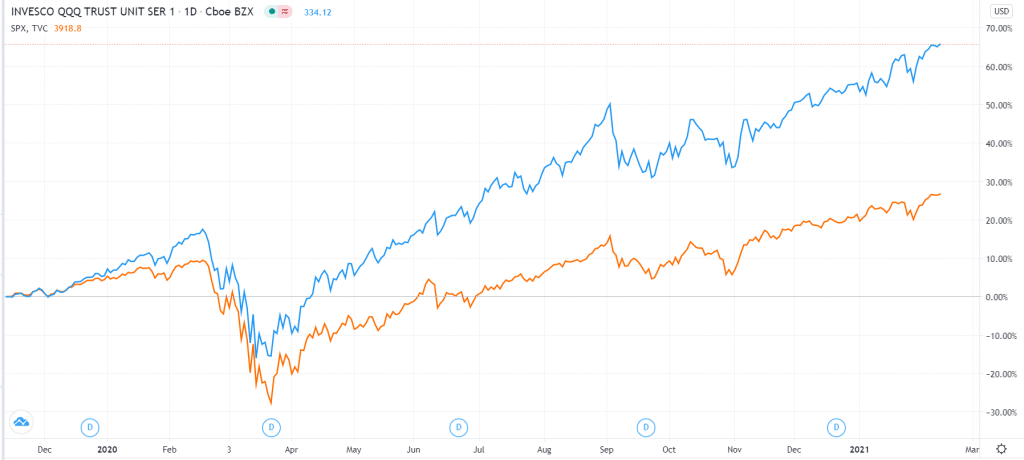

There are several important reasons why investing in QQQ in 2021 makes sense. First, the ETF has all the names in technology that you know and love. Therefore, through it, you can invest in the future of America at once. Second, it is also a relatively cheap ETF to invest in with its 0.20% 0.20% expense ratio. Third, the ETF has a long and well-proven track record of performance. The chart below shows its performance compared to the S&P 500.

Invesco QQQ vs. S&P 500

iShares Russell Mid-Cap Growth ETF (IWP)

The iShares Russell Mid-Cap Growth ETF is a fund that tracks some of the fastest-growing mid-cap stocks in the United States. It was started in 2001. Most of the companies in the ETF are in the technology industry. In total, the company tracks 352 companies, and it has more than $16 billion in assets.

The index is made up of some of the best-known brands in the United States. 38.8% of them are in the technology sector, while 22% and 10% of them are in the health care and industrial sectors.

Some of the best-known constituent companies of this ETF are Moderna, Roku, Twilio, Docusign, Chipotle Mexican Grill, and Veeva Systems. Other popular brands are LuluLemon, Palo Alto Networks, and MSCI.

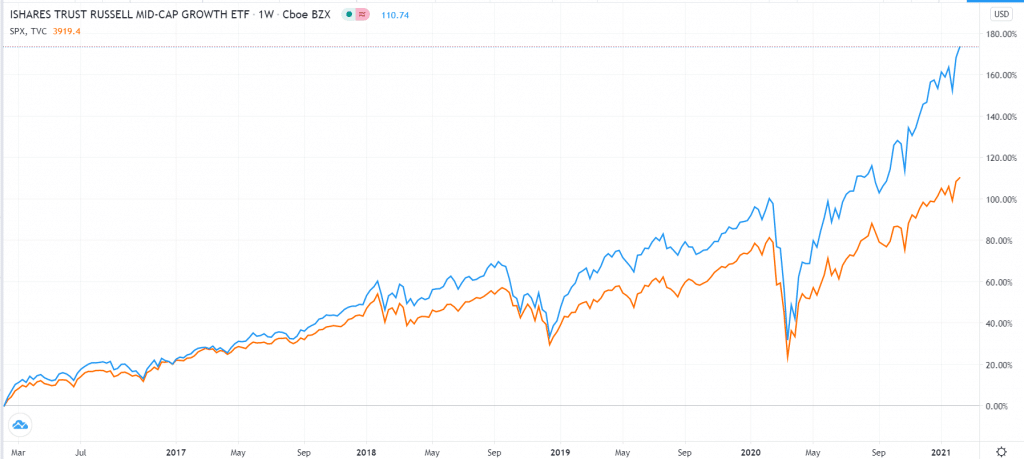

The IWP is an excellent ETF to invest in this year because of several reasons. First, like the Invesco QQQ, it has a relatively low expense ratio of 0.24%. Second, it is a well-diversified ETF, tracking companies in all sectors. Third, the ETF tracks some of the best-known mid-cap brands in the United States. Finally, as shown below, it has a long track record of success.

IWP vs. S&P 500

ARK Innovation ETF (ARKK)

Cathy Wood is one of the best-known women in the finance industry. She is famous for her ability to foresee changes that will happen in the future and companies that will dominate. For example, she has been an outspoken supporter of Tesla for almost a decade. She believes that the company is worth more than $1 trillion. Also, she is one of the top believers in Bitcoin.

Cathy also runs ARK Invest, a money management firm whose assets have moved from less than $5 billion in 2017 to more than $40 billion. This performance has been because of asset appreciation.

The ARK Innovation ETF is one of the funds managed by ARK Invest. It was started in 2014 and has since grown to have more than $17 billion of assets under management. The fund is made up of some of the best-known companies in the technology space. Its biggest holding is Tesla, a company that Wood has followed since its early days.

Some of the other well-known companies in the ETF are Roku, Teladoc Health, Square, Zillow, Spotify, and Shopify. All these companies dominate their industries. For example, Roku has become the biggest streaming company in the United States, while Teladoc is the biggest player in e-health. Zillow dominates the house listings industry, while Shopify is one of the biggest SAAS companies worldwide.

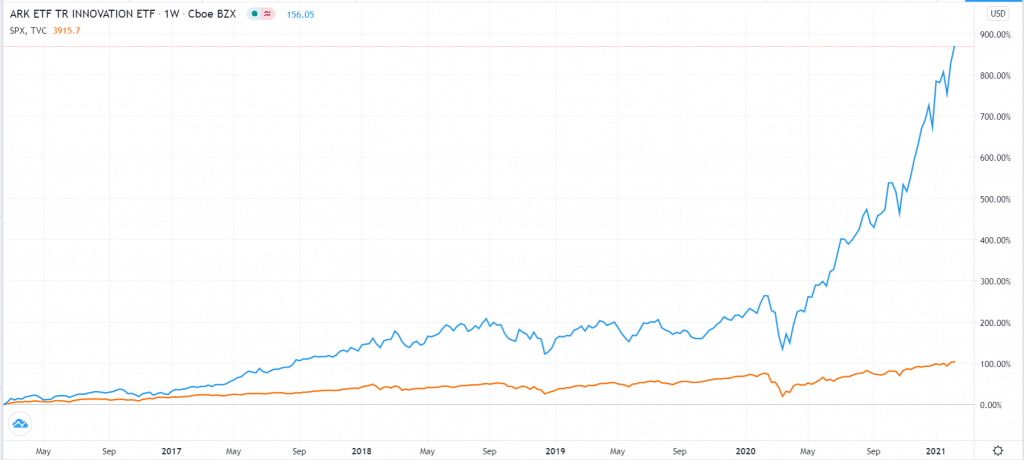

ARKK has a long history of outperforming the overall stock market. However, it does not come cheap. The ETF has an expense ratio of 0.75%, making it a relatively expensive fund to invest in.

ARKK ETF vs. S&P 500

Invesco China Technology ETF (CQQQ)

China will soon become the world’s biggest economy. That’s an unknown fact to many Americans. Also, gone are the days when China was known for cheap items like shirts and shoes.

Today, China is the second-biggest player in the technology industry. Indeed, many of the biggest companies in the world are all from China. They include Tencent, Alibaba, Meituan, and Ant Financial.

Unfortunately, it is relatively difficult for many Americans to invest in some of the biggest firms in China. This is where the Invesco China Technology ETF comes in. The index tracks some of the best-known brands in China like JD, Alibaba, and Sunny Optical. It also has about 102 companies and more than $1.8 billion in assets.

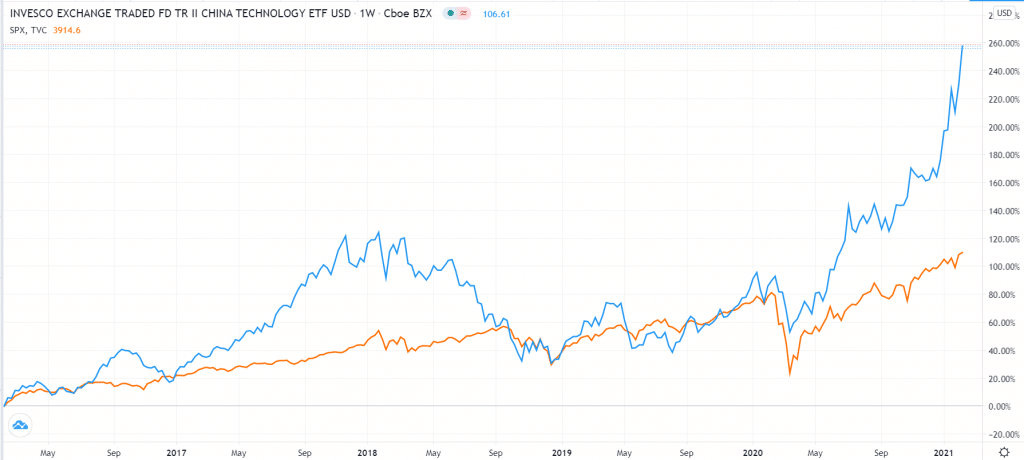

Like ARKK, it is also an expensive ETF with an expense ratio of 070%. But it is worth it considering that it invests in some of the fastest-growing companies in the fastest-growing economy.

CQQQ vs. S&P 500

Summary

ETFs are an excellent way of investing your money. They help you invest in hundreds of assets at once. They also tend to be less volatile than individual stocks. We believe that the four ETFs mentioned here will offer you some of the best returns in 2022. Other notable mentions are the Vanguard Information Technology ETF (VGT), Invesco WilderHill Clean Energy ETF, and ARK Fintech Innovation ETF.