The ever-growing debate about whether to use active or index mutual funds has been going on for a long time. If you’ve searched for mutual funds to invest, you may be aware of the varied choices you have. Mutual funds present their holders with a variety of options. There are funds devoted to stocks, to bonds, focused on large or small caps, or even funds that concentrate on the US equities and the stock market from overseas companies. However, one of the tough choices you have to make is choosing between an actively managed strategy or one that mimics a particular index.

Passively Managed Mutual Funds Explained

Passively managed or index mutual funds involves a manager who strategizes and sets out to track a particular benchmark’s performance, without the fund’s associated expenses.

Few Characteristics of Passively Managed Mutual Funds

- One of the aspects of measuring the fund’s success is to understand how closely it tracks the performance of the benchmark it tracks. If there is a slight decline in the benchmark by a few percentage points, the fund ideally should go down by the same amount as well, before the funds’ expenses are taken into consideration.

- Fund companies that offer index funds focusing on small-capitalization stocks may track the Russel 2000 Index. They may contain most or all of the same stocks of the index, holding shares in the same proportions.

- Managers of index mutual funds do not focus on beating the market, instead of keeping pace with it.

Actively Managed Mutual Funds Explained?

An actively managed mutual fund involves a professional fund manager, who conducts analytical research and uses his/her own experience and judgment to create a portfolio consisting of individual stocks and bonds. The main aim of the manager is to achieve a long-term return that will exceed a particular benchmark, which could be a standard index like the S&P 500 Index or something less known, such as any small company or international stock index.

Few Characteristics of An Actively Managed Mutual Fund

- Actively managed mutual funds may have holdings that are not contained in the benchmark. This can be a move on the part of the professional manager trying to generate gains for the fund above the benchmark return.

- Actively managed mutual funds typically have fewer bonds or stock holdings compared to the benchmark it tracks. The allocation to underlying sectors such as financials, technology, healthcare, and others also differs in the portfolio from the benchmark.

Vital Differences Between the Two

Performance

The risk of underperformance is more in active mutual funds than in passive mutual funds. Active mutual funds always have that risk of delivering a return which is worse than the benchmark. Thus, when you invest in an actively managed mutual fund, keep an eye out for its past performance, the experience of the manager who leads the fund, or the fund’s rating on any independent rating body such as Lipper or Morningstar.

Expenses

Mutual funds that use an active approach generally have higher expenses associated with them, as compared to index funds. This is due to the relatively labor-intensive process that the active portfolio manager engages in. It consists of portfolio managers and analysts providing support for the fund and conducting daily research to gain a competitive edge. The expense ratio is used to measure the cost of operating a mutual fund. It is calculated by dividing the fund’s operating expenses by the dollar value of the AUM. Thus, if you want to invest in an active mutual fund, make sure to look for managers who charge below-average fees.

On the other hand, investors who want to minimize management fees as well as the risk associated with underperformance can choose index mutual funds.

Returns

Even though active mutual fund expenses are higher, it offers a chance of above-market returns. Active fund managers who are experts can make the right choices and deliver returns better than the benchmark, in both rising as well as declining markets.

However, in the case of index mutual funds, you are actually tying your returns to the underlying index performance tracked by the fund. Investors can expect a return that is in line with the market whether the market rises or falls.

Which One Is the Choice?

With passively managed mutual funds, you know what you are getting. This is because its performance is tied to the market index and its highly unlikely that it will underperform the market index by a substantial margin. If you have a preference for low-performance fees, then you can choose index mutual funds. Last, but not the least, index mutual funds offer an easier and quicker way to gain access to a particular market.

On the other hand, you may choose an actively managed mutual fund if you find a manager who can produce market-beating results. Long-term investors can also choose active mutual funds as the returns delivered by its manager can offset the higher expenditures associated with this option.

Conclusion

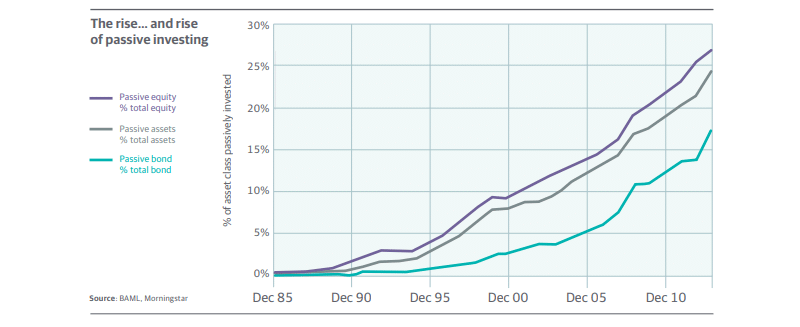

While there are certainly some good professional fund managers who will dedicate all their effort into producing good returns, the chances of finding out one remains extremely low, especially considering the competition in the market. On the other hand, index funds have shown that they have beaten actively managed mutual funds when comparing past performance records of the last ten years. This is one of the reasons why long-term investors go for passive mutual funds rather than active ones.

Both active and index mutual funds are viable options. Your choice will ultimately depend on your goals as an investor as well as your personal risk tolerance. This is one of the reasons why you should work with experienced advisors who can help you select the best mutual funds to add to your portfolio. They can easily determine which is the right combination of approaches to have a positive effect on your portfolio.