AvaTrade is a trusted Forex and CFDs broker famous for its availability of trading platforms. Based on our findings, AvaTrade is excellent in its copy trading service and competitive in the diversification of trading platforms. Moreover, the industry average pricing and the education service may attract investors to assist this broker.

However, the demerits about the broker are that it does not provide US traders trading services, nor does it accept any funds from within the US.

Can AvaTrade be trusted?

Regulation

The broker prides itself on having seven different jurisdictions from legitimate regulatory bodies across the globe.

Its licenses booklet holds registrations from bodies such as the Central Bank of Ireland, the ASIC, the CySEC, the FSCA, among a portfolio of other reputable licenses.

- The Central Bank of Ireland regulates AvaTrade EU Ltd under registration number C53877.

- AvaTrade Markets Ltd. abides by the laws imposed by the British Virgin Islands (BVI) Financial Services Commission.

- AvaTrade Capital Markets Australia Pty Ltd holds license No.406684 from the ASIC.

- AvaTrade Capital Markets Pty holds license number 45984 from the South African Financial Sector Authority (FSCA).

- The broker also holds a two-tier regulatory license (No. 347/17) from the CySEC.

- In Israel, the broker is regulated by the Israel Securities Authority under license number 514666577.

- AvaTrade Japan holds license No. 1662 from the Financial Services Agency (FSA) and its license No. 1574 from the Financial Futures Association of Japan.

- The broker is regulated by the Abu Dhabi Global Markets (ADGM) in the Middle East and holds license number 190018 from the Financial Regulatory Services Authority (FRSA).

Foundation

Online forex and CFDs trading company AvaTrade rolled out its services in Dublin, Ireland, in 2006.

History

Over the years, AvaTrade has grown significantly, with 200,000 registered clients worldwide making over two million trades per month. The company’s total trading volume already exceeds $60 billion per month, perhaps because AvaTrade’s user-centric vision, coupled with solid financial backing, offers a unique service in the online trading minefield.

Thanks to the company’s 24/7 multilingual support and its wide range of platforms and services, the optimal trading environment is created for traders of every level. AvaTrade’s extensive capabilities include a full range of trading instruments, including foreign exchange, stocks, commodities, and indices.

Location & Offices

It now claims to offer 1250+ trading instruments to a wide range of clients and runs offices in different locations worldwide. Some branches operate from China, Chile, Australia, South Africa, and other nations.

Markets overview

Now, we will see the list of available markets on the AvaTrade platform. In AvaTrade, you can diversify your trading portfolio from forex, stocks, indices, commodities, and cryptocurrencies.

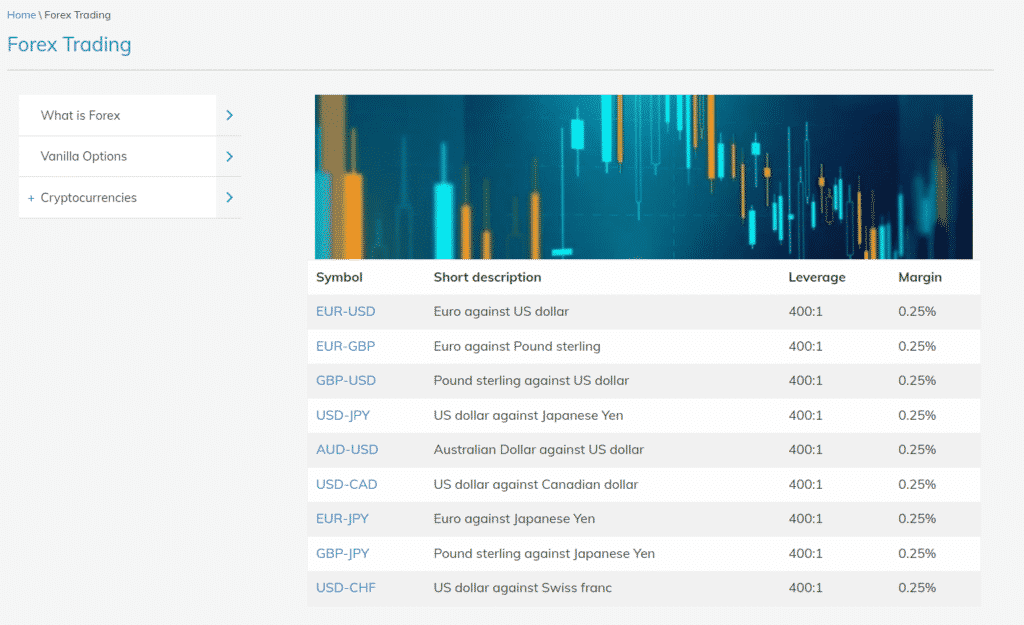

Forex

- AvaTrade offers forex trading liquidity from several Tier-1 liquidity providers.

- You can trade majors, minors, exotics with a single platform.

- Forex trading is allowed in MT4, MT5, and brokers’ proprietary platforms.

CFDs trading

- Avatrade offers trading opportunities with seven regulations across six continents.

- Large availability of CFDs on ETFs, stocks, bonds, commodities, etc.

- Availability of multiple trading platforms for CFDs trading.

Cryptocurrencies

- Trading opportunity in the world’s famous cryptocurrencies: Bitcoin, Ethereum, Ripple, etc.

- Cryptocurrency trading in MT4, MT5, or AvaTrade Go Platforms.

- No wallet is required. Traders can directly trade with their investment in AvaTrade.

- No hidden fees or commissions for crypto trading.

Comparison with other brokers

| AvaTrade | FXTM | RoboForex | Forex4you | InstaForex | Exness | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metals | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | No | Yes | Yes |

| ETFs | Yes | No | Yes | No | No | |

| Options | Yes | No | No | No | Yes | No |

Platforms overview

AvaTrade provides diverse trading platforms to clients looking to exploit its markets. The broker operates as a market maker, offering competitive spreads averaging around 0.9 pips and STP executions. To meet its quality of services, the broker brings on board multiple trading platforms integrated with smart plugins for clients to choose from.

Traders select either its braced trading platform, the AvaTrade Go, or the world’s renowned MetaTrader Platforms, the MT4 and the MT5. Moreover, it provides copy trading platforms tailored to serve investors and expert traders. In addition, customers have the privilege to access platforms tailored for a set of assets, such as AvaOptions. That best works when trading options.

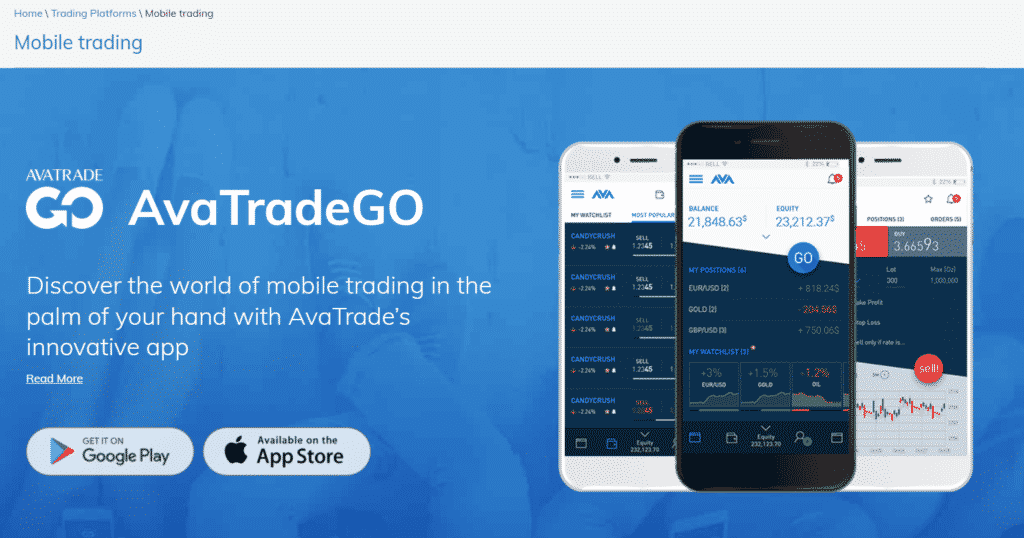

AvaTrade Go

- Voted as the best FX trading platform by the Global Forex Awards

- Sophisticated dashboard

- Clear charts

- Integrated with management tools

- Access to all markets

- All strategies — allowed

- Full integration with EAs

- Automated trading — yes

- Integrates with social platforms like ZuluTrade

AvaTrade MT4 platform

- Easy interface with nine time frames

- 30 + built-in indicators

- 24 graphical objects

- Available in mobile, web, desktop, and mac

- EAs with MQL4 language for algorithmic trading

- One-click trading

- EA functionality

- Three charts with direct trading

- One single login across all platforms

- Micro lots — available

- Internal mailing system

- News streaming

AvaTrade MT5 platform

It is a sophisticated trading platform with more than 100 trading tools & indicators.

- 38 built-in indicators

- 37 graphical objects

- 12-time frames

- Automated trading with MQL5 language

- Available in mobile, web, desktop, and macMulti-asset trading

- Integration with copy trading platforms

- Inter-account funds transfer

- One-click trading

- EA functionality

- Three charts with direct trading

- One single login across all your trading platforms

- Six pending orders

- Trading history information

- Micro lots available

- Internal mailing system

- News streaming

- Multi-threaded strategy tester

Is AvaTrade good for mobile trading?

With the AvaTradeGO and MT4 mobile apps, traders can access their AvaTrade account wherever they are. Trade via Mac AvaTrade makes it easy to trade on a Mac, whether web trading or custom downloads.

MQL 5 — signal service MQL5 is fully integrated with MT4, so traders can directly subscribe to signals from thousands of Australian and international providers from their trading platform. Ava Trader software generally provides one-click, one-screen trading for FX, indices, stocks, commodities, and bonds and offers numerous live news feeds.

AvaTrade fees

The broker’s fees and commissions are important considerations while looking for a suitable forex or CFDs broker. Traders usually find a high regulated broker with a lower-cost facility. However, it is often difficult to match the requirement, but traders should adjust the cost with the maximum safety of funds.

Spreads

Let’s start with the spreads first. AvaTrade does not take any commission besides the feed, so its main charge is the spread.

The average spread of the EUR/USD is 0.9 pips, which is considered satisfactory compared to the industry average. Moreover, such a spread with a $100 deposit is another positive point for AvaTrade. However, other brokers allow trading with 0.0 spreads. So, in some cases, we can find alternatives to AvaTrade in the industry.

Trading commissions

Besides FX pairs, the average round trip fees and costs for other CFD instruments like stock, indices, and commodities are better than the industry average. We observed the trading cost during our review and found it near 0.13%, which is quite impressive.

Moreover, another essential fee regarding trading is the overnight fee charged to any open trades at 5 PM NY. Swing trades and position trades are the primary victims of overnight fees, but AvaTrade does not take any overnight fees, a plus for the broker.

Besides, there is an inactivity fee of $50 per quarter, but in that case, your account should not have any trading activity within the time.

Non-trading commissions

When it comes to looking at all the non-trading fees, AvaTrade is an average broker. Some of the non-trading fees are high, but the others are low or not charged at all.

Such fees include various brokerage fees at AvaTrade that you pay not to buy and sell assets. Typical non-trading fees are withdrawal fees, deposit fees, inactivity fees, and account fees.

A high-level overview of how AvaTrade stacks up in non-trading fees

| AvaTrade | ATFX | HYCM | |

| Withdrawal fee | $0 | $0 | $0 |

| Deposit fee | $0 | $0 | $0 |

| Inactivity fee | Yes | No | Yes |

| Account fee | No | No | No |

Deposit & Withdrawal

Payment methods

There are three ways to deposit in AvaTrade, as mentioned below:

- Bank transfer

- Credit card

- Electronic wallet — Neteller, Skrill, Webmoney

The сredit сard and wire transfer are available for global clients, while electronic payments are not allowed for EU and Australian clients.

The wire transfer may take a maximum of 7 days to complete while payments with a credit card are instant. Moreover, Electronic payments require a maximum of 24 hours to complete the deposit.

Minimum deposit

$100

Base currencies

USD, EUR, GBP, BTC

Where does AvaTrade excel?

- Top-class customer service

- No deposit fees

- Segregation of funds and negative balance protection

- Easy to open an account

- Copy-trading available

- Multiple regulations from seven different continents

What are AvaTrade disadvantages?

- High spreads compared to other brokers

- The account varieties do not attract different types of traders

- Slow withdrawals compared to other brokers

- Limited choice of ways to deposit/withdraw funds

- Additional fees apply for inactive accounts

Who AvaTrade is best for?

The FX and CFDs broker has strength in the regulation and trading instruments.

AvaTrade does not provide services for US clients, which might be the biggest drawback of the company. Plus, there is an inactivity fee where traders have to pay an amount to keep the account inactive. On the other hand, AvaTrade is a multi-regulated forex broker where trading cost is relatively low. Therefore, based on our review, we can consider the broker trustworthy.

Conclusion

AvaTrade is an online FX and CFDs trading platform existing as a stream of brokers scattered in different sections of the globe. It holds tight regulation from seven jurisdictions co-led by the ASIC and CySEC and claims to have attained 30+ industrial awards in the last ten years. The broker links traders to the financial markets through its well-furnished platforms to speculate on a wide range of assets.

But, although it claims to provide competitive spreads on its instruments, the broker’s spreads are capped a bit higher when compared to other liquidity providers. Also, it fails to provide sufficient information about its account types which can affect some clients, especially newbies.