Climate change is one of the leading crises facing our generation. Scientists cite the severity of hurricanes, forest fires, and droughts in many places globally. As a result, the overall cost of climate change is expected to surge to more than $7.3 trillion annually by 2050.

Therefore, there is a general consensus that moving away from fossil fuels is a solution to the crisis. This article will look at some of the top climate change exchange-traded funds (ETFs) to invest in.

Invesco Solar Fund (TAN)

Solar is one of the most popular sources of clean energy. This is because, unlike fossil fuels, solar power is mostly free and it does not produce carbon emissions. As a result, many countries are investing in solar energy. In the United States, many households have embraced solar power provided by companies like First Solar and Tesla.

In total, studies estimate that the global solar industry will rise to more than $194 billion by 2027. Further, the Biden administration is expected to ramp up incentives to prop up the solar energy sector. Therefore, investing in companies that are in the industry can be a good thing.

The Invesco Solar Fund is a leading climate change ETF that is made up of the leading companies with exposure in the industry. The fund has more than $3.2 billion in assets and has an expense ratio of about 0.69%, making it a bit more expensive than most other funds.

The ETF tracks the MAC Global Solar Energy Index that is made up of 56 companies. The most prominent companies in the index are Enphase Energy, Solar Edge, Sunrun, and First Solar. Most of the companies in the fund are from the United States, followed by those from China, Spain, Taiwan, and Germany.

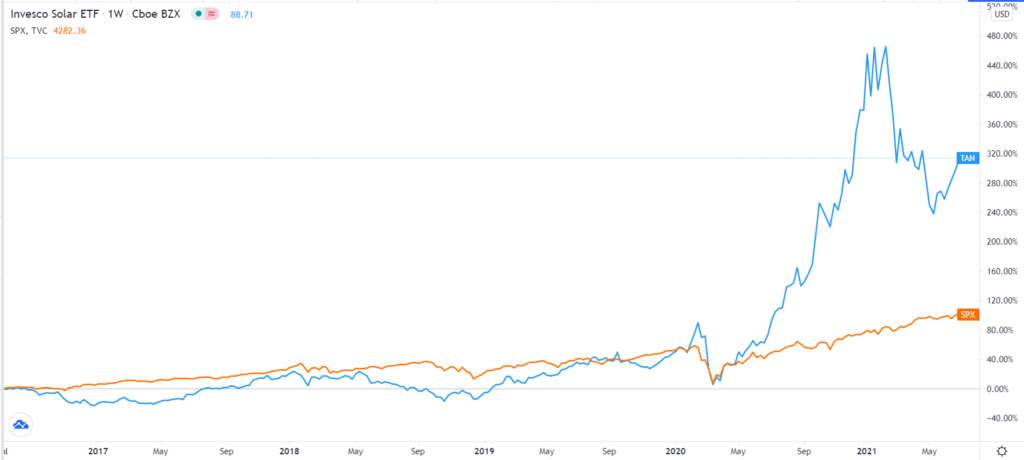

The fund was started in 2008, before the financial crisis. At the time, it soared to an all-time high of $307. It then declined sharply during the crisis and reached an all-time low of $14.50 in 2013. In the past five years, the fund has bounced back and gained over 300%.

TAN vs S&P 500

It makes a good investment for several reasons. First, it is the biggest fund that focuses on solar energy. Second, it is a relatively diversified fund by geography. Third, some of its constituent companies have experienced substantial growth in the past few years. Still, the biggest risk is that the ETF will lag if the transition to solar energy fails to catch up as expected.

First Trust Global Wind Energy Fund (FAN)

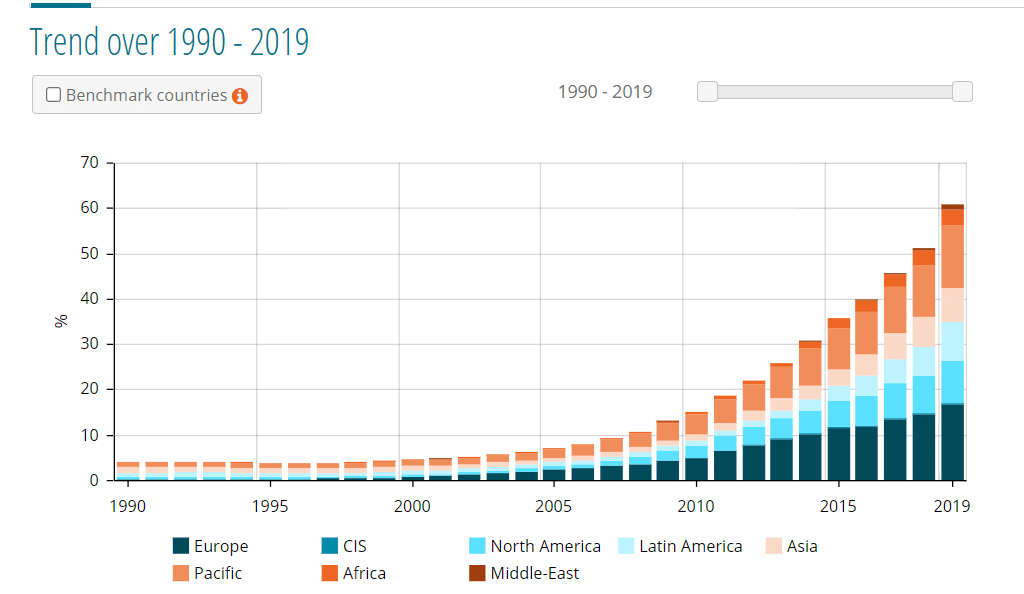

Wind energy is also seen as a good alternative to fossil fuels. In the past few years, the share of wind energy in electricity generation has been on an upward trend, as shown below.

Wind investments trends

Some of the countries leading the transition to wind energy are Germany, Portugal, Spain, and the United Kingdom. This trend has created a good market opportunity for companies that generate wind turbines and other products. It has also benefited power companies or utilities that are focusing on wind. These firms make money by selling power to the grid and by generating carbon credits.

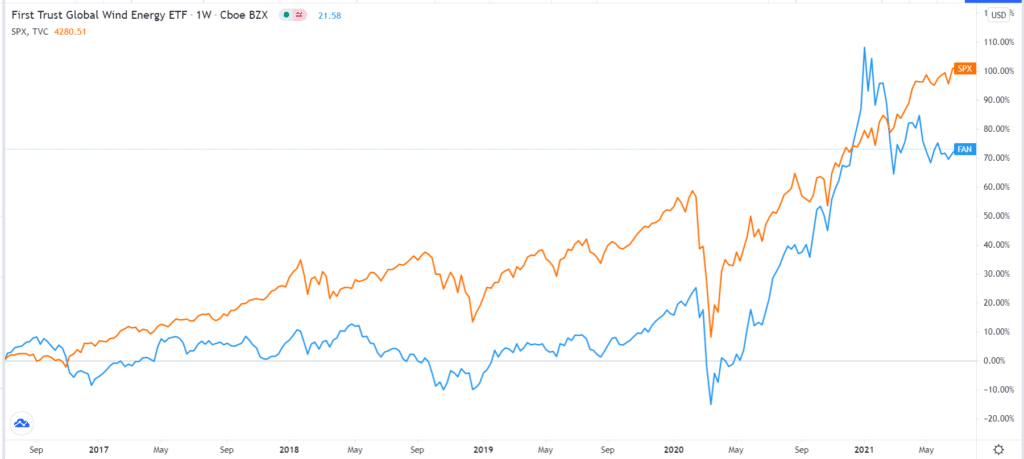

The First Trust Global Wind Energy Fund offers investors a good way to invest in companies in the wind sector. These firms are primarily industrials and utilities. It has more than $396 million in assets and has more than 50 companies worldwide. Some of the biggest constituent firms are companies like Vestas Wind Systems, Northland Power, Siemens Gamesa, Orsted, and Boralex. FAN has an expense ratio of 0.67%.

Vestas, the biggest constituent company, has a market capitalization of more than $12 billion, while Northland Power has a value of more than $5 billion.

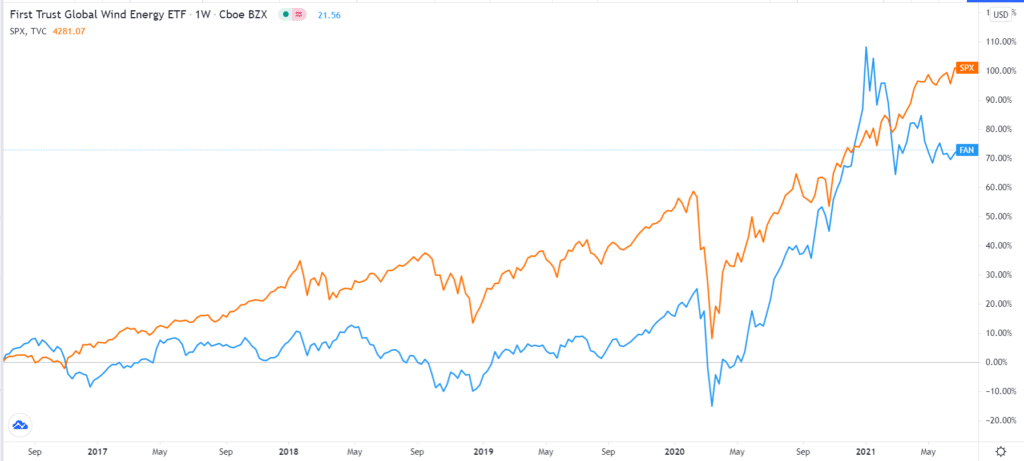

FAN vs S&P 500

The ETF offers the best way to invest in wind energy. Additionally, the fund gives investors the best access to companies they would have difficulties reaching. For example, it is relatively difficult for American retail investors to invest in Chinese firms like China Longyuan Power Group and Xinjiang Goldwind Science.

iShares S&P Global Clean Energy ETF (ICLN)

We have already looked at the best solar and wind ETFs to invest in above. The iShares S&P Global Clean Energy ETF is a fund that combines solar, wind, and other renewable sources. It is a global fund that has stakes in many companies. It has more than $6 billion in assets and an expense ratio of 0.46%.

Notably, the index mostly includes the same companies that make up the other two ETFs. It also adds companies in other energy sectors like hydrogen and geothermal.

Its biggest constituent companies are firms like Vestas Wind Systems, Enphase Energy, Orsted, Plug Power, and XCel Energy.

ICLN vs & S&P 500

The ICLN is a good clean energy ETF because of its diversity, unlike the previous two funds. This means that a decline in one sector will mostly support the other one.

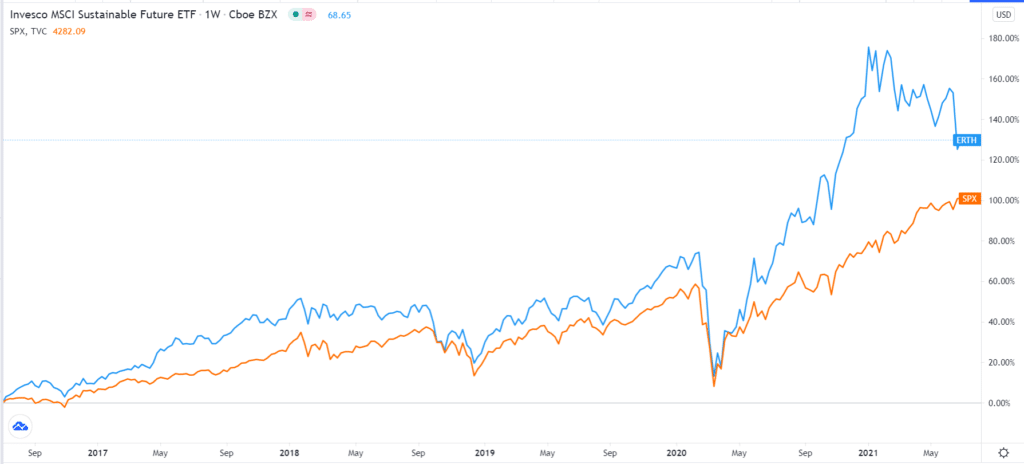

Invesco MSCI Sustainable Future ETF (ERTH)

The Invesco MSCI Sustainable Future ETF is a fund that tracks the MSCI Environment Select Index. The index generally invests in companies that offer products and services that help people to substitute fossil fuels. It looks at some industries like green building, energy efficiency, and alternative energy.

It tracks 135 companies from around the world and has an expense ratio of 0.58%. Most companies in the index are in the industrial, consumer discretionary, and real estate sectors. Most of these firms are from the United States, followed by China, Japan, and Denmark.

ERTH vs S&P 500

Some of the top constituent firms in the index are Nio, Tesla, Digital Realty Trust, Vestas Wind Systems, and Central Japan Railway.

Summary

Many ETFs focus on clean energy in the market today. In this article, we have looked at some of their best options in terms of diversity. We have looked at funds that track both wind and solar separately and a hybrid one that looks at both. We have also looked at ETFs that help to solve climate change issues indirectly as well as a good trading option — ETFs to trade.