If you want to become a successful trader, the first thing you need to decide is what timeframe you will trade on. This is something you should take great responsibility to, as the trading period you choose can seriously affect your success in trading. First, in order for you to decide which timeframes to choose, you must find out how each of them works.

The difference between day trading and swing trading

Day traders, as a rule, most actively buy and sell currencies during the European and the beginning of the American session, since at this time the largest movements occur in the market. These traders trade, choose a chart period from 1 to 15 minutes.

Swing traders, on the other hand, hold positions open for about 2 to 10 days. Traders are waiting for good price movements where they can make significant profits. As you can see the difference between the two types of trading, this is the difference in the presence of traders in the foreign exchange market with open positions.

Risks of different timeframes

No matter what timeframe you trade on, you are always at risk, since each timeframe has its own characteristics. Traders who trade within the day, closing their terminal, may not be worried that some news may come out that will provoke the movement of the market against the position of the trader. In addition, when a position is transferred from Friday to Monday, a gap can occur that can make a negative one from a profitable position. Traders can close all their positions and calmly wait for the next trading day. If you are a swing trader, then you should leave the positions open for several days and hope that no events will happen during your absence.

Swing traders, leaving their positions open at night, are at greater risk, but also get the opportunity to make big profits. There are many things that can happen during the absence of a trader at the terminal. Although the trader puts up a stop that minimizes their losses, but still, when the trader is directly in front of the terminal, he can respond to the news much faster and get out of this situation with a profit.

Day trading: How long does it take to trade?

Due to its nature, day trading requires traders to spend a large amount of time on the market. Day traders are obliged to concentrate on the actions of the market in order not to miss the insignificant price movements and other points that may affect their position.

On swing trading, you can spend much less time managing your position. It will take you less than an hour to analyze the market and see how your position behaves. This is the advantage of swing trading that you do not need to spend a lot of time trading. This makes it very attractive for traders who work full-time. They can do the analysis after returning home from work or on the weekend.

Effective Day Trading Techniques and Strategies

A lot of different effective strategies have been created for day trading. Further it is necessary to dwell on the most effective day trading strategies. First, you need to dwell in detail on scalping, which involves the rapid creation and closing of many orders daily.

Scalping

When scalping, transactions are closed in case of earning a few pips. In this case, traders earn by opening a large number of transactions in a short time. This trading method brings the desired income only on currency pairs with high volatility and a small spread.

Pips Strategy

Another way to trade in day trading is the Pips Strategy, which is super short-term trading. Transactions are closed upon receipt of minimum profit. Pips Strategy is characterized by leverage up to 1: 200. Pipsers create more than 100 positions daily.

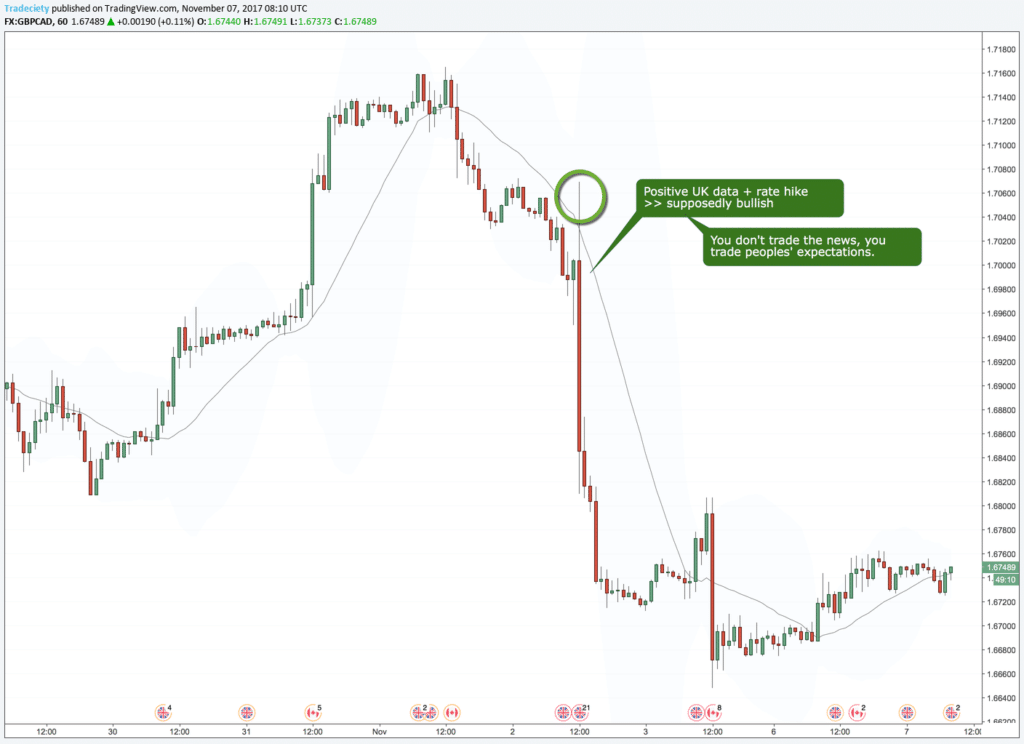

News Trading

Special attention should be paid to intraday news trading. Important news (political or financial) significantly affects the situation in the foreign exchange market. For this reason, you need to follow the news and know the time of their release.

If you decide to use this method of day trading, then you should get a Forex economic calendar. You will have to constantly follow the news, do analysis and make forecasts. In order to master such trading tactics, you should carefully study market development and gain a certain trading experience.

Pullback strategy

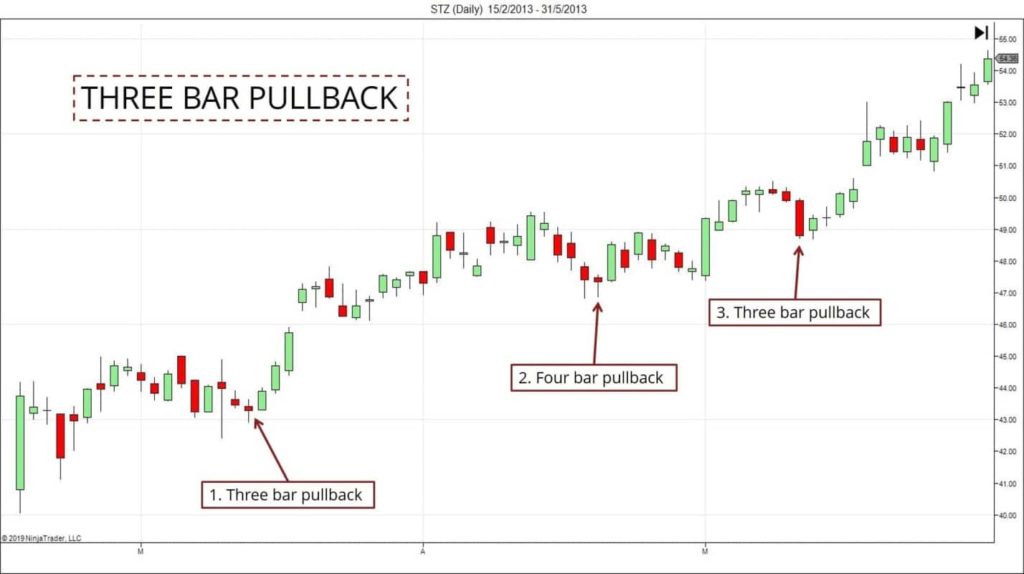

Another popular day trading strategy is called the Pullback strategy. The essence of this trading methodology is to create orders with low activity on the used time frame. Positions are created against the present trend. In fact, this strategy is a mirror image of the usual trending strategies.

So, for example, if the upward trend dominates the time frame, then trading on pullbacks involves creating transactions for the purchase of currency after the correction of the price level ends. If the market is dominated by a downward trend, then after the rollback of the price it is necessary to conclude transactions for the sale of currency.

Effective Swing Trading Technique and Strategy

Swing trading strategies can be used when flat prevails on the used currency chart. The trader needs to determine the support and resistance levels that perform the functions of the channel boundaries. As soon as the price level approaches one of the borders of the channel, it is necessary to create orders. If the price is close to the support level, it is necessary to create a deal to purchase foreign currency, and if next to the line of resistance, then to sell the currency.

This situation can be considered on a concrete example.

The uptrend is visible here, as well as support and resistance lines highlighted in red. In the areas inside the green rectangles, the trader should find places to create a deal. In order not to make mistakes, it is best to use a time frame less than the one shown in the picture above, since this will allow you to more accurately determine the place to enter the market.

The most effective swing trading is during a sideways movement of the price level. In situations when the market is dominated by a pronounced trend, the price will move pretty quickly in one direction, so the trader will have to wait a long time for the right moment to enter the market.