These are exchange-traded funds and mutual funds designed to grow assets in an optimized way for a specific user frame. While structuring them, the investor’s primary needs at a future date are addressed. This is why it is called the “target date.” Investors resort to these most often with their retirement onset. However, these funds are being used more frequently by investors who work towards a future expense like the college tuition of a child. You should understand the risks of target-date funds if you want to use them.

Are there any risks involved when using these?

If that is the question that concerns you, the answer is, unfortunately, positive. There are a number of disadvantages involved when these are used. Some are explained below:

Inequality in created funds

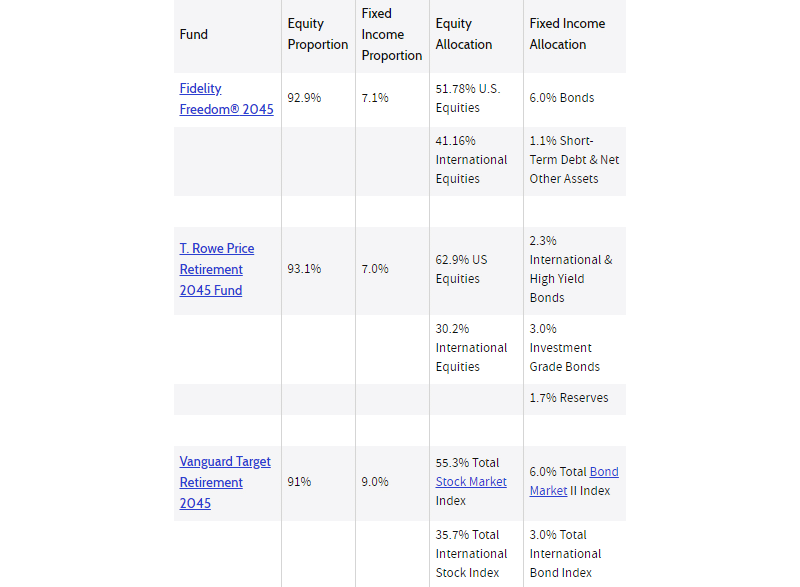

The first disadvantage is that all created funds are not equal. Look at the sample below of the average holdings with a target date of 2045 that proves this point.

Any of the funds is indeed a good option for investors who will be retiring in 2045, but the contents of the funds are not the same. Remember that this proportion can vary more over time. This variation can cause problems for retiree investors. One retiree may have enough money for investing in fixed-income assets and bonds, while another may need an equity component to track the portfolio as they require both growth and income. So, a fund may be able to meet the requirement of one investor, but it cannot meet the needs of another.

Apart from holdings, these may also differ in investment style. For example, based on your preference, you can find a fund made up of index funds completely. According to algorithms, the fee of such a fund would be lower.

Underlying funds provided by the same company

Another problem is that every underlying fund in the target portfolio is provided by the same fund company. Each target fund in Vanguard’s lineup has nothing but other Vanguard funds in the portfolio. It is the same for the T. Rowe and Fidelity funds. Trusting all your instruments to a single fund family does not look like a good plan when the era is full of corporate scandals.

Added expenses

There is a difference among funds in terms of expenses as well. Since each of them is a fund of funds, the portfolio an investor purchases into consists of many underlying mutual funds with an expense ratio each. The expenses can add up quickly depending on how fees are calculated by the fund family. For example, a fund company may charge two or three times as much as another one.

The advantages – still outweighing the disadvantages

There are many benefits which include the following:

- Professionally managed portfolios offer a hassle-free investment.

- Low minimum investments support instant diversification among several asset classes, like equities, bonds, and more.

- Low maintenance due to the one-size-fits-all design of the funds.

Special considerations when you are selecting

Besides being aware of the advantages and disadvantages of target-date funds, there are certain issues that may come along with your attempts to accumulate target-date funds. To avoid those issues, you need to consider the factors below a priory.

Structuring, developing, and monitoring asset allocation

You can gain ultimate control in defining your priorities and the underlying assets by creating tailored strategies. You can also add diversifying assets, like commodities, real estate, or other liquid alternatives. Doing this helps to reduce volatility and enhance diversification.

Personal advisors and consultants can help you decide on the number of strategies your plan may offer, the sufficiency and appropriateness of core investments, rebalancing the time frames, and the initial and ongoing asset allocation. Most individuals prefer assistance deciding on the objective and shape of the asset allocation. You can approach an advisor or consultant to act as a fiduciary or a discretionary investment manager.

Cost implications

Many plans can lower expenses by creating custom target-date strategies using the industrial core strategies of the plan for defined benefit plans. According to the Employee Benefit Research Institute estimates, the net savings, for larger plans especially, to be between 27% and 65% for IRA and 401(k), respectively. However, all the plans are different and, thus, imply different costs.

You can conduct a full analysis of your plan costs, taking the fees for consulting, recordkeeping, custody, legal support, trustee services, communications, and the expense of staff dedicated to the project into account.

When you choose between the plans that seem to meet your requirements, there are several points worth your consideration:

- Your potential plan costs

- Consulting fees

- Recordkeeping

- Custody

- Legal support

- Trustee services

- Communications

- Your expenses on staff dedicated to the project

If you are a plan sponsor and want to encourage plan participants, it is also important to consider investments in the plan even after retirement or termination. It may result in significant additional assets and can lower the overall cost of the plan.

Legal issues

Along with other investment plan options, custom target strategies need legal support to make sure that fiduciary, regulatory, and structural requirements are met. Apart from ensuring compliance with the plan guidelines and the law, specialized legal professionals may require reviewing the implications of regulatory requirements and safe harbor rules as much as plan documents and asset allocation.

As a plan contributor, if you intend to offer a custom target-date option as a QDIA, you need to decide if you will be the fiduciary on the asset allocation. If that is not an option for you, you may also hire a third-party fiduciary manager. You can discuss the fiduciary roles associated with custom target-date funds with your legal professional and consultant.

Conclusion

In spite of the popularity of such funds in getting individuals involved in saving for their retirement, the funds are creating issues for both plan sponsors and participants when it comes to serving as a default investment option.

TDF’s features are very appealing for younger investors as an automated investing option, but the costs, risks, and one-size-fits-all limitations create problems for those with large balances and old investors, specifically those who are within five to ten years of retirement. So, you need to consider the important aspects of a particular target-date fund cautiously before choosing it.