Introduction To Energy Sector Companies

First, what is the energy sector? When discussing the stock market, the energy sector comprises stocks of companies involved in producing and supplying energy. These companies operate from upstream to downstream of the oil and gas industry.

Upstream companies are into exploration, extraction, and production of crude oil and gas. Companies like BP, ExxonMobil, and Gazprom operate oil wells and gas rigs for extracting oil and gas. Contrariwise, downstream companies primarily deal with the tail end of the oil and gas products before reaching consumers. They are the last point of contact between producers and consumers.

But some companies have operations across the entire stream. Such companies are involved in locating oil/gas reserves and then going ahead to start drilling. At the same time, the companies have units that refine and distribute the oil/gas products to the point of sale. An example of such an integrated company is ExxonMobil.

The energy sector could be renewable or non-renewable. Nevertheless, some companies operate across these sectors, making it difficult to distinguish them by this measure. Instead, the energy industry is classified along with the following general sectors: Oil and gas drilling and production, pipeline and refining, coal mining, chemicals, and renewable energy.

Investing opportunities in Oil, Gas, and Energy Sector

Often, one wonders why oil and gas do not merely fall under the energy sector tag. Depending on where you are coming from, the energy sector could refer to the entire energy-producing industry. Other times, the energy sector refers to alternative sources of energy apart from oil and gas.

Nonetheless, it is easy to remember that all energy-producing and supplying companies fall under the energy sector in the equities market. It means investors can take positions in the industry by buying equities from the energy companies.

Many investors opt for corporate bonds when equities markets become jerky. After all, bonds are a safer holding because bondholders have the priority when it comes to payouts. Bondholders have the option of garnishing a company’s assets if it fails to pay interest owed on bonds.

There is a third option. Fearful of the energy equities but reluctant to take on bonds because of low returns, investors opt for ETFs. The exchange-traded funds comprise stakes in a range of energy equities and then made available to be bought like a stock on an exchange. ETFs are low risk and offer a regular payment much like bonds. It is like getting the best of both worlds.

Top Energy ETFs

Energy Select Sector SPDR Fund (XLE)

XLE is the sector’s largest ETF with $10.04 billion assets under management. The ETF has interests in 123 energy companies included in the S&P 500 index, and it weighs them based on market capitalization.

Because of all its holdings being picked from the S&P 500, the fund has the best liquidity position of all energy ETFs. Its three biggest holdings are Chevron Corporation (22.86%), Exxon Mobil Corporation (22.52%), and EOG Resources, Inc. (4.63%).

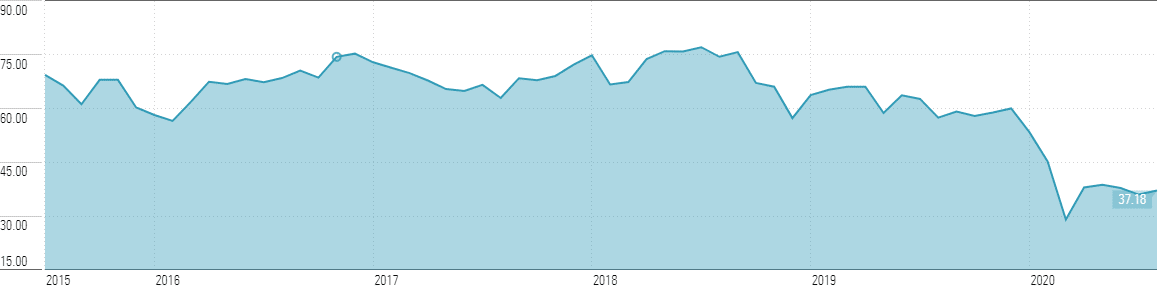

Over the past five years, the ETF has lost about 46% of its value, but the dividend yield remains one of the highest at 9.28%.

Alerian MLP ETF (AMLP)

AMLP is the industry’s second most valuable ETF in terms of AUM at $3.68 billion. Like XLE, AMLP is market-cap-weighted, but the difference is that the fund picks its stocks under the energy infrastructure MLPs sub-sector. The fund is issued by SS&C and holds 20 companies in its portfolio, including MPLX LP (10.90%), Enterprise Products Partners LP (9.91%), Magellan Midstream Partners, LP (9.67%).

Vanguard Energy ETF (VDE)

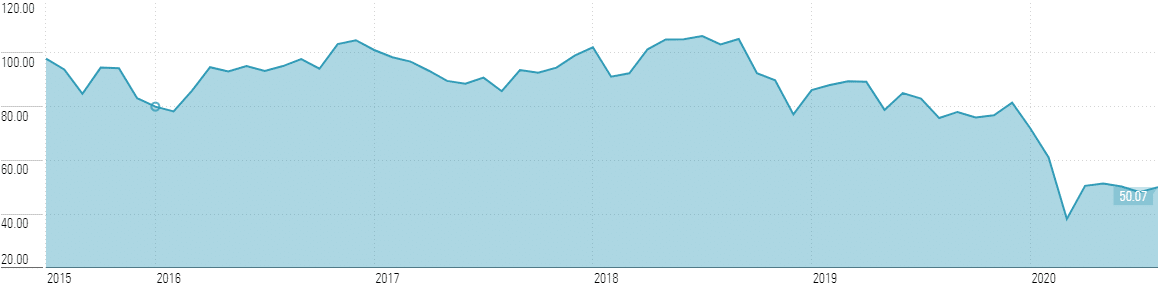

VDE is non-discriminating in terms of the companies it includes in its portfolio. The fund has 122 holdings, which is among the highest. Three of these holdings include Exxon Mobil Corporation (22.18%), Chevron Corporation (20.71%), and ConocoPhillips (4.29%). Similar to XLE, VDE has been on the downtrend over the past five years.

How to Invest in Energy ETF

Undoubtedly, energy ETFs are a bargain for those interested in the industry, but investors need to understand the basics of the funds before going in. Investing in ETFs is an excellent opportunity to reduce unsystematic risk in a portfolio, but one should always be aware of the systematic risks present. Investors need to exercise care, especially by focusing on the equities in an ETF’s portfolio before moving.

It is always prudent to consider the top ten holdings of an ETF – especially when the fund is market-cap-weighted. Because this is where the weight of the portfolio lies, make sure that the fund’s weighty equities have innate strength to weather market doldrums.

Another thing to keep an eye on is the difference between the expense ratio and the annual dividend payout. Always look at the two values as diametric opposites. That is when they cancel each other. A higher annual dividend payout is desirable.

Conclusion

The energy industry is one of the most essential globally since it powers economies. As time goes by, energy companies gain more value because of the increasing demand for energy from hungry economies worldwide. This growth is an opportunity for investors to generate wealth if they make the right decisions.

One of the best options to take is to buy into an energy ETF. The funds track indices that comprise energy stocks. The ETFs pay out a certain percentage in annual dividend yields depending on the composition of their portfolio. Usually, the yields are more lucrative compared to bonds. Though they are lower than what you could earn from buying individual stock, they offer much-needed safety and significantly reduced unsystematic risks.