- EUR/USD is struggling for direction ahead of the Federal Reserve policy report

- Oil price continues to edge higher amid improving demand outlook.

- U.S. indices are struggling to find support above all-time highs amid FED policy concerns

- Cryptocurrency rally after recent bounce back has stalled.

The U.S. dollar is struggling for direction near one-month highs as traders await communications from the Federal Reserve about the course of U.S. monetary policy. Markets are uneasily waiting to see the timing of tapering bond-buying and raising of interest rates.

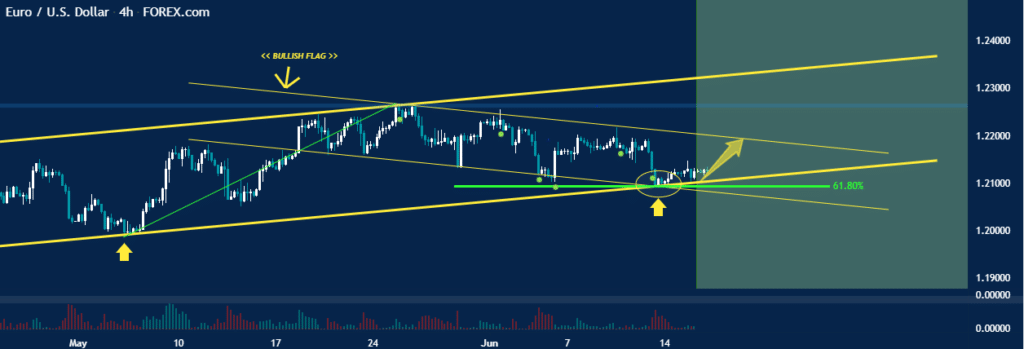

EUR/USD tight range

The EUR/USD pair is one of the pairs susceptible to significant moves on the outcome of the Federal Reserve meeting. The pair has been struggling for direction near one-month lows and faces the risk of drifting lower to 1.2000.

The pair has been trading between the 1.2099 and 1.2148 ranges since the European Central Bank report failed to anchor support to the common currency. The lack of catalysts from the Eurozone means the pair’s price action is dependent on the impact of the FED report on the dollar.

With momentum on the Euro waning, analysts at UOB believe the pair could tank to the 1.2050 level. However, a break of the 1.2180 level would avert any downside risk.

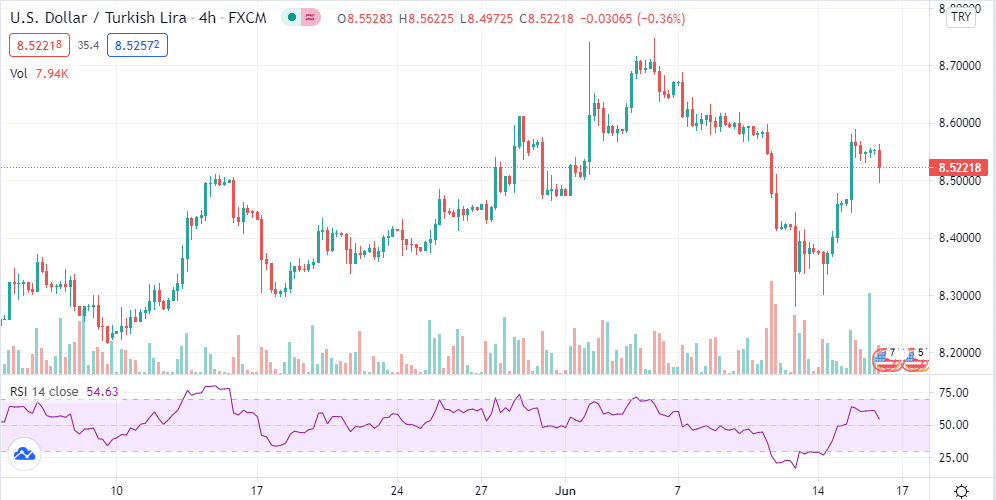

Turkish lira sell-off

The Turkish Lira is another currency under pressure amid a resilient dollar. The Lira dropped for the second day running on Tuesday. It has shed a significant amount of value from last week’s gains as the meeting between President Joe Biden, and Turkey’s Recep Tayyip failed to bear fruits that would ease political tensions.

The lira was down by 1.1% against the dollar on Tuesday, leading the losses amongst emerging currencies. Last week, the currency was up by more than 3% amid optimism that a meeting between the two leaders would ease tensions.

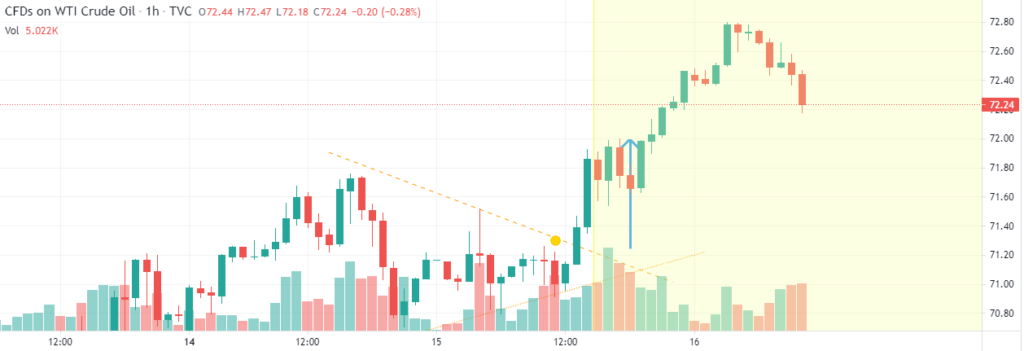

Oil rally

In the commodity market, bulls remain in control, pushing oil prices higher for a fifth consecutive session. Brent crude was up by 0.9% early Wednesday morning to $74.68 a barrel as U.S. crude found support above the $70 barrel level after a 0.9% gain to $72.78 a barrel.

The catalyst behind the recent spike in oil prices is the falling oil stockpiles and recovery in demand worldwide. The crude demand outlook is robust, fuelled by recoveries in the U.S., Europe, and Asia. Oil inventories in the U.S. dropped by 8.5 million barrels last week, affirming the strong market demand.

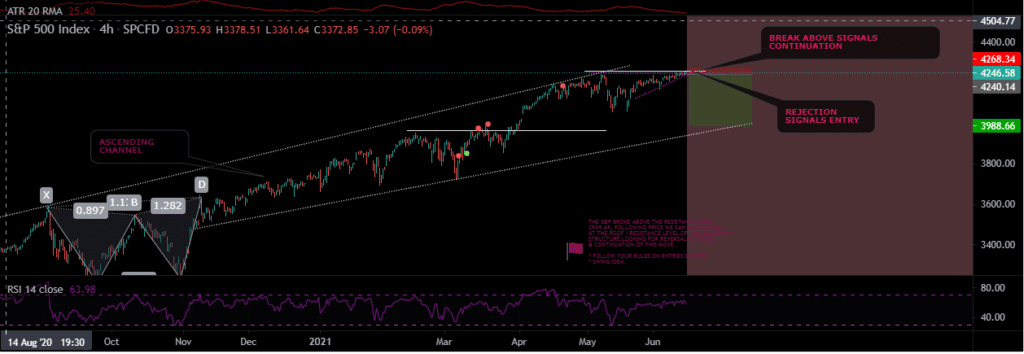

U.S. indices drop

Major U.S. indices traded lower on Tuesday as investors took little notice of improving economic data, with the focus shifting to the two-day Federal Reserve policy meeting. The Dow Industrial Average fell 94.42 points to 34,299.33 as the S&P 500 slid 8.56 points to 4,246.59. The Nasdaq Composite Index was down 0.7% to 14,072.86.

The sell-off came on the major indices starting on the front foot on Monday, rallying to record highs. The indices continue to flirt with record highs on economic data signaling accelerated economic recovery from the pandemic. The latest data show the producer price index rose 0.8% in May. While May retail sales dropped 1.3%, data show rotation towards services, consequently supporting the reopening of the border economy.

Bitcoin and Ethereum rally stalls

Bitcoin is struggling for direction in the cryptocurrency market after a recent bounce back past the $40,000 level. The BTC/USD pair is struggling to rise past the $40,900 level after a recent spike higher. A resurgent U.S. dollar could be one of the factors weighing on the flagship cryptocurrency.

The bullish momentum in BTC resumed early Monday on Elon Musk, reiterating that Tesla only sold 10% of its holding in the cryptocurrency. The executive reiterated that they are open to accepting Bitcoin payments in the future and offer support to BTC prices.

Ethereum, which has been trading in tandem with Bitcoin, is also struggling for direction after a recent bounce back. ETH/USD is struggling to rise past the $2,600 level, which appears to be a key resistance level.

Ethereum has lost more than 40% in value from its record highs recorded in May.