- The Federal Government’s 10-year bond yield is expected to face turbulent times in 2021 due to high volatility.

- Increased inflation rates will derail bond yields as prices of essential goods such as airfares will peak into 2021.

- Various governments are considering expanding quantitative easing (QE) to finance the purchase of treasury and private securities.

Purchase of federal government bonds may turn out as a safe investment strategy for investors looking to secure their assets in a low-risk environment. With the current interest rates at historic lows, the investment may not present a high-earning potential but a risk-free opportunity. Additionally, the signing of the $2.3 trillion stimulus package may pave the way for the federal government’s extended lending program.

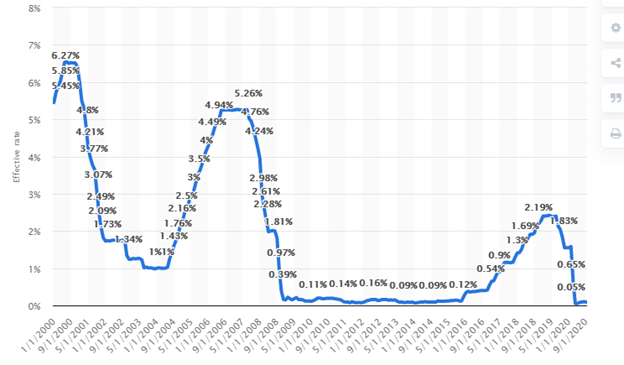

Since February 2020, the (effective) Funds rate has fallen by 94.30% to rest at 0.09% from a high of 1.58. Since the interest rates are falling, investors have low-interest rate risk. Such a scenario means that investors’ bonds have a higher-paying fixed rate compared to the market. It is also essential to select the bonds that will keep up with inflation.

In an economy, inflation measures the increase in product prices over a while. According to the Consumer Price Index (CPI), the inflation rate is expected to close in 2020 at 1.2%. In 2019, the inflation rate hit a high of 2.3%. Inflation is expected to rise to 2.1% with the issuance of the COVID-19 vaccine and the resurgence of the economy. This rate takes into account the increase in rental incomes, air travel, and other industrial activities. Core inflation is also expected to increase to 2.1% in 2021, from 1.7% recorded in 2020.

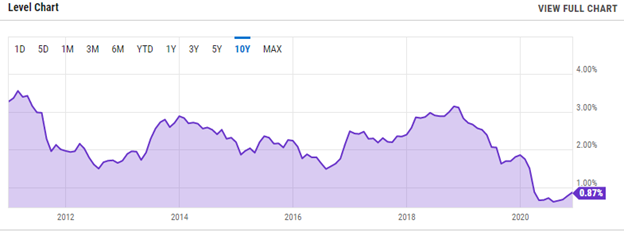

If the inflation rate currently stands at 1.7% (as of December 2020) from 2.3% in 2019 and the 10-year government bond interest rate is at 0.87%, the interest paid will consider the increased inflation rate. In real terms, the investor will earn 0.4% on average on a monthly or annual basis until the bond period reaches maturity.

The yield of the Treasury’s 10-year note is expected to reach the 0.97% mark after the COVID-19 relief stimulus aid passage. This yield will increase its attractiveness to investors. We cannot rule out that the US Central Bank will embark on quantitative easing to stabilize the expanded money supply into 2021. In this case, the government will not just print money but will use all options, including printing money to buy both Treasury and private security.

Indications are rife that the Bank of England (BoE) will continue its quantitative easing (QE) program into 2021. Interest rates have been put on hold at 0.1% into 2021. This program will help the bank continue its asset purchases into the New Year. Additionally, BoE will advance the stimulus plans for British Citizens by continuing its bond-buying project at £895 billion. The British government pumped in an additional £150 billion in November 2020 to prepare for the Brexit disruption and the new COVID-19 strain.

Technical Analysis

The 14-day relative strength index (RSI) gives 42.832 on the 10-year yield US bond. The pivot points on Classic and Fibonacci indicators are constant at 0.936. The ultimate oscillator is low at 33.467. The 5-day simple moving average (SMA) stands at 0.940, while the 5-day EMA is 0.938. All moving average indicators (from 5 to 100 days) rest above the 0.936 marks. The 200-day moving average is at 0.931 (simple) and 0.933 (exponential). These indicators show that the 10-year yield will experience intense volatility into 2021. Investors should expect minimal returns due to the increasing inflation rate. At the moment, the sell option is the best bet.