- Brexit continues to haunt the UK, with border checks affecting the economy.

- Rising US Treasury yields are helping to stabilize the dollar.

- The UK is set to release two key economic data.

On Tuesday, the GBPUSD pair lost further ground, losing 0.05% to trade at 1.3636. That set the stage for a possible third day in the red for the pound as pressure from the EU impacts the British economy.

Brexit repercussions shake the pound

The United Kingdom Foreign Secretary Liz Truss is preparing for a new round of crucial Brexit negotiations with EU Exit Minister Maros Sefcovic. So far, nothing concrete has come out of the negotiations.

The border check rules have impacted the UK negatively, with many seeing them as a barrier to trade. Specifically, the so-called Northern Ireland Protocol has led to a slowdown in the movement of goods into the United Kingdom. Many businesses in the UK are now starring at the real possibility of shutting down as the EU insists on implementing its restrictive standards checks for goods crossing the Irish border.

Prior to its latest struggles, the British pound had been rising against the dollar, as the UK released its GDP figures last week. However, the uncertainty surrounding the Brexit situation is likely to destabilize GBP after Tuesday’s key economic releases.

Key UK data out today as political temperatures rise

The market expects the UK to release its Claimant Count Change data, which will indicate the number of unemployed persons in the country. In addition, The Average Earnings Index figures for November will be released, with consensus estimates putting it at 4.2%. Nonetheless, the two macro-indicators are likely to play second fiddle to the Brexit talks in influencing the pound’s strength.

Beyond its economic struggles, the UK faces an uncertain political future. There are growing calls for the resignation of the British Prime Minister, Boris Johnson. Conservative MPs are exerting pressure on the premier to quit, as many see him as baggage heading into May’s local elections. The combined forces of paralysis on the Brexit front and political turbulence at home could erode gains by the GBP.

Rising US Treasury yields cushion the dollar

In the meantime, US Treasury yields continued to rise on Tuesday, as the market reopened following Monday’s holiday. Notably, the 2-year Treasuries edged past the 1% mark for the first time in nearly two years. The spike in Treasury yields has helped the dollar gain ground against the pound, despite the underperforming US economy.

In the absence of major macroeconomic releases from the US, the pound could edge higher if the UK economic releases prove favorable.

Technical analysis

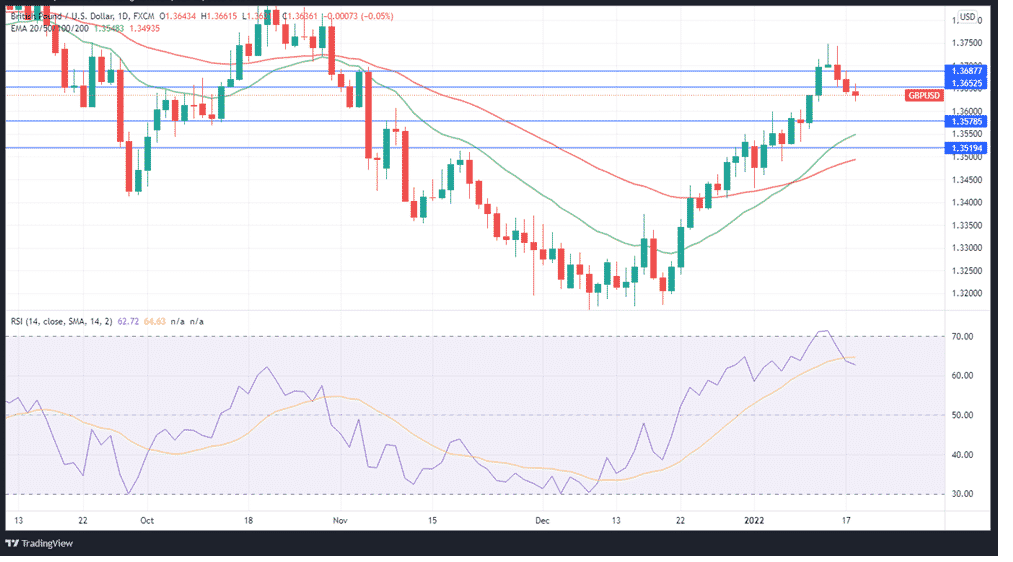

GBPUSD is still on strong market momentum, despite the three-day decline. The pair‘s RSI is currently at 62. However, it has dropped below the 14 SMA, signaling a declining momentum. If the bears keep up the pressure, they will likely push the price to the first support at 1.3578.

Movement below the second support at 1.3519 would make a strong case for a potential downtrend.

On the other hand, the 20-EMA is still above the 50-EMA, signaling that GBPUSD could still head up. Based on current momentum, upward action could encounter the first resistance at 1.3652. If it breaks that barrier, the second resistance will likely be at 1.3687. However, price movement to 1.3519 will probably invalidate the potential rise to R2.