The Goldman Sachs (GS) stock price rose by more than 2.8% on Wednesday after the Wall Street behemoth reported strong earnings that led to analysts upgrades. The shares are trading at $335, which is 155% above the lowest level in 2020.

Goldman Sachs strong results

It has been an excellent start of the year for Wall Street banks. The economy has done well, leading many analysts and the bond market to signal that higher interest rates are on the way. At the same time, market activity has increased, leading to the robust performance by Wall Street traders.

Most importantly, firms have billions of dollars in last year’s rainy-day provisions. In line with the latest accounting standards, banks need to report provisions for bad credit before the default happens. This is why all banks set aside billions of dollars in provisions last year. Since the defaults have been smaller than expected, the companies have now turned these losses into this year’s profits.

This performance was evidenced when Goldman Sachs published its first-quarter results. The company reported that its total revenue soared to $17.7 billion in the first quarter, zooming past the analysts’ forecasts of $12.2 billion. Its profits came in at $18.60 per share.

The closely watched Fixed Income, Commodities, and Currencies (FICC) income soared. Fixed income had $3.89 billion of revenue, while equities had more than $3.69 billion. Its investment banking income rose to more than $3.77 billion because of the surge in the Special Acquisition Purpose Companies (SPACs). Recent data shows that SPACS has raised more than $80 billion.

Is Goldman Sachs stock a buy?

The strong Goldman Sachs earnings led to upgrades from other Wall Street banks. In a report, analysts at Wells Fargo boosted their outlook for the stock from $360 to $380, about 12% above the current price. Similarly, those at Citigroup boosted their outlook for the GS stock price from $370 to $390.

Those at JMP Securities and Barclays expect the bank’s shares to rise to more than $400. These analysts’ calls should be taken with a grain of salt. Historically, analysts tend to boost their forecasts after a company publishes strong earnings.

Nonetheless, Goldman Sachs has several catalysts going forward. First, the American economy is expected to recover faster than expected because of the recent stimulus and the upcoming infrastructure spending. This means that the Fed could turn hawkish, which is a good thing for the bank.

Second, the bank is seeing strong growth in its consumer-facing business. The firm recently launched Marcus Invest, a Robinhood-like company that helps consumers leverage its experience in the business. The Marcus investing platform will provide GS with cheap funds that will help it fund its growth.

Third, consolidation and SPACs will continue growing. These deals will provide the firm with more income in the next few quarters. Other strong catalysts for the Goldman Sachs stock price are the performance of the FICC business and its recent focus on cryptocurrencies. Its key risks are the recent scrutiny of SPACs by the SEC and its role in prime broking after the crash of Archegos.

Goldman Sachs stock price analysis

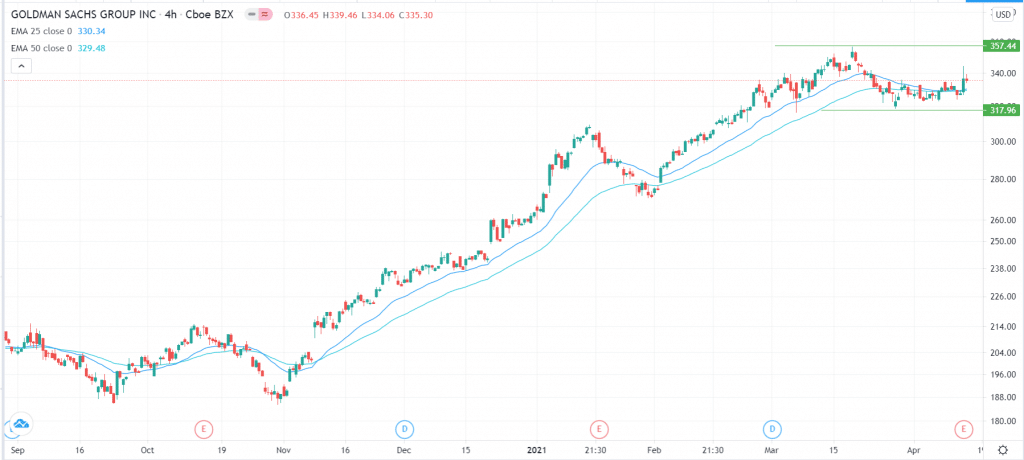

The four-hour chart shows that the GS stock price has been in a consolidation mode recently. While the stock rose yesterday, it remained within this range. In fact, it is just a few points above the important 25-day and 50-day moving averages. It also seems to be attempting to retest its YTD high of $356. In my view, with the Fed committing to the current easy-money monetary policy, I suspect that it is just a matter of time before the stock soars to $356.