Volatility can be described as the fluctuations in the rate at which a market price moves. The more significant the change in the price of an asset over a short period, the higher the volatility. Following the same logic, the lesser the change in an asset’s price over time, the less the volatility. Volatility can increase in either direction and, over time, is not steady.

The fact that volatility behaves differently in different asset markets and even within a single asset class is another important component of market volatility to understand and appreciate. For example, volatility in the stock market operates in a manner distinct from that of volatility in forex markets.

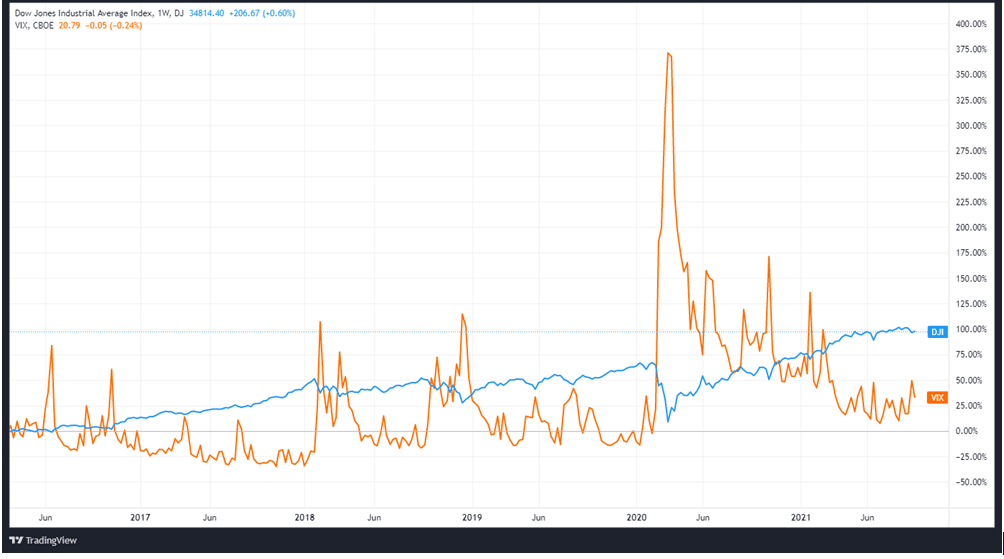

The volatility index (VIX) and the DJIA chart below illustrate that volatility tends to rise during sharp declines in the stock market.

Below are some of the most memorable and impactful incidences of volatility on record.

Black Monday

Events that occurred on 19th October, in 1987, which was a Monday, led to the day being referred to as “Black Monday.” Although it did not happen all at once, stock markets around the world experienced a major drop on this day. The stock market in the United States experienced its largest one-day percentage plunge ever on this day.

The Industrial Average of Dow Jones plummeted by just about 22%, and in addition, the S&P 500 shed off 20.4 percent of its value. To have a better understanding of the severity of Black Monday, consider that the DJIA lost about 12% in the stock market crash of 1929.

What caused it?

According to the findings of research conducted by the Securities and Exchange Commission, traders’ concerns about the impact of anti-takeover legislation that was being considered by the House Ways and Means Committee created panic. The bill was introduced for the first time on Tuesday, October 13, and it was passed two days later. Stock prices plunged by more than 10% in three days, the greatest three-day decrease in stock prices in more than 50 years—the bill intended to repeal the tax benefit for loans used to finance corporate acquisitions.

On October 16, Treasury Secretary James Baker made a statement that also played a role in the outcome. In his words, the United States was considering devaluing the dollar with an intention to attract foreign capital into the stock market. Instead, this spooked investors, who began to sell their stock in large quantities. Baker believed that a weaker currency would aid in the reduction of the worrying increase in the United States’ trade imbalance.

There was widespread fear that this would set the US economy on a path to recession. However, the Fed acted by providing stimulus through large institutions, leading to the stabilization of the economy. Consequently, DJIA recovered and was up by 15% by the end of October.

The global financial crisis of 2008

The housing market bubble, which began to build up in 2007, laid the groundwork for the global financial meltdown. The cheap interest rates offered by banks and lending institutions enticed many people to take out mortgages that they could not afford to pay back in the long run.

As a result of the influx of mortgages, lenders thought that they needed a creative way to make the most out of it. They, therefore, developed mortgage-backed securities (MBS). These were actually bundles of mortgages, which they packaged as financial products that were tradable as securities in financial markets.

With the confidence that the MBS was, after all, low risk due to coverage by credit default swaps (CDS), they headed to the market. Here, the MBS provided an easy way for them to pass the risk of an over-mortgaged financial system to third-party buyers.

Lenders were able to get away with shoddy underwriting because of outdated standards that were not strictly enforced. As a result, the true value of MBS could not be guaranteed.

Thousands of people who took out subprime mortgages ended up defaulting on their obligations. As a result of their inability to pay, financial institutions suffered massive losses. What followed thereafter was widespread evictions as well as foreclosures.

When the stock market fell, as a result, many large corporations all around the world went bankrupt, causing billions of dollars in losses. Finally, the US responded to the crisis with the passage of the 2009 US Recovery and Reinvestment Act. It was a $427 billion worth of rescue package for banks, as well as facilitating mergers and stimulating economic growth.

The Great Crash of 1929

The 1929 Wall Street Crash is commonly accepted as the biggest economic meltdown to have occurred in modern times. Stock prices began to decline in September of that year, peaking on October 29th. On that day alone, about 15 million shares were traded, triggering the collapse of the NYSE and setting the stage for the Great Depression.

Due to how severe the crisis was, stock values did not recover to their pre-depression highs for nearly two decades.

A number of causes triggered the crash. Let us begin by noting that this era, known as the “Roaring Twenties,” was characterized by easy credit and tremendous optimism. Getting loans was an easy thing, and the bullishness in the financial system certainly motivated investors further.

In addition, with only 10% of the value of one’s trading position, people could readily obtain leverage. This created an overly heated business environment, with industrial and farming businesses confidently overproducing goods. Ultimately, there was a supply glut in markets, with the stocks of companies plummeting as a result.

In August 1929, the Federal Reserve dented investor confidence when it raised interest rates to 6% from 5%. The result was reduced investor optimism.

However, it was extreme panic, which eventually accelerated the crash. The financial press extensively reported the fall and emphasized the unfavorable fundamentals that hadn’t improved, fanning the panic. It would be uncovered that bank executives had used the reserves to purchase stocks (which had lost most of their value). This left depositors with nowhere to turn to. The banks were bleeding, the NYSE was down, and the economy was on its knees.

To cushion investors from ever having to go through such a traumatizing experience, the Glass-Steagall Act was enacted and signed into law in 1933. Through its provision permitting banks to exclusively invest in low-risk assets, the Act contributed to the restoration of confidence in the financial system. The Act also provided an insurance scheme that would safeguard depositors against bank collapse.

In summary

Throughout the history of modern economics, there have been a significant number of volatility incidents leading to massive financial losses. Each was unique in its own ways in terms of how it came about and how it was resolved. We have drawn some lessons from them and have adjusted some aspects of how we trade, but there’s always a chance of more crises occurring.