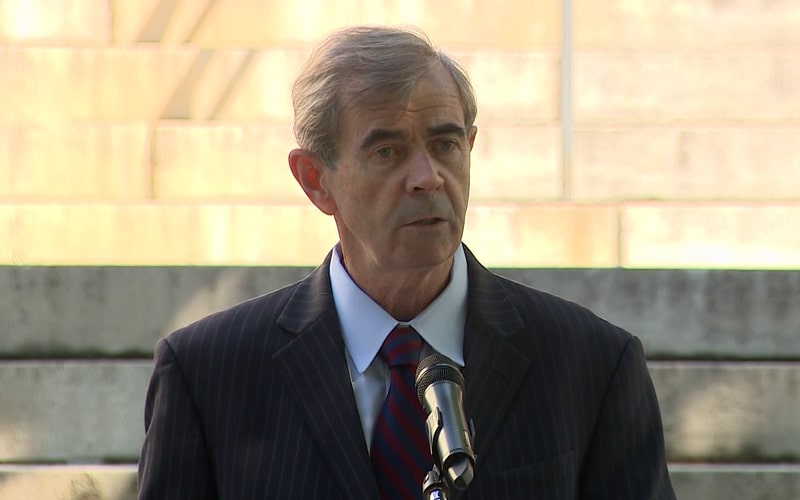

Massachusetts Commonwealth secretary William Galvin is suing Robinhood brokerage firm for taking advantage of “young and inexperienced” investors, according to Bloomberg.

- Galvin’s office filed the suit in December. He said the platform emphasized the addictive thrills of trading over helping new investors learn to make sound decisions.

- Galvin said Robinhood’s smartphone application is promoting “gamification” of investing. Among the features noted were animated confetti, and free stock for signing up and referring friends.

- Robinhood does not charge commissions, but makes money from trading activity. Other firms pay to fill the orders of the firm’s customers.

- Robinhood spokesperson says the company doesn’t have to meet a fiduciary standard because it does not make recommendations. Savings from commissions estimated at $180 million to $360 million in trading costs since December 2017.

- The firm also denied gamifying the application, claiming customers trade less when they stay on the platform.

- “I don’t have a problem with risk,” said Galvin. “I do have a problem when investors are naively told they can do this. They deliberately target young people.”

- Robinhood IPO could take place within weeks, to make co-founders Vlad Tenev and Baiju Bhatt billionaires.