The Nike (NYSE: NIKE) stock price surged by more than 3% in extended hours on Monday after the company published strong quarterly results. The stock rose to $162, which was higher than this week’s low of $155.

Nike earnings review

Nike is the biggest manufacturer of sporting footwear and apparel globally. The firm is known for its brands like Air Jordan and its athleisure brand.

As a result, the company has gone through two mixed situations this year. On the one hand, demand for the company’s products has risen substantially as most countries have reopened. Most sports like soccer and baseball have all resumed this year.

At the same time, the company has been affected by the relatively high cost of doing business as wages and cotton prices have surged. The country has also faced supply chain disruptions. For example, due to the Covid-19 illness, it had to cancel about 130 million units from Vietnam.

This trend explains why the Nike stock price recently moved into a correction zone as it fell by about 12% from its highest point.

Despite all these, Nike had a relatively strong quarter. Its revenue rose by just 1% to $11.4 billion. The eponymous brand had revenue of $10.8 billion while Converse revenue rose by 16% to $557 million.

The company experienced significant growth from its digital business. Its revenue in the segment rose by about 11% in the quarter and is about 25% of the total brand. About 40% of these digital sales were from mobile applications.

Despite the rising costs of doing business, Nike recorded strong margins. Its gross margin rose by 280 basis points to about 45.9%. Its net income was more than $1.3 billion. The company increased its dividend in the quarter to $1.4 billion and repurchased shares worth more than $968 million.

Is Nike a good investment?

The Nike stock price has done well over the years. It has risen by about 12% this year even as the company experiences significant supply chain disruptions. In total, the stock has risen by more than 240% in the past five years. This is a strong performance since the S&P 500 has risen by about 100% in the same period.

There are several reasons why Nike is a good investment. First, the company has a strong global brand that is known for its quality. This helps the company do well in all market conditions, including during the Covid-19 pandemic.

Second, the company has a strong competitive advantage in sports. It has achieved this by entering deals with most of the leading sports brands like the English Premier League and many American sports teams. These partnerships help it to have a competitive advantage.

Third, the company has a relatively strong balance sheet that helps it to deal with adverse market conditions. It has more than $15 billion in cash.

Finally, analysts are also bullish on the stock. Most analysts have a bullish view of the stock. For example, analysts at Telsey recently upgraded their outlook for the stock to $190. Others who are bullish on the stock are Truist, Wells Fargo, and Deutsche Bank and Morgan Stanley.

Nike stock price analysis

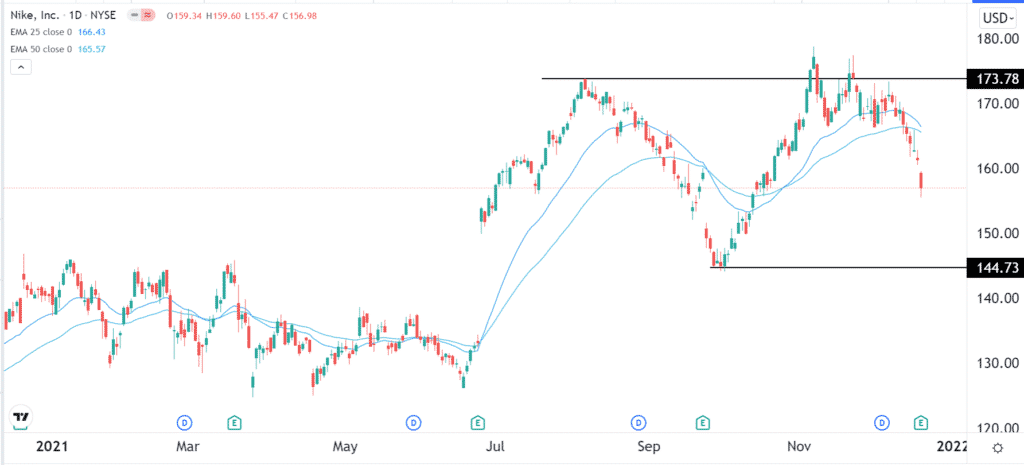

The daily chart shows that the Nike stock price has been in a bearish trend in the past few weeks. It has formed a double-top pattern between $173 and $180. The neckline of this double-top was at $144. The stock has also moved slightly below the 25-day and 50-day moving averages. Therefore, despite the post-earnings jump, there is a likelihood that the stock will remain in a bearish trend for a while.