- Reflation trade has gripped the markets in the US as markets make bets on Biden’s administration. Mr. Biden has said he will not delay invoking massive fiscal stimulus if need be. A massive fiscal boost is driving bets that have lifted the 10-year Treasury inflation-protected securities (TIPS) breakeven inflation rate beyond 2%.

- Bloomberg Economics predicts a 4% shrinkage of the euro-area economy for the first quarter of 2021, from previously expecting the economy to expand by 1.3%. Most euro-area countries have gone back into lockdowns, and vaccination drives are stuttering. Nonetheless, the US reflation trade is lifting euro zone government bond yields. Also, it could be that the market is anticipating more support for the bond market from the ECB as it meets next week.

What is behind the US reflation trade?

- Breakthrough SARS-CoV-2 vaccine data

Hopes are high in the market that the economy will reopen soon despite reports of a resurgent COVID-19 crisis. New COVID-19 strains are sweeping across the world, with the UK being the hardest hit. The new strain has made a case for tougher restrictions in Germany and China.

But US investors are willing to wager that the pandemic will be over in the coming months. The confidence was boosted by Dr. Ugur Sahin’s comments, CEO and Co-Founder of BioNTech, pointing to the company’s vaccine having the ability to combat new COVID-19 strains.

Dr. Sahin told CNBC that the company’s vaccine has unique mechanisms that empower the immune responses to deal with the virus and its mutants. “We believe that the immune response which is induced by our vaccine could also deal with (a) mutated virus,” he said.

- Easy money in China and the US

The incoming President, Joe Biden, has made it clear that his administration will go it big on fiscal stimulus even though “the price tag will be high.” All indications show that Biden will boost stimulus checks from Trump’s $600 to $2,000.

Though China recovered quite remarkably from the COVID-19 pandemic, the People’s Bank of China (PBOC) feels that consumers will need a “targeted and flexible” monetary policy to survive in 2021. This implies the availability of cheap money and debt forgiveness for struggling businesses.

- Possibility of resurgent global merchandise trade

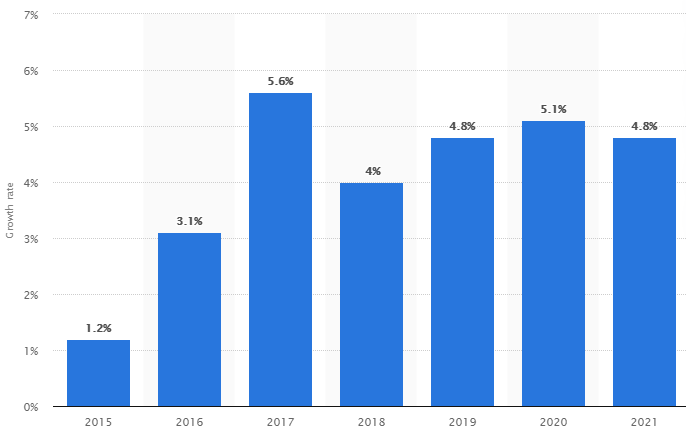

The World Trade Organization anticipates a 7.2% uptick in global merchandise trade this year. By the close of 2020, container-shipping networks were running at capacity. Statista projects the global container market to grow by 4.8%, which is just 0.8% short of a five-year peak reached in 2017.

Data shows imports approaching pre-crisis levels in the US, while November exports for Germany were up for the seventh consecutive month. The market anticipates similarly positive figures from China and the Eurozone later this week.

A resurgent USD indicates buyers are piling

The EUR posted a superior performance for the last two months of 2020. But a resurgent USD is within sight as the EUR struggles. The EUR/USD bears are growing in strength, egged on by reflation trades in the US.

Although the EUR/USD is holding above the 200-day simple moving average (SMA 200), the setup lacks enough strength to hold for longer. The Relative Strength Index (RSI) of the setup is at 32.01, meaning the pair is not too oversold to avoid further decline.

Conclusion

The euro is hanging on a thin thread, which could become worse if the Friday data disappoints. Meanwhile, the USD is on the warpath, and a smooth transition to Biden’s administration should continue to buoy the greenback.