The silver price dropped for the third consecutive week as investors exited relatively risky assets. It is trading at $25.30, which is 16% below the year-to-date (YTD) high of $30.

Risk assets slump

Silver is an important precious and industrial metal that is used to manufacture several items like kitchenware and solar panels. It is also one of the most volatile assets because of its close relationship with gold.

In the past three weeks, the price of silver has slumped because of the actions in the US bond market. On Thursday, the yields on the ten-year government bonds rose back to a 1.50% level after a speech Jerome Powell delivered.

In the speech, he talked about the bank’s policy response to the coronavirus pandemic. He also warned that the economy was far from recovery since millions of people are out of work. Indeed, data by the Bureau of Labor Statistics (BLS) showed that the economy added more than 379k jobs in February. The unemployment rate declined to 6.2%, which is substantially higher than the pre-pandemic level of 3.8%.

As such, he committed to leave interest rates unchanged and continue with the asset purchases to stimulate growth. Still, the performance of the bond market shows that the market is getting ahead of the Federal Reserve. It believes that the bank will likely increase rates ahead of schedule. Furthermore, the 5-year breakeven rate has risen to the highest level in more than a decade, which is a sign that investors expect the rate of inflation to climb.

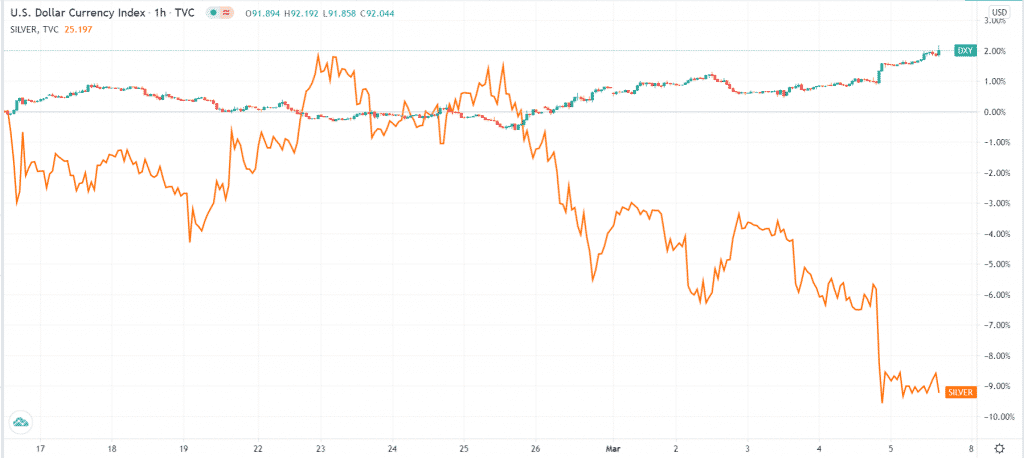

Interest rates have an impact on gold and silver prices. As it happened last year, the low interest rates tend to push the price of silver and other assets higher. This is partly because it makes it easy for people to borrow and buy the metal. Also, it leads to a relatively weaker US dollar. Since silver is usually priced in dollars, the two have an inverse relationship. The chart below shows how the US dollar index has jumped while the silver price has slumped.

US dollar index vs. silver prices

Silver risks and opportunities

There are several key catalysts for silver prices. First, the US Senate is debating a new $1.9 stimulus package. On Thursday, Kamala Harris broke the tie to advance these deliberations. With the bill being popular among voters, there is a probability that it will pass. Such a bill will be positive for silver because of its industrial use.

Second, China, a key buyer for the metal has unveiled its annual growth for the year. The country expects its economy to grow by 6% this year after growing by 2.3% in 2020. This means that there could be more demand for the metal.

Third, the Biden administration is expected to provide more support to support clean energy. This could lead to more demand for solar energy.

However, the biggest risk for silver prices is that supplies could soon increase. In their recent financial releases, Polymetal and Fresnillo announced that they might increase production this year. In commodities, higher supply usually leads to lower prices.

Silver price technical analysis

The daily chart shows that the silver price has been under pressure. It has dropped for the past three consecutive days and moved below the ascending red trendline. It has also moved below the 25-day and 50-day exponential moving averages, while the Relative Strength Index (RSI) has moved below the oversold level. Therefore, in the near term, the metal’s price may continue falling as bears target the next key support level at $24.