People don’t like paying taxes. Furthermore, the American government is known for wasting a substantial amount of taxpayers’ money. This is why businesses spend millions of dollars per year on lobbyists to fight tax increases. Similarly, the wealthy spend millions every year on tax planning. This article will look at some of the top tax tricks for investors and traders.

You can avoid income taxes

In 2021, ProPublica ran a widely read article on how wealthy people like Jeff Bezos and Elon Musk avoid paying taxes. The article’s main point was that while these billionaires made a lot of money as their share prices appreciated, they ended up paying little taxes. At times, they even requested a tax refund from the government.

While this method is widely utilized by wealthy people, ordinary people like you can also embrace it. This is mainly because the Internal Revenue Service (IRS) mostly taxes income from people.

For example, if a company is trading at $10 and you spend $1 million, you will own 100,000 shares. If in a year the stock doubles to $20, you will have made a profit of $1 million on paper. However, since you have not sold the stock, you will not be liable to pay any taxes on that return. You will only pay the tax the moment you decide to sell the shares. In this case, you will pay between 15% and 20%, depending on your returns.

At the same time, it is possible to avoid the tax by taking a loan that is backed by your portfolio. These types of loans are very common among rich people. Indeed, many billionaires survive on loans since the IRS does not consider a loan to be income.

Therefore, at a time when interest rates are at a record low, you will end up paying almost nothing on the amount you borrow. According to ProPublica, Larry Elison had a credit line worth $10 billion that was secured by his Oracle shares. As such, if you have a sizable portfolio, you could use it to save your taxes by borrowing against them and by just avoiding selling them.

Use a 401 (K)

A 401 (k) is a popular retirement tool that has more than 50 million members. A 401 (k) account is an investment account where you invest funds that you intend to take out when you retire. The account is mostly sponsored by an employer, who will send money directly to the fund every month. Employees can then top-up their 401 (k) accounts to increase their retirement nest egg.

There are two main tax benefits of having a 401 (k) account. First, the employer sends the funds directly to your account, meaning that it is not recognized as income. Second, upon retirement, you will pay the ordinary income tax when you decide to withdraw your savings, which is relatively small. Therefore, a 401 (k) will help you grow your retirement and save you money in taxes as well.

Tax-loss harvesting

Another popular tax trick for investors and traders is known as tax-loss harvesting. This is a strategy where holders of loss-making assets decide to sell them in order to lower the overall tax bill. For example, assume that you own five stocks in a year.

Of these stocks, three are profitable, and the rest make a loss. In this case, you could recognize the three that made a profit and then offset these gains with the two that made a loss. Also, you can offset these losses from the other types of income that you have.

Tax-loss harvesting is so popular that it is one of the main reasons why stocks tend to underperform ahead of the final day of filing taxes.

Still, there is a catch known as a wash-sale rule. This is a rule that was created with the goal of preventing extreme measures of tax-loss harvesting. The rule prevents you from selling a loss-making asset with the goal of avoiding taxes and then buying the same or identical asset.

For example, assume that a stock is trading at $20, and you buy 200 shares. This means that you hold $4,000 of the stock. After a while, the stock drops to $16, and you decide to sell it. Here, you will recognize a loss of $800. In this case, you can do the tax-loss harvesting.

However, if the stock drops to $14 and you decide to buy 200 shares, the wash sale will be recognized. Therefore, the initial loss of $800 will be disallowed when you go to file your returns.

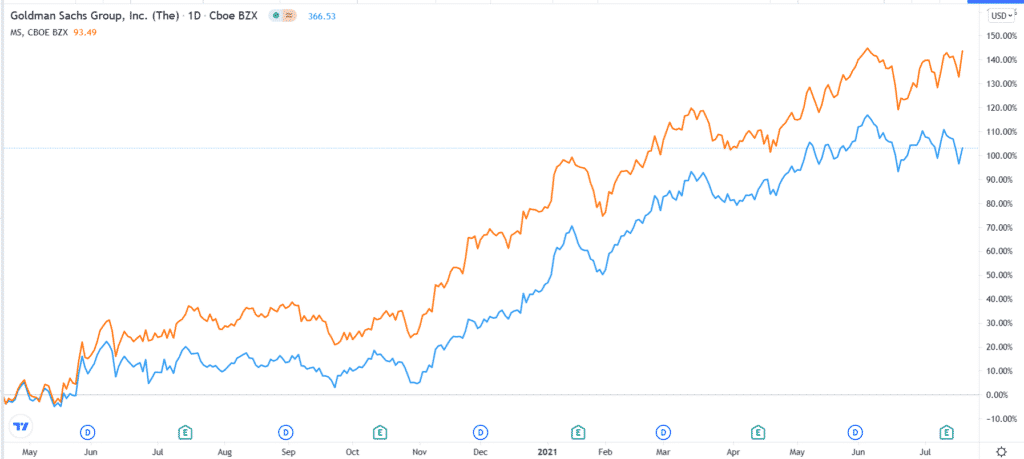

Still, there are ways of gaming the system known as correlation. In this case, you could buy another stock that is correlated to the initial one. For example, if the initial stock was Goldman Sachs, you could instead buy Morgan Stanley, as shown above.

Allocate money in tax-efficient assets

For long-term investors, it is possible to save money in taxes by allocating assets that are relatively tax-friendly. For example, to incentivize Americans to lend to municipalities, the Federal Government does not charge a tax for municipal bonds. Munis are a large part of the financial market that are worth more than $3.9 trillion. Therefore, you can do your research to find some of the best municipal bonds to invest in.

Some of the other assets that you could invest in to save money on are exchange-traded funds that are created to lower your taxes. Some of the most popular tax ETFs are Vanguard Tax-Managed Capital Appreciation (VTCLX) and Vanguard Tax-Managed Small-Cap (VTMSX).

Summary

Most traders and investors are constantly looking for legal strategies to reduce their tax bills every year. Since the US has a relatively complex tax code, it is relatively easy to find loopholes. A good example of this is the wash sale rule that you can avoid by using the mathematical concept of correlations.