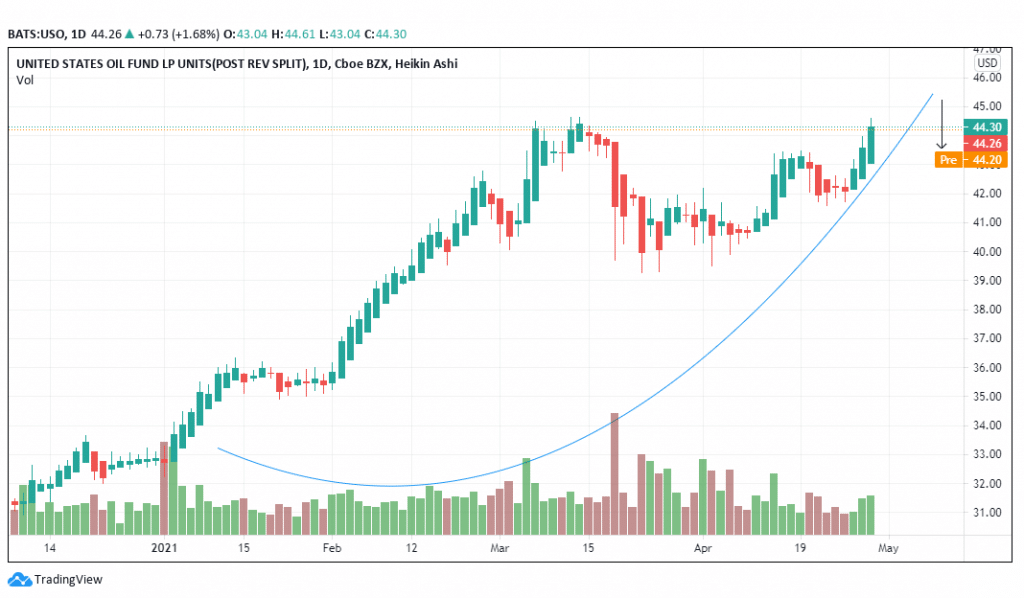

- The USO ETF was on a 3-day winning streak since April 27, 2021.

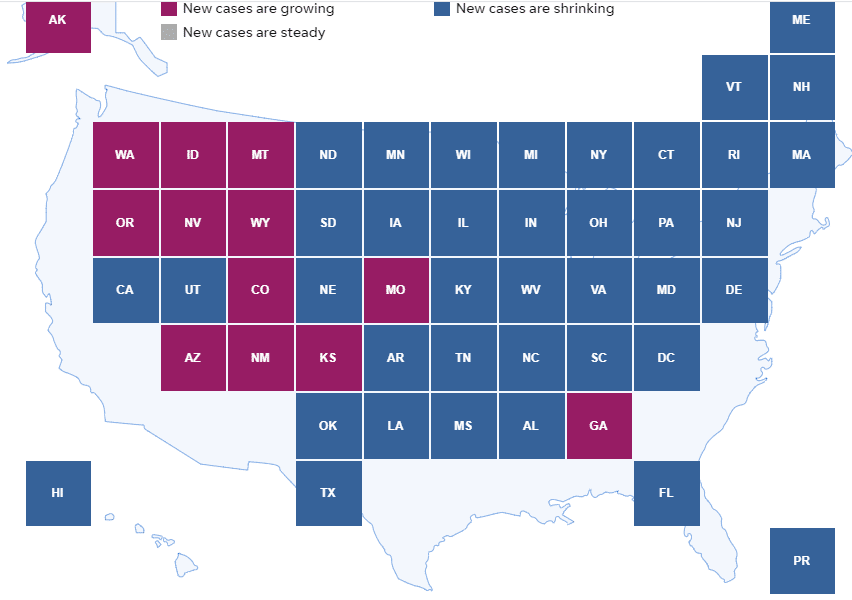

- Only 13 states reported new growing cases, while most indicated a shrink in new cases as of April 28, 2021.

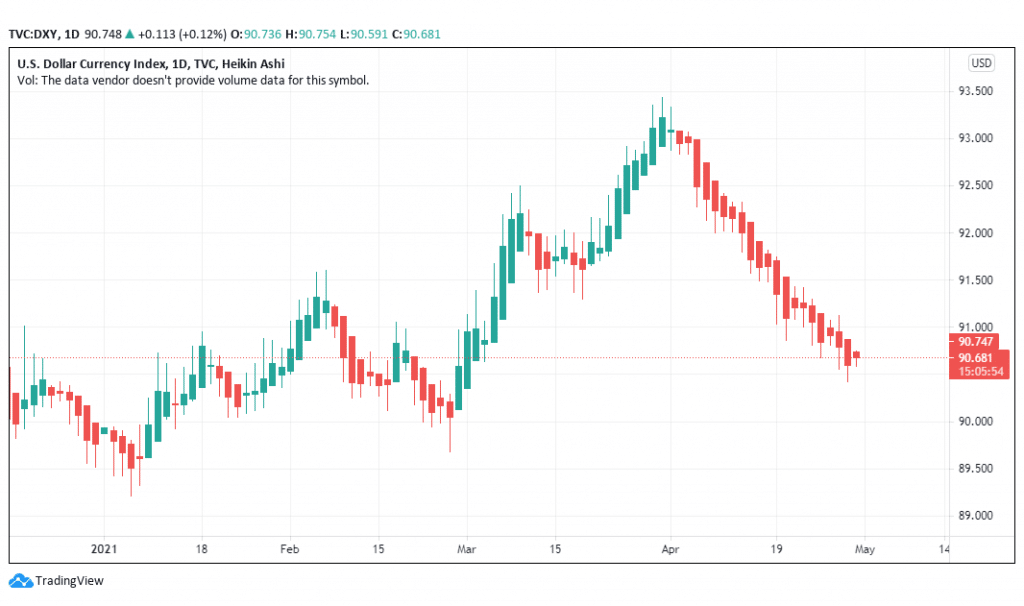

- Inflation fears are likely to raise the US dollar index.

The US Oil Fund (USO) ETF closed at +1.68% on April 29, 2021, from the previous day trading at a high of $44.26.

High oil prices at the close of April 2021 indicated that the rising COVID-19 cases in India and Brazil were being outweighed by high commodity prices.

US dollar Index (DXY)

The US dollar has been on a losing streak since April 2, 2021, from $92.87 to a low open at $90.63 on April 30, 2021 (-2.41%).

The USO ETF that specifically tracks the WTI crude oil was on a 3-day winning streak since April 27, 2021, when it closed at $43.11. On its part, the WTI crude oil traded at $64.68 on April 30, 2021, dropping -0.51% from the previous day’s trading. June 2021 contracts for WTI crude oil closed trading at $64.64 on April 29, 2021. It rose 1.55% after closing at a low of $63.69 for the September 2021 contracts.

Ease of restrictions

As of April 28, 2021, more US states were coming out of lockdowns with governors easing restrictions. Only 13 states reported new growing cases, while most indicated a shrink in new cases.

New cases of Covid19 in the US as of April 28, 2021

States such as Florida saw an ease in restrictions with mobility increased in DC by +1.21% in the seven days leading to April 28, 2021.

As more US cities emerge from restrictions and lockdowns, the market will continue to experience rising demand for gasoline and crude oil in the coming weeks.

However, the rising cases Covid19 cases in India and Brazil have instigated new headwinds into the global economic recovery. Deaths related to coronavirus reached 205,000 in India as of April 29, 2021, as total cases soared to 18.4 million.

Brazil, on its part, had 401,000 deaths related to Covid-19 as total cases reached 14.6 million. Globally total cases have soared to 150 million, with deaths standing at 3.16 million.

Increased oil production

Estimates by the OPEC+ indicate that the global consumption of oil is expected to reach 6 million barrels/ day in 2021. Countries such as Saudi Arabia and Russia urged the oil producers to push supply limits by 2 million barrels/day until July 2021.

However, the resurgence of economic activity is expected to be trimmed with the rising Covid-19 cases as well as a new variant in India.

The OPEC+ coalition expected to raise oil production by 600,000 barrels/ day by May 2021 while still considering raising the tally to 8 million b/d.

At this production rate, the coalition will only have covered 8% of the global oil supplies. It is expected that demand will continue to rise to meet crude oil production. Further, global estimates also indicate that the decline in oil inventories may reach 1.2 million b/d in 2021.

In March 2021, the draw-down of inventories into Q2 2021 was viewed at 800,000 b/d. Consequently, the stockpile of oil inventories may reach 8 million b/d by the end of Q2 2021.

However, the economic recovery in India may tilt the scales since the country is the 3rd largest importer of oil.

Inflation

Increased inflation after the US stimulus is expected to boost NYMEX WTI futures after it hit a record low in April 2020. An increase in the dollar index is expected to lower the USO ETF price.

Analysis

The USO ETF is expected to hit a high of $45.00 before tumbling to $42.00, following the increase in the US dollar index.

USO Rev Split

However, an increase in the ease of restrictions in the US will continue to widen demand as more states reopen their economies.