Are you looking for index funds with a low expense ratio and that can earn you fruitful returns over the long run? Vanguard Index Funds have got your back! Here is a simple guide on what Vanguard Index Funds are and how you can leverage them to earn substantial returns in the long run.

What are Vanguard Index Funds?

Index fund is a type of Mutual Fund where the portfolio tracks the components of a financial market index. For instance, the S&P500 is an equity index which tracks the 500 leading publicly held firms in the USA.

Founded by John Bogle, the Vanguard Index Funds set off the passive-investment revolution in 1976. The index fund merely attempted to match the market and sector benchmarks as closely as possible, allowing people to have more access to stock investments. Vanguard Funds are said to be the largest issuer of mutual funds and have a low expense ratio for portfolio management. They facilitate a diversified portfolio, with low portfolio returns with a relatively lower operating expense. VI funds see a stable growth over a period of time in comparison to the actively managed funds which is why they are considered a safe investment option by investors.

How Can You Use Them?

Investors flock towards passive investing – as it allows them to keep more of their money in the market. When a trader invests in a VI fund, they invest in more than hundreds of securities at once. Their investments are protected in such a way that if some securities perform poorly, the others can pick up to mitigate the risk. Professionally managed, these funds offer diversification at very cost-effective investments. An investor must study if the fund they pick to invest in aligns with their investment goals. Additionally, it is prudent to check factors like the fees and the minimum costs associated with various funds that track the same index. Vanguard offers funds in various categories such as U.S. bond and stock funds, International bond and stock funds, Balanced funds, sector and specialty funds.

Some of the Best Performing Vanguard Funds

There are more than 60 Vanguard index mutual funds that track a wide variety of domestic and international stock and bond indexes. Some of the best performing Vanguard Index Funds are explained below –

- Vanguard 500 Index Fund:

Set up in 1975, the Vanguard 500 Index Fund is one of the earliest Index funds set up by Vanguard. This fund tracks the components of the Standard & Poor’s 500(S&P500), exposing the investors to the 500 major companies in the USA which constitutes 75% of the total market share. The fund has seen exceptional growth over the last 5 years. Even with the oil crisis, the coronavirus trickling down the economy, the Vanguard 500 still continues to grow. The Vanguard 500 requires a minimum investment of $3000, has an expense ratio of 0.04% and provides a 10 year average annual return of 10.49%.

- Vanguard Total Stock Market Index Fund(VTSAX):

If the investor is not satisfied with 75% of the total market share, Vanguard Total Market Index Funds allows the investor to invest in the whole of the USA’s equity market – small cap, mid cap,large cap funds. VTSAX consists of approximately 3500 stocks, thus a dip in the stock price of one stock doesn’t affect the investor’s money as a whole . The returns on this fund have been very consistent and since it’s a passively-managed index fund, it is bound to grow with time. The VTSAX requires a minimum investment of $3000 and has an expense ratio of 0.04%.

- Vanguard Wellesley Income:

A low risk fund offered by Vanguard – with an allocation of 40% stocks and 60% bonds. This fund provides steady return on the investment for the investment who have a low tolerance for risk. The fund constitutes the stock holding of those companies which have provided a more than average dividends or are expected to provide higher dividends in the future. This constitution provides a higher quarterly income than non-income focused balanced funds. This fund requires a minimum investment of $3000 and has an expense ratio of 0.23%.

Asset Allocation (as of August, 2020)

- 38.57% Stocks

- 59.21% Bonds

- 2.22% Short-term Reserves

- Vanguard Total Bond Market Index Fund(VBMFX):

This fund gives the investor an exposure to the investment grade bonds in the United States – with 70% investments in government bonds and 30% in corporate bonds. The only risk involved with the VBMFX is the increase in interest rate, which further leads to a decrease in the price of the bond causing the net asset value of the fund to depreciate. This fund requires a minimum investment of $3000 and has an expense ratio of 0.05%.

- Vanguard Balanced Index Fund:

This fund splits the investment between stocks and bonds in a 60%-40% ratio, hence the name, Vanguard Balanced Index Fund. With investment of $3000 and has an expense ratio of 0.07%, this fund gives the investor a benefit of a fixed return from the bonds and provides exposure to the varying equity.

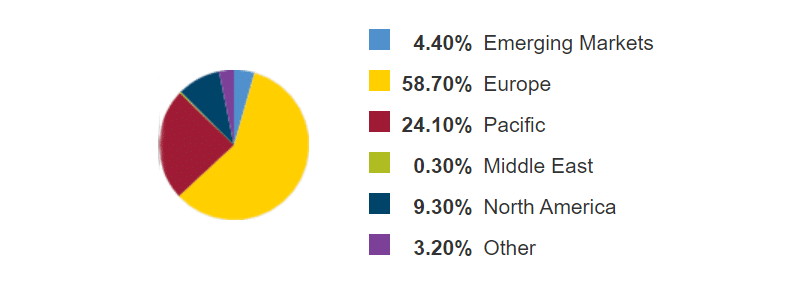

- Vanguard International Bond Index Fund:

The Vanguard International Bond fund traces the performance of International investment grade-bonds from corporations and governments of developed and developing countries and requires a minimum investment of $3000 and has an expense ratio of 0.11%.

Diversification of the Fund

Conclusion

Vanguard Index funds offer a great opportunity for passive investments. You should opt for VI funds to protect yourself from the volatility of the market. The low expense ratio helps you save up on the high management cost that you may otherwise incur in an actively managed fund. As they allow you to reap substantial returns in the long-run, Vanguard Index funds are best recommended to fuel the retirement fund. There are a wide variety of Index Funds that you can explore and invest in, depending on your investment needs and your tolerance for risk.