Vulnerabilities from liquidity and maturity mismatches continue to be at a low level, the Federal Reserve said in its latest Financial Stability Report.

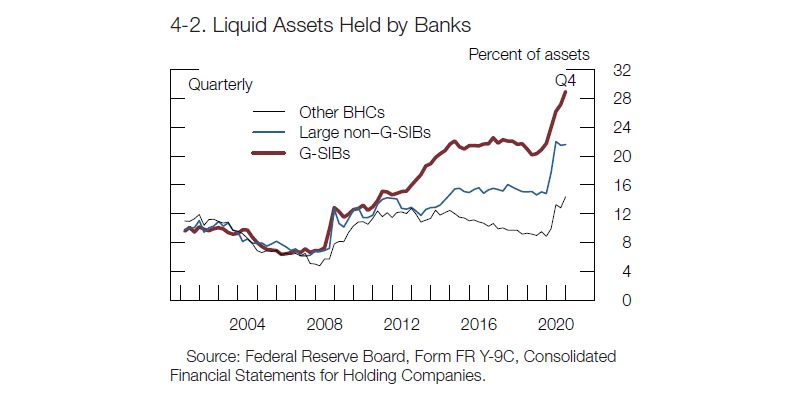

- For most domestic banks, liquidity ratios surpassed regulatory requirements after assets surged in the last quarter of 2020.

- The Fed said funding risks remain low because domestic banks rely only “modestly” on short-term wholesale funding, and continue to hold sizable amounts of high-quality liquid assets.

- Domestic banks also received high deposits throughout the COVID-19 pandemic, as the government released stimulus, along with precautionary savings of households.

- Total liabilities vulnerable to runs grew 13.6% to $17.7 trillion in 2020, equivalent to 85% of the gross domestic product (GDP).

- The growth in potentially vulnerable liabilities offset the declines due to the size of prime and tax-exempt money market funds (MMFs).