Currency trading has given rise to the biggest marketplace with a daily turnover of more than $5 trillion. In addition to being the biggest market, the forex market shares a unique attribute unmatched anywhere else. The fact that the market runs 24-hours a day explains why it is the most tracked and followed market worldwide.

The $5 trillion market is opened every Sunday at 5 p.m. EST and runs without shutting down until 4 p.m. EST on Friday. At no one given time is the market closed for the day during this time. In contrast, stock and commodity markets open and close at the close of business each day.

Why is it open 24 Hours?

Trading activities in the trillion-dollar market go on 24 hours from Sunday to Friday, partly because of the different time zones in play. Different time zones give rise to overlapping markets such that whenever one market is closed, there is always one or more open, conversely bringing traders together.

Likewise, as long as there is any market opened at any given time, there will always be people to balance off. The fact that currencies are a necessity for international trade also ensures there is always a demand for a currency at any given time.

The use of computers to place trades is another reason the forex market remains open 24 hours. The network of computers makes it possible for traders to log into trading accounts at any given time of the day or night to place trades and profit from price swings.

Likewise, whenever news outlets report that the US dollar closed at a given rate, it essentially means it is the price as the markets closed in New York. Currencies continue to trade even with the US Session going offline at the close of business.

In contrast, other securities are never traded all day long, as is the case with currencies. This is partly because they are not as relevant as what many people think. The amount of hours allocated to trade stocks and commodities is often sufficient given the limited number of market participants trading such items.

While the currency market is opened throughout, not all currencies are traded all day long. Currencies of emerging economies are often not always available for trading. The most-traded currencies are those of economic powerhouses that influence trading activities.

Speculators are known to prefer currencies of major economies, as they are highly liquid and come with lots of volatility. Conversely, the most traded currencies in the 24-hour market are the US dollar, the British pound, the Euro, the Swiss francs, the Japanese yen, the Canadian dollar, the Australian dollar, and the New Zealand dollar.

When is the Forex market active?

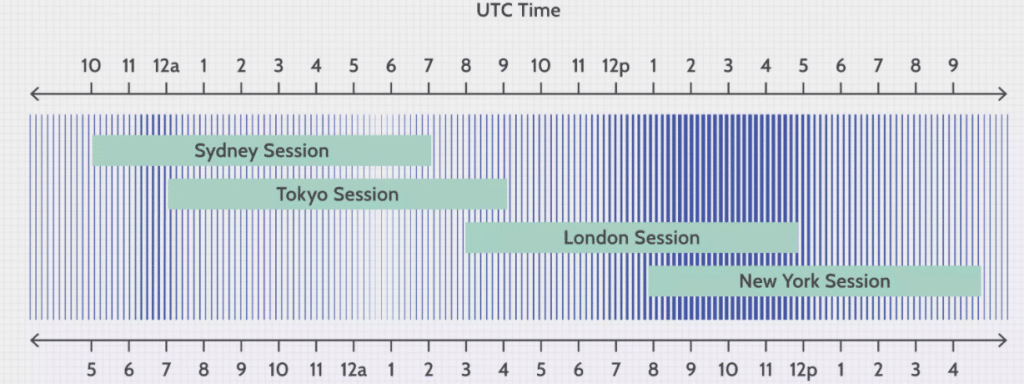

Trading activities in the currency market begin as soon as markets in Australia go live, followed by the European session and finally the North American session. The cycle goes on and on from Sunday to Friday. Overlapping between different sessions is a common phenomenon known to give rise to the best trading opportunities, especially when it triggers a significant increase in market participants.

The Australian session does not offer the best trading opportunities. This is due to the reduced number of people needed to influence the forces of supply and demand. When the Australia session opens, Europe is closed. However, as the Australasia session comes to a close, Europe is just starting.

Similarly, traders in Australia and its surroundings often wait for the European session to go live. The opening of the European markets often sees an increase in the number of market participants that sway supply and demand forces, conversely triggering high volatility and rapid price swings on currency pairs.

When activities are but starting in New York offers the best trading opportunities in the currency market. During this time, there are more market participants from Europe and the Americas. The result is usually heightened liquidity and volatility crucial for opening and closing trades with ease. The overlapping between Europe and New York sees some of the biggest commercial companies, central banks, and management firms engaged in all sorts of trading activities.

Likewise, when the New York and London sessions are running concurrently, traders should look for trading opportunities. Whatever happens at this time always has the potential to affect what happens throughout the day or night. Likewise, the period sees the most trading volume.

Whenever these two markets are overlapping, forex brokers are known to offer tight spreads in currency pairs. Tight spreads reduce the cost of trading, making it possible to generate optimum profits on any given position opened.

Often the rate set on major currency pairs when the two sessions are open goes on to be used as the daily valuation by the big players in the market.

Price Swings

The forex market is the most active, as depicted by substantial daily trading volume, because of the factors influencing traders’ sentiments conversely currency rates. Some of the factors that influence trader’s sentiments on currencies relate to economic releases and political developments.

Monetary policies by central banks also go a long way in influencing trader’s sentiments about currencies, conversely affecting currency fluctuations. These things occur at any given time of day, given the time differentials ensure there is always a market-moving event that influences trader’s sentiments, conversely triggering price swings.

Conclusion

Currency is a necessity as it is the fuel that powers international trade. Time difference between various economies means international trade will always take place at any given time. Similarly, large computer networks spread worldwide go a long way in supporting currency trade without time limitation.

Conversely, the forex market will always be a 24 hour market given the time differential and large computer networks that support currency trading regardless of time. The necessity of currency to power transactions between businesses, banks, companies, and traders should also fuel the 24-hour marketplace.