XTB is a safe multi-asset broker with over 15 years of experience that serves customers from all regions worldwide through its powerful xStation 5 platforms. In addition, the multiple regulations from top-tier regulatory bodies like FCA ensure that clients’ funds are kept secure. Overall, the broker offers its users a great trading experience, with educational resources and many features.

Can XTB be trusted?

Regulation

- CySEC (license № 169/12 as of 2020).

- Comisión Nacional del Mercado de Valores (license № 40).

- Financial Conduct Authority (license № 522157).

- Polish Securities & Exchange Commission (license № 4021-57-1/2005).

- Belize International Financial Services Commission (license № IFSC/60/413/TS/19).

Foundation

The world first learned about the XTB broker in 2002. The abbreviation of its brand stands for X-Trade Brokers. The company is registered and headquartered in Belize. Brokerage services are provided through the official web portal www.xtb.com.

History

X-Trade Brokers (XTB) was founded in 2002 as X-Trade. It was the first leveraged forex brokerage institution in Poland. In 2004, it morphed into XTB in compliance with Polish new financial regulations. It has operated as XTB online trading since 2009.

It is known that over the 16 years of its operation, the company has gone through several rebranding. During such changes, its name and the founders’ composition have changed.

It helps market participants trade in the interbank currency exchange market worldwide. The company has opened subsidiaries in Spain, Poland, Germany, France, Great Britain, and other countries. It is believed that the company’s activities are focused exclusively on working with European investors.

It’s also listed for public trading on the Warsaw Stock Exchange under the symbol XTB.

XTB is an award-winning global CFD and FX broker, recognized for its excellent features, outstanding customer service, and a large selection of trading and research tools. It offers clients over 5200 financial instruments to trade on, mainly CFDs.

Location & Offices

XTB is a global CFD broker with headquarters in London and Warsaw.

Markets overview

XTB offers over 5200 trading instruments that you can trade as CFDs. You can also trade cryptos and forex. Since the broker is primarily a CFD and forex trading platform, its default settings feature CFDs and FX.

Available markets

Forex

- 48 currency pairs, including the major pairs, some minor and exotic pairs

- The forex-supported CFDs have reduced spreads of 0.1 pips

- Micro-lot trading

- A leverage of 1:30

Commodities

- 24 hours trading is available

- The maximum leverage is 1:20

- Available on PC, Tablet & Smartphone

- Twenty tools of commodity-supported CFDs with no costs for any trading positions holding overnight. Thus, traders can continue trading for 24 hours at no extra charges.

Indices

- Over 40 tools of CFDs with index support

- Spreads of 0.24 pips

- Leverage of 1:20

Cryptocurrencies

- 25 crypto assets, with 16 being pairs and nine being individual coins

- Some of the coins available are Bitcoin, Dash, Ethereum, Litecoin, and Ripple

- The maximum leverage is 1:2

- Market participants can trade all through the week’s seven days

Stocks

- Over 2000 listed shares are listed for you to choose

- Low commission from 0.08%

- Trade with a 20% deposit

ETFs

- Leverage up to 5:1 (20%)

- 80+ ETFs globally at no commission, ranging from companies, real estate, and other commodities.

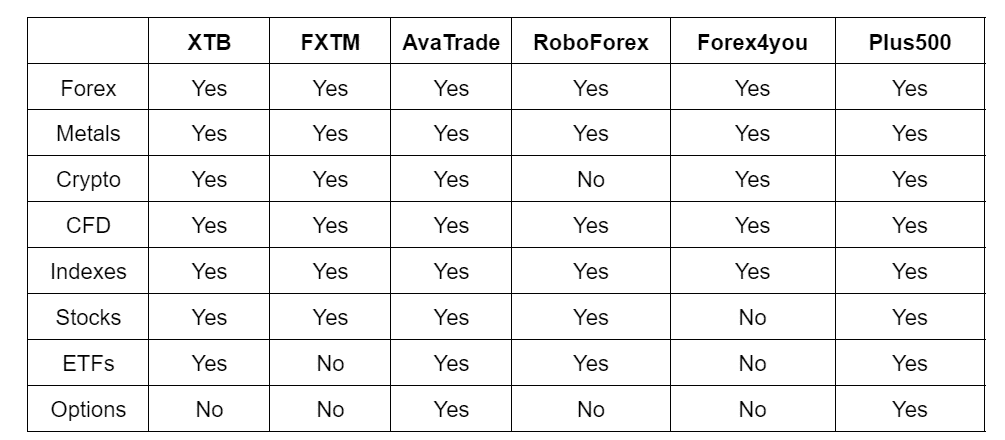

Comparison with other brokers

Platforms overview

XTB runs on the excellent xStation 5 trading platform. It stands out for its superfast execution, ease of use, and reliability. It’s available on the web, desktop, and mobile applications.

For online trading, the broker uses two trading terminals:

- MetaTrader 4

This is a classic software with wide functionality and a vast selection of tools for practical technical analysis. When registering a Pro account, trading advisors and robots for automated trading become available to the client.

- xStation

This is an innovative software of the broker’s development, characterized by a simple interface, many popular indicators, and tools for predicting the market situation. The program is updated automatically in real-time.

Trading and information terminals can be downloaded on a desktop or mobile version. To make a profit, traders can use over 1,500 financial assets, including:

- Currency pairs

- Cryptocurrency

- Indices

- CFD and ETF contracts

- Commodities

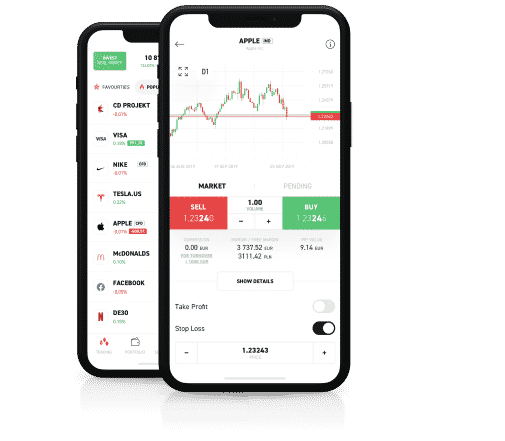

Is XTB good for mobile trading?

Forex and CFD trading and stock trading are possible through the xStation5 application. Of course, trading on XTB can also be done through the mobile app. To do this, use an Android or iOS device.

The corresponding software is also available for Apple Watch. The xStation5 application does not differ in functionality from the desktop version. You can also use regular stop-loss, analysis, indicators, or trade CFDs. All functions are also possible using a mobile device.

XTB fees

XTB charges both trading and non-trading fees, which vary for both account types. For example, standard accounts only charge spreads, while pro accounts pay both spreads (market range) and commissions.

Spreads for a standard account range from 1.2 to 0.9 pips, while on a pro account, they can go as low as 0 pips. Trading CFD ETFs and CFD stock commissions attract a commission of 0.08% for every open and close position of every transaction.

XTB charges low forex fees and considerably high stock CFD fees compared to other brokers.

Trading commissions

| Account type | Spread/commission | Withdrawal commission |

| Standart | $5 more | 1.5% while withdrawing money to a bank card (Visa, Mastercard), as well as when withdrawing to SafetyPay; 2% while withdrawing to Neteller and Skrill |

| Pro | $1 | |

| Islamic | $7 and more |

Non-trading commissions

- Inactivity fee — €10/month after one year of account inactivity.

- Withdrawal fee — $20 for all withdrawals less than $100. Withdrawals above $100 are free.

- Deposit fee — a 2% charge on deposits via e-wallets. Deposits through bank transfer, credit and debit cards are free.

Deposit & Withdrawal

Payment methods

- PayPal (or other e-wallets, like Paysafe, Sofort, Bilk, etc.)

- Bank wire

- Credit cards

- Electronic payment systems

- Payment within a maximum of three days

Minimum deposit

$0

Base currencies

EUR, GBP, USD, and HUF

Withdrawals methods

XTB allows withdrawals through bank transfer only. A withdrawal fee of $20 applies for amounts below $100. The company is aware that clients may want to withdraw small amounts depending on their account balances, so it has set different thresholds for such withdrawals.

Once you initiate a withdrawal, it is processed within one business day. If the withdrawal is made before 1 pm, the amount reflects in the bank within the same day. Otherwise, your money will reflect in your bank the next day.

Broker XTB provides a relatively fast withdrawal of funds, but in USD only.

The company charges a commission of 1.5% (but not less than $30) for bank transfers and transfers to SafetyPay, and 2% for withdrawals to Neteller and Skrill e-wallets.

There are five options for depositing/withdrawing funds:

- Bank transfer

- Visa or MasterCard

- Skrill

- Neteller

- SafetyPay

Withdrawals to a bank card usually take 1-3 business days on average. Withdrawal to e-wallets Skrill, Neteller, SafetyPay takes 3-5 working days on average.

Where does XTB excel?

- The min. deposit is $0

- A wide range of trading instruments

- Branches in 12 countries

- The presence of five financial regulators of the European level

- Two trading terminals to choose from

- More than 1,500 financial assets, including crypto

What are XTB disadvantages?

- Complicated registration procedure

- Uninformative analytical materials

- Hidden commission costs

- There are no popular electronic wallets

- There are no PAMM accounts

- There is no two-factor authentication for extra security

Who XTB is best for?

XTB is one of the best online brokers. The variety of over 3000 assets and financial products is vast for clients, and you will indeed find a suitable market. The company is trying to expand its offer and add new markets. It is a regulated and licensed broker from Europe with a high deposit guarantee. In addition, the company’s share is listed on the Polish Stock Exchange.

Conclusion

With over 14 years of experience, XTB is one of the largest FX & CFD exchange brokers. Currently, the company is represented in most European countries and China, India, and CIS countries. The broker works under the supervision of several regulators at once. The company’s website has been translated into 18 languages.

The information is presented in an accessible manner, and the site’s interface is pleasant. A block of good quality educational materials is presented, and a section for news and market analysis (access to most of the materials appears only after opening an account with the company).