Vanguard is the second-biggest asset manager in the United States after Blackrock. It has more than $7.1 trillion of assets under management (AUM) and more than 30 million individual investors from more than 30 countries.

Vanguard runs almost 200 funds that cater to all types of investors. If you are a growth investor, the company has an exchange-traded fund (ETF) for that. Similarly, if you are a commodity investor, the firm has ETFs to cater for that. In this article, we will look at some of the best Vanguard funds you should add to your 401(k) fund.

What is a 401(k)

A 401(k) is a fund where employers contribute a certain amount of your pre-tax income to. The funds are then invested in a range of assets like stocks, ETFs, and bonds. Many employees also match their employers’ contributions to ensure that they have more money after retirement. In addition to having enough money during retirement, 401 (k) plans have other benefits like taxes and shelter from creditors.

Best 401 (k) funds by Vanguard

Vanguard offers everyone willing to invest in their future retirement four options to choose from, so let us look at each of them in turn.

Russell 1000 Growth ETF (VONG)

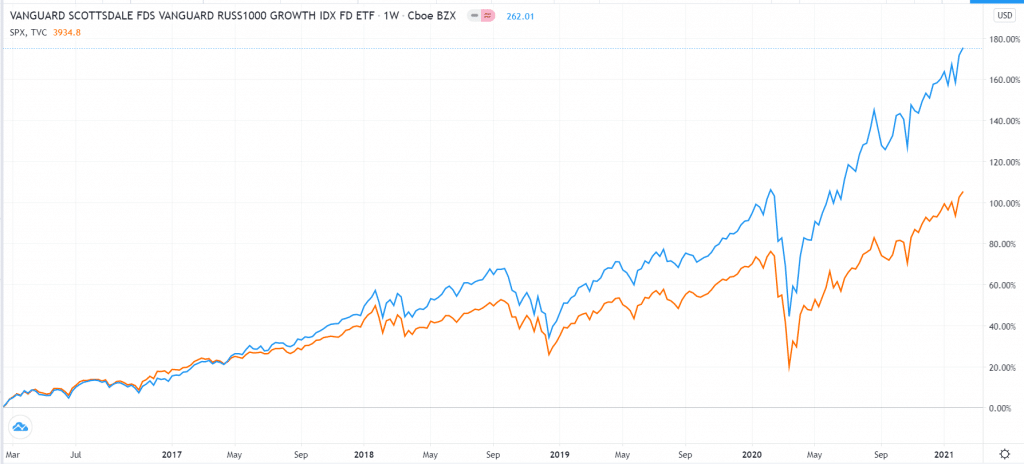

The Russell 1000 Growth ETF (VONG) is an exchange-traded fund that tracks the biggest growth companies in the United States. Most companies in the ETF are in the technology sector, which is well-known for its growth. It has more than $5.6 billion in assets and is relatively cheap to own because of its small expense ratio of about 0.08%.

Some of the biggest companies in the VONG ETF are Apple, Microsoft, Amazon, Tesla, and Nvidia. In total, 40% of the constituent stocks are in the tech industry, while consumer discretionary are about 20%. Healthcare and industrials are the rest of the constituent companies.

The Russell 1000 Growth ETF has been an excellent performer over the years. For example, in 2020, the ETF returned 38.4%, beating the benchmark S&P 500 index. The same trend is seen in the past five years when the ETF has gained by about 180% compared to the S&P 500 average gain of 110%.

Some of the other reasons you should invest in the ETF is that it is highly diversified and is mostly tilted towards growth stocks. In the past few years, growth stocks have outperformed other types of stocks.

Russell 1000 Growth ETF vs. S&P 500

Vanguard Dividend Appreciation ETF (VIG)

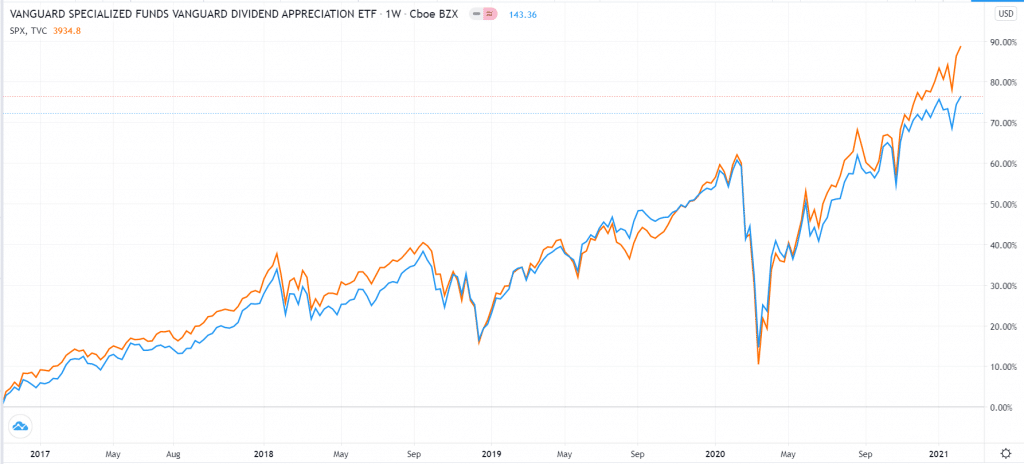

Long-term investors, especially those focusing on retirement, want to have a stable income from their investments. One way of achieving this is by having a portfolio made up of the best dividend-paying companies.

The Vanguard Dividend Appreciation ETF is ideal for any retirement or 401 (k) portfolio. The fund tracks the NASDAQ US Dividend Achievers Select Index. This index is made up of companies with at least ten years of increasing their dividends.

The VIG ETF has grown from a relatively small fund to more than $54 billion in assets. It is also a relatively cheap fund to invest in because of its 0.08% expense ratio.

It is also a well-balanced ETF, with consumer discretionary companies making up 22.80% of the fund. They are followed by industrials, healthcare, and technology companies.

In total, it has 212 companies, with the biggest ones being Microsoft, Walmart, Johnson & Johnson, Procter & Gamble, and UnitedHealth Group.

There are several reasons why you should have this ETF in your 401 (k). First, most of these firms have a record of increasing their dividends. Second, it is a highly-diversified fund, and third, it is a relatively cheap fund to own.

VIG vs. S&P 500

Vanguard Mid-Cap ETF (VO)

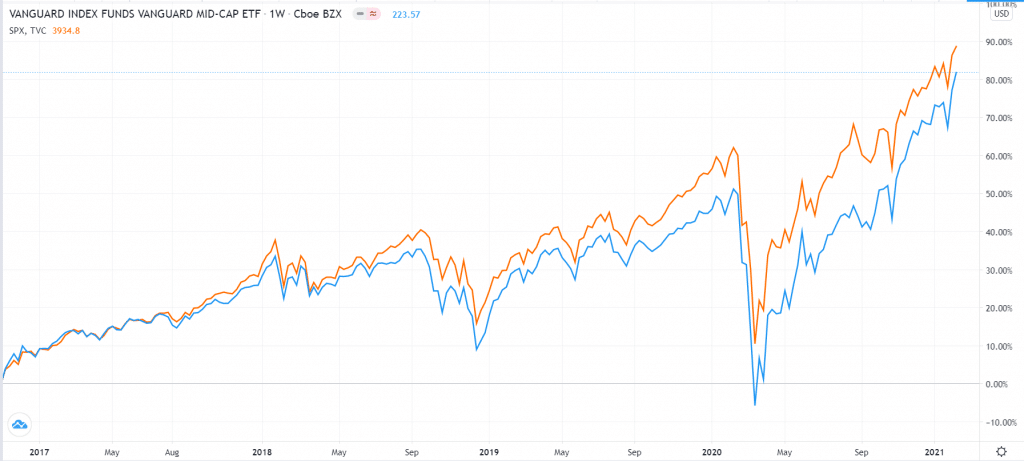

In most periods, the focus among investors is usually on the big companies like Apple, Microsoft, and Amazon. However, in most periods, the relatively small companies that are not covered by the press tend to do better.

The Vanguard Mid-Cap ETF is a fund that tracks a group of the mid-cap sector. Precisely, it tracks the CRSP US Mid Cap Index, which covers companies that fall between 70% and 85% of the total market capitalization.

The ETF tracks 347 companies, with most of them being in the technology sector. It is followed by consumer discretionary, health care, industrials, and financials. Some of the biggest companies in the fund are KLA Corp, Chipotle Mexican Grill, DocuSign, Digital Realty Trust, and Twitter.

You should add this ETF into your 401 (k) because of its focus on the mid-cap segment, its low expense ratio of only 0.04%. It also has an attractive dividend yield of about 134%.

Vanguard Mid-Cap ETF vs. S&P 500

Vanguard Information Technology ETF (VGT)

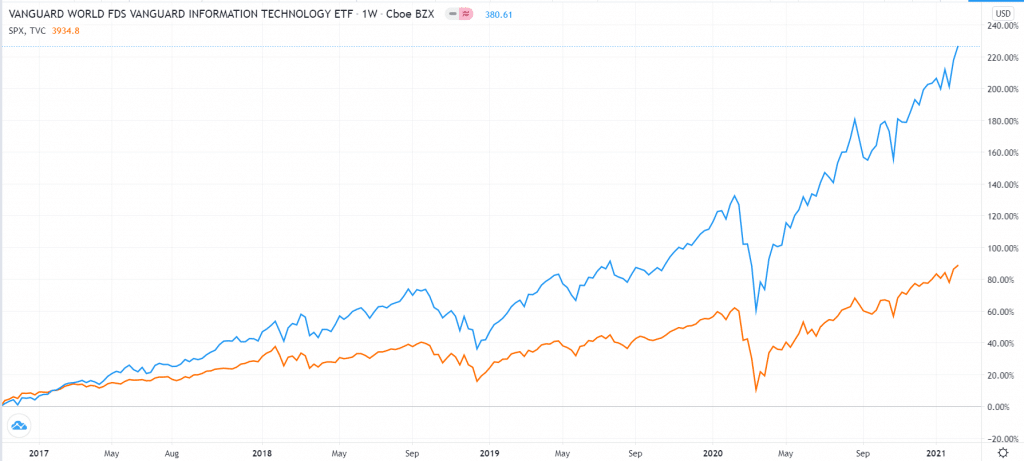

As mentioned above, the technology sector is becoming the biggest player in the United States. In fact, the biggest five tech companies in the country have a market cap of more than $8 trillion, which is almost half the US GDP. The sector will continue to play an important role in the country for years to come.

Therefore, investing in an ETF that tracks the biggest tech firms in the country is ideal. The Vanguard Information Technology ETF is one such ETFs. It has more than $44 billion of assets and an expense ratio of 0.10%.

All companies in the index are in the IT industry, with most being in the systems software subset. Others are in the technology hardware, storage, and peripherals, semiconductors, and data processing. Among the biggest firms in the fund are Apple, Microsoft, Nvidia, and PayPal.

VGT vs. S&P 500

Summary

Vanguard is a relatively different company from other large asset managers in the United States like Blackrock, Schwab, State Street, and JP Morgan. All these companies are publicly traded and are in the business of maximizing their shareholders’ wealth. Vanguard, on the other hand, is owned by its customers, making its funds relatively cheaper than those of the other companies.

We believe that the four funds we have mentioned above are the best ones to add to your 401 (k). But there are many others that you can consider, including the Vanguard Health Care ETF (VHT), Vanguard Small-Cap Growth (VBK), and Vanguard S&P 500 Growth ETF.