The private equity sector is one of the biggest industries in the global financial sector. According to Preqin, the sector has more than $5 trillion in assets under management (AUM). It expects that the AUM will almost double to more than $9 trillion in the next four years. In this article, we will look at some of the best private equity stocks to buy and hold.

What is private equity?

Broadly, there are three types of investment companies. First, there are public asset managers, which are companies that invest in publicly traded companies like Coinbase, Square, and Twilio. Second, there are investors who focus on allocating capital to companies that are not publicly traded. Finally, there are hybrid investment companies that invest in both private and public companies.

Private equity (PE) companies are investors who raise money from pension funds, sovereign wealth funds, companies, and high-net-worth individuals to invest in privately-run firms. Most PE firms differ from venture capital firms in the aspect that they typically invest in established companies.

There are hundreds of PE firms globally, with most of them being from the United States. Some of the biggest ones are Blackstone, Carlyle, KKR, and TPG. Most of the biggest PE firms are privately owned, with only a handful of them being publicly traded.

How private equity works

PE firms do their research and buy a large stake in a private company. Others use their balance sheet to acquire a publicly-traded company. After acquiring these companies, they use their experience to reduce costs and improve their operations.

Lastly, they typically make money by taking the companies public. Some of the most popular deals by PE firms are the acquisition of the elevator unit of Thyssenkrupp by Advent in an $18 billion deal and the Energy Future Holding acquisition by KKR and TPG for $48 billion.

Here are some of the best PE stocks to invest in.

Blackstone (BX)

Blackstone is an American PE firm with more than $650 billion in AUM. The company operates its business through different segments like Private Equity, Real Estate, Hedge Funds, and Credit and Insurance. Its PE business has more than $212 billion in assets. Some of the companies it owns are Ancestry, Refinitiv, and Aypa Power. It is also the biggest holder of real estate in the United States.

Blackstone has billions of dollars available to invest.It also has seen its annual revenue grow from more than $4.99 billion in 2016 to $14 billion in the past 12 months. It generates more than $3 billion in annual profits. It has a market capitalization of more than $100 billion.

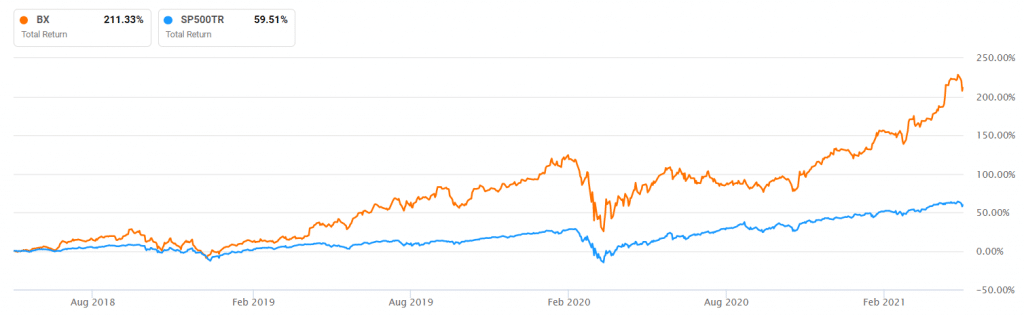

Blackstone vs. S&P 500

One of the reasons why Blackstone is an ideal company is its scale, which helps it be able to spot and actualize investments. Additionally, the company is quite undervalued based on the sum of parts of the companies it owns. Also, Blackstone’s business is relatively diversified and has a history of underperforming the market.

Apollo Global Management (APO)

Apollo Global Management is a PE firm that struggled in 2020 when its founder was named in the Jeffrey Epstein scandal. In early 2021, Leon Black announced that he would step down as the CEO and Chairman.

APO is a PE firm that has a market cap of more than $24 billion. Like Blackstone, it operates its business through different segments like Credit, Private Equity, Real Assets, and other vehicles. Its PE business has more than $81 billion in assets and 150 portfolio companies. Some of its best-known holdings are Hostess, Claire’s The Fresh Market, and ADT. In 2020, the company decided to acquire Athene Holdings for $11 billion.

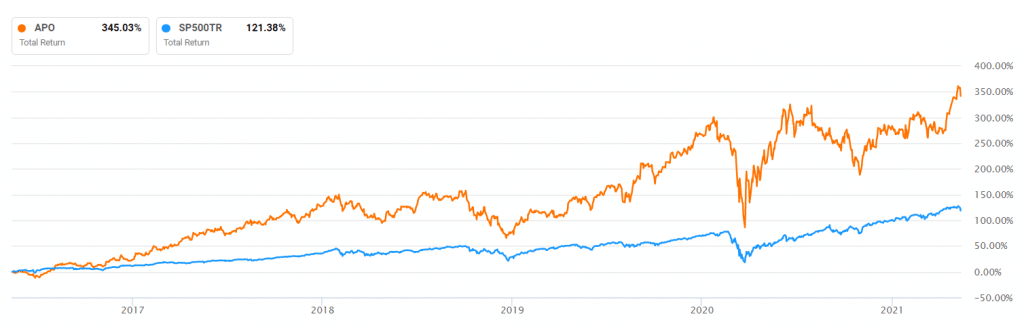

Apollo Global vs. S&P 500

Apollo makes more than $2.2 billion in revenue and more than $500 million in profits. Some of the top reasons to invest in the company are its large scale, attractive valuation, and its attractive dividend yield of more than 5%. This yield is substantially higher than some of its peers because its stock struggled amid Leon Black’s scandal. It also has a long record of outperforming the broad market.

The Carlyle Group (CG)

Carlyle is a high-profile Washington-based PE firm that has more than $260 billion in AUM. The company operates in three divisions: Private Equity, Global Credit, and Investment Solutions. Its PE business has more than $137 billion in assets and more than 200 companies. CG has a market cap of over $15 billion. Some of the companies it owns are NGP, StandardAero, Golden Goose, and Duff & Phelps.

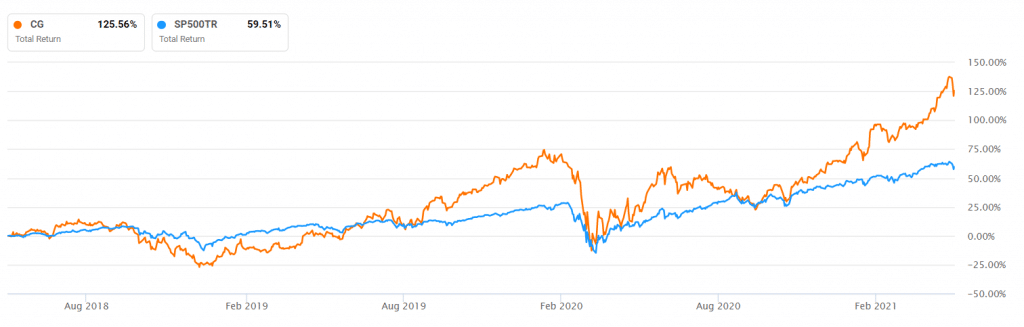

Carlyle vs. S&P 500

Carlyle Group makes around $3 billion in total revenue and close to $400 million in profits. The company has a relatively healthy balance sheet, a good reputation, an attractive balance sheet, deep Washington connections, and decades of experience managing assets. Additionally, Carlyle trades at relatively low multiples compared to its peers. It also has a long history of outperforming the broad market.

KKR

KKR is a PE firm started by Henry Kravis, one of the most legendary Wall Street professionals in modern history. The company has a market cap of more than $47 billion, making it one of the biggest in the industry. It has more than $252 billion in AUM and 107 portfolio companies. It operates in the private equity, real estate, energy, credit, infrastructure, and capital markets industries. Some of the best-known companies it owns are Ajax Health, Acteon, BMC, and Fiserv.

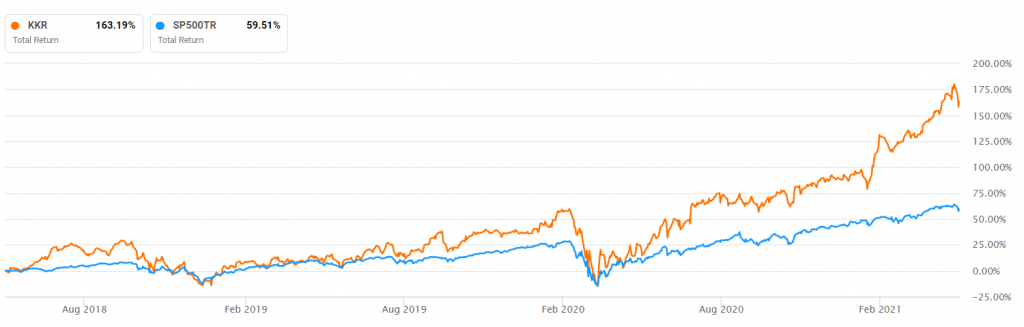

KKR vs. S&P 500

KKR makes more than $8 billion in revenue and more than $5 billion in profits. It makes a good investment because of its excellent historical performance, the quality of its portfolio holdings, and its excellent dividend yield of more than 2.40%. The company also has higher margins than its peers, and its valuation is relatively reasonable.

Final thoughts

There are many PE stocks that you can invest in. We have not mentioned some of the notable ones are Brookfield Asset Management, Prosus, EQT, and Ares Capital. However, we believe that the four companies described in the article are the best because of their scale and track record.