Robo-advisors are financial companies that provide investment and advice services to investors through the internet. In recent years, these companies have become relatively popular in the United States, particularly among young investors. In total, these companies hold more than $250 billion in assets under management. And, the number of Americans using the services is expected to reach more than 25 million in the next few years. In this report, we will look at the most popular robo-advisors in the United States.

Acorns

Started in 2012, Acorns has grown to become one of the fastest-growing robo-advisors in the United States. The company has raised more than $207 million from investors, receiving a valuation of close to a billion dollars. The firm’s number of clients has grown to more than 4 million. It has more than $1.2 billion in assets under management.

Acorns offers a suite of products. Acorns Invest allows customers to invest their spare change automatically while Acorns Later allows customers to invest for their retirement. The firm also has Acorns Spend, a checking account that offers relatively modest returns for customers. It also has Early, an investment product for children.

To use Acorn’s robo-advisor, users create a free account, answer a few questions about their investment goals, and then the company recommends a preferred portfolio. It has the following portfolios:

- Conservative – This portfolio invests 40% of the funds to short-term government bonds, 40% to short-maturing corporate bonds, and ultra-short-term government bonds. While the returns of this portfolio are limited, the funds are usually relatively safe.

- Moderately conservative – This portfolio invests 24% in large-cap stocks, 4% in medium-sized stocks, 12% in foreign company shares, and 60% in government and corporate bonds. The latter tend to be safer investment options.

- Moderate – This portfolio invests 40% of its funds in government and corporate bonds, 18% in foreign stocks, 2% in small-cap stocks, and 40% in large and medium-sized stocks.

- Moderately aggressive – This one invests a substantial amount in large-cap stocks, followed by foreign stocks, government and corporate bonds, medium-cap, and small company shares.

- Aggressive – This portfolio invests most of the money in large companies, followed by international stocks, medium-sized companies, and small caps.

Wealthfront

Wealthront is one of the biggest robo-advisors in the US with more than $20 billion in assets under management. The company has raised more than $205 billion and is valued at almost a billion dollars. The company has even expanded its business to checking accounts, lending, and financial advisory services.

Wealthfront’s robo-advisors invest in various assets including bonds, stocks, emerging market funds, and real estate investment trusts (REITs). Unlike Acorns, the company does not have specific portfolios that one can choose from. Instead, the company will ask you a series of questions about your risk appetite and duration of the fund. After this, it will allocate your funds to its specific portfolios according to your risk score.

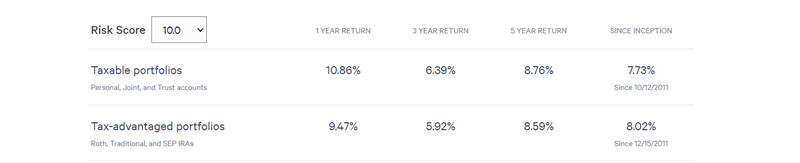

Unlike Acorns, Wealthfront has a minimum investing account. In this case, a customer must invest at least $500 in the fund. The company has an annual management fee of 0.25% of your funds. That means that you will only pay just $1.25 if you invest $500 and a 0.25% expense ratio for ETFs. The chart below shows the average return of an investment account with Wealthfront.

Sample Wealthfront portfolio returns

Betterment

Betterment is a robo-advisor in the US states started in 2010. Over the years, the company has raised more than $275 million from investors. It is valued at slightly below $1 billion and has more than $21 billion in assets under management. Also, it has more than 500,000 customers. In addition to investment accounts, the company offers an interest-yielding checking account and retirement (IRA) accounts.

Betterment is relatively similar to Wealthfront. The only major difference is that the company does not have a minimum balance, meaning that you can invest as little as $100. The firm charges an annual management fee of 0.25%, meaning that you would pay just $25 if you had a $10,000 account.

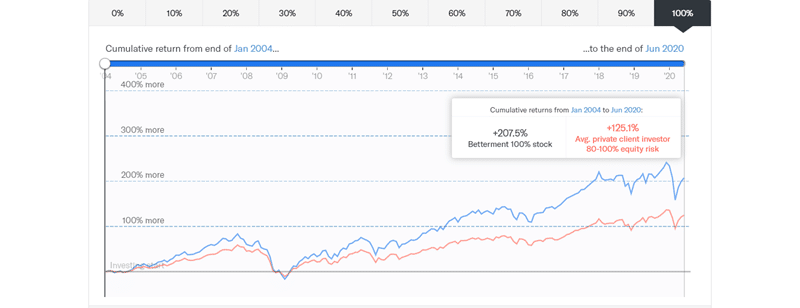

The company charges an annual management fee of 0.40% for clients with more than $100,000. This fee comes with added benefits like in-depth investment advice and access to Certified Financial Planner (CFP). It also offers tax-loss harvesting, which is a process of selling assets at a loss to reduce capital gains tax. The chart below shows the performance of a sample Betterment portfolio invested since 2004.

Sample Betterment returns

SoFi Robo-Advisor

SoFi (Social Finance) is a fintech company started in 2011 to offer financial services to young people. The company’s core products are in student loans, personal loans, mortgages, and insurance services. It started its robo-advisor business in 2017 to offer investment products to its customers. To date, the firm has funded more than $50 billion in loans, has more than 1 million customers, and raised more than $2.5 billion from investors. It is valued at more than $4.3 billion.

The company’s robo-advisor works in a similar way to Betterment and Wealthfront. A user requires to just create an account, answer a few questions about their financial goals, and then the company’s algorithms will recommend portfolios. Unlike the two firms, however, SoFi does not charge any fees for the fees. Instead, it makes money from order flows, meaning that other high-frequency companies pay it for the data. Also, the company does not offer tax-loss harvesting.

Schwab Intelligent Portfolios

Schwab Intelligent Portfolios is a product offered by Charles Schwab, one of the biggest finance companies in the United States. The company has a market cap of more than $45 billion and millions of clients. It also has more than $3.7 trillion in assets under management.

Schwab Intelligent Portfolio allows investors to take advantage of the company’s experience in the investment industry. The robo-advisor builds and rebalances diversified portfolios based on a customer’s goals. These portfolios are based on stocks, commodities, exchange-traded funds, government bonds, and corporate bonds.

Unlike the other firms mentioned, the company has a minimum investment amount of $5,000 and no management fees and commissions.

Final thoughts

There are several benefits of investing in Robo-advisors. They are excellent platforms to diversify your investments. As online-only companies, they are also relatively cheaper compared to traditional advisors, who charge more than 2% every year. Importantly, some advisors are tax-efficient through their tax-loss harvesting features. However, we recommend doing more research before you invest in any advisor. Also, we recommend that you use these firms only for long-term investments.