Aeron trades on multiple currencies and is capable of making profits in a stable as well as a volatile market. The EA has various adjustable settings and requires a 24/7 Internet connection for efficient performance. It trades the market using a custom set of risk management and is subjected to regular updates.

Is investing in Aeron a good decision?

We have gone through the historical data, live records, drawdown, and customer reviews in our review to see if the algorithm is a good investment in the long run.

Company profile

The information related to the company selling products, founding year, and address is not available. This kind of approach is very unprofessional that makes it hard for traders to put their trust in the product. Users can get in contact with the company by sending them an email or via filling out the form present on their website.

Main features

The robot comes with the following features

- It trades on multiple currency pairs.

- Risk management is available.

- The algorithm is fully automated.

- The product is on sale for a limited time.

- Best VPS and broker recommendations from the developer.

How it works

We can use the system with the following steps:

- Purchase the algorithm from their website

- Login to MetaTrader 4 platform using your details

- Bring the algorithm to the expert directory and refresh the page

- Connect the robot with the chart and start trading

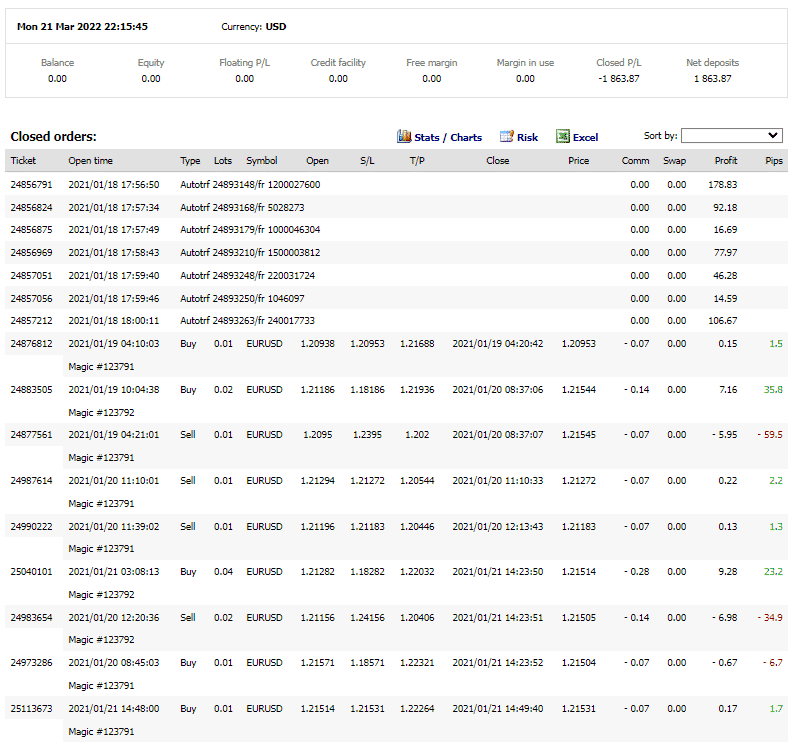

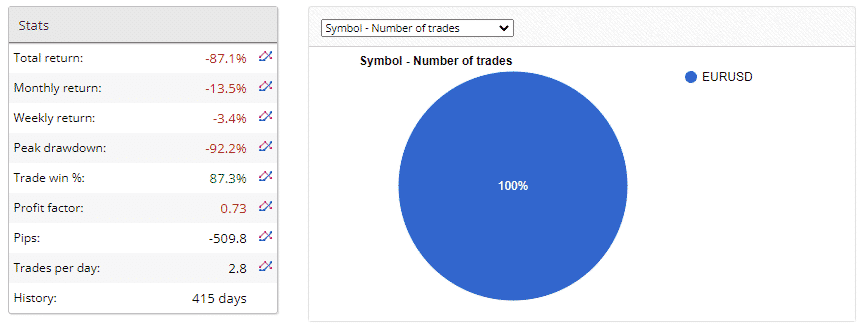

The algorithm uses a combined strategy of scalping and grid that can be customized and is designed to bring maximum and steady profit with minimum risk. It trades on EURUSD, EURJPY, USDJPY, CADJPY, and AUDCAD and places each position with take profit and stop loss. From FXBlue history, we observe that it also implements martingale on trades. The positions with the highest lot size is closed first to cater with the FIFO rules.

Price

The EA is available at $230, which is a bit high compared with other robots in the forex market. Traders can buy the algorithm from the website by clicking on the buy now option via PayPal.

Trading results

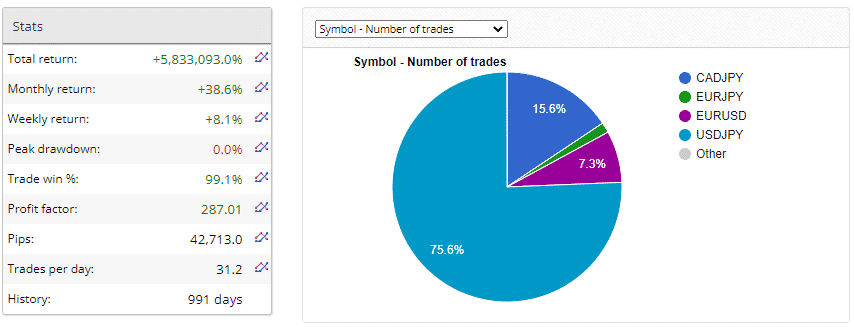

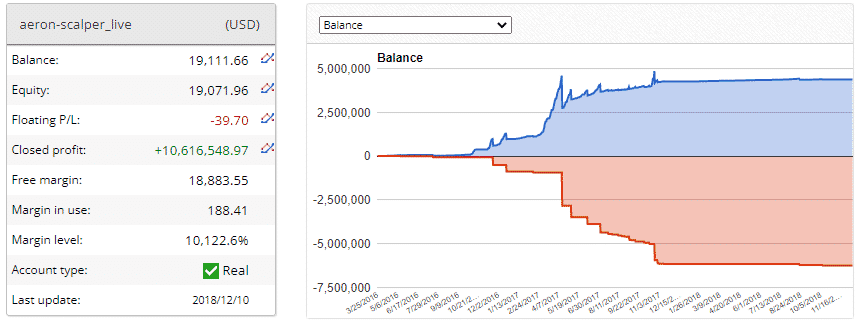

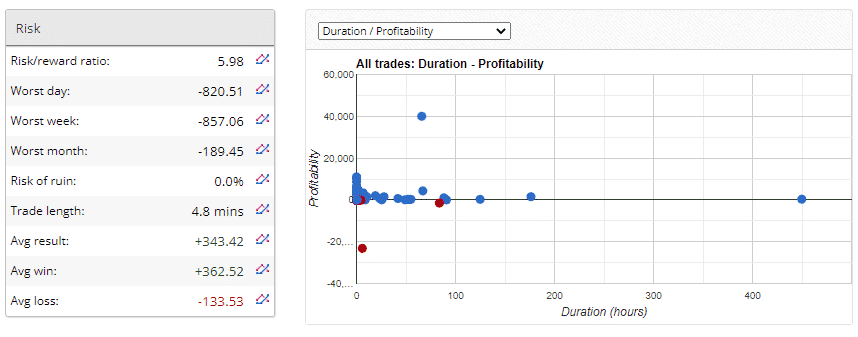

The past trading results of the system are available from March 2016 to May 2018 with a risk to reward ratio of 5. 98. The current balance is $19,111.66 with a floating P/L of -39.70. The stats showed that the total return was +5,833,093.0%, with a monthly gain of +38.6% in 991 days of trades.

The respective trading frequency for CADJPY, EURUSD, and USDJPY is 15.6%, 7.3%, and 75.6%.

Live results

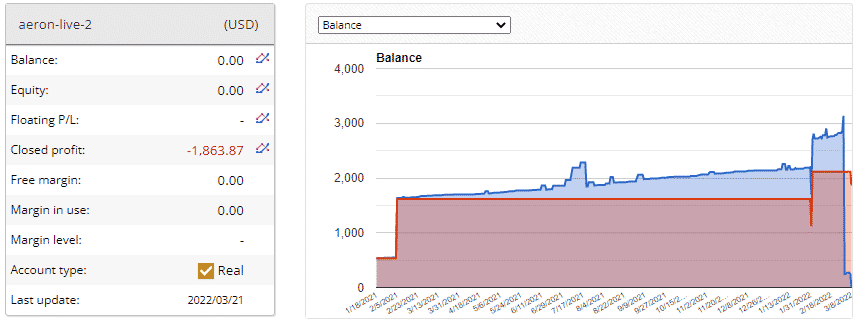

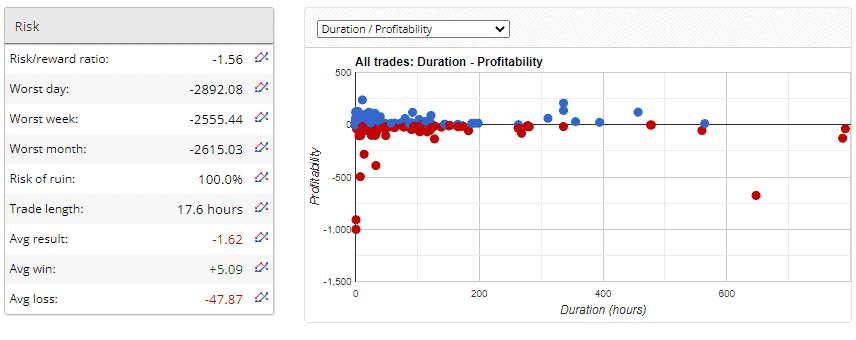

Verified live track records of Aeron are available on FX blue. The algorithm started trading in January 2021 and was last updated in March 2022. The risk/reward ratio is -1.56, which resulted in a total balance of $0. This system participated in made an average of 2.8 executions/24hours for 415 days, from which the total return was -87.1%.

The peak drawdown was noted as -92.2%, with a profit factor of 0.73, highlighting the terrible output. The algorithm has nearly caused a margin call on the account due to the implementation of risky grid and martingale.

Customer reviews

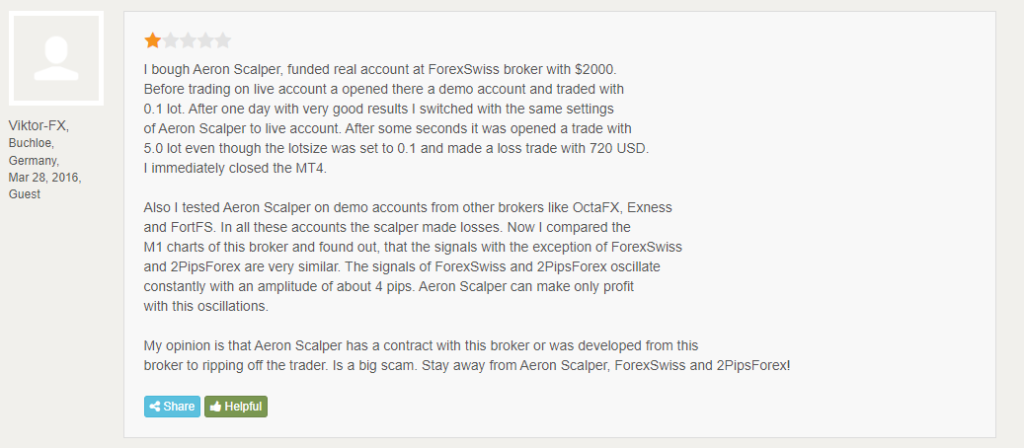

Traders seem unsatisfied with the company as they have a rating of 2.026 for 11 feedbacks on Forex Peace Army. One of the users comments that he traded with 0.1 lot on a demo account and, after getting positive results, transferred to a real account and credited $2000.

Using the algorithm with the same set files as the virtual portfolio caused him a massive loss of $720. He adds that a trade opened with a 5.0 lot even though the lot size was set to 0.1.

The Review

As seen on FX Blue, the Aeron trading system has no backtesting results. The live performance is poor. There is no information on the company profile and a lack of details on the money-back guarantee. The poor feedback on third-party review website Forex Peace Army raises even more suspicions about the product.