Overview:

- ARK Innovation ETF (ARKK) benefits from the three branches of disruptive innovation, namely industrial innovation, genomics, or Web x.0.

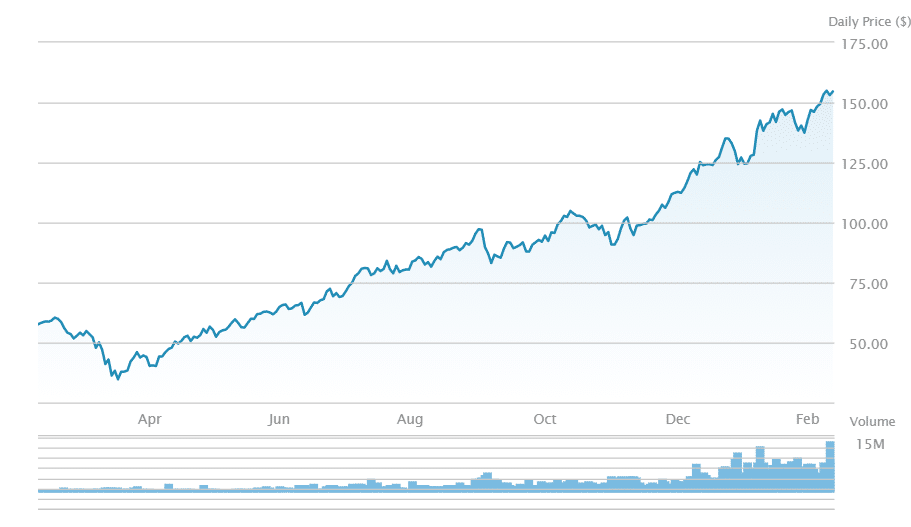

- The price of the ETF has tripled since April 2020, while its daily volume grew from nearly $10 K within the same period to fluctuate between $5.38 and $7.73 as of February 2021.

- 88.8% of ARKK stocks are US-based companies, most of them specializing in technology and healthcare.

About ARK Innovation ETF (ARKK)

Segment: Equity: Global Technology

Official Site: www.vaneck.com

ARKK ETF is focused on three market sectors whose growth was considerably propelled by the increased need for agility in the global pandemic of 2020. As the opportunities for the companies implementing the state-of-art technologies increased across the market segments, the sectors (and stocks) tracked by ARKK were influenced by the new trends and managed to turn the disruptions into meaningful strategies.

The fund comprises the stocks specialized in the following sectors:

- industrial innovation

- genomics revolution

- Web x.0

The ETF scored 4.81 in MSCI ESG, which equals the BB rating. More significantly, it occupied the 6th position in the top 20 best-performing ETFs 2020, its year-to-date return being 148.25%.

| Issuer | ARK |

| Dividend (Distribution Yield) | 1.37 % |

| Inception Date | 10/31/14 |

| Expense Ratio | 0.75 % |

| Market Cap | $122.20B |

| Number of Holdings | 54 |

| Index Weighting Methodology | Proprietary |

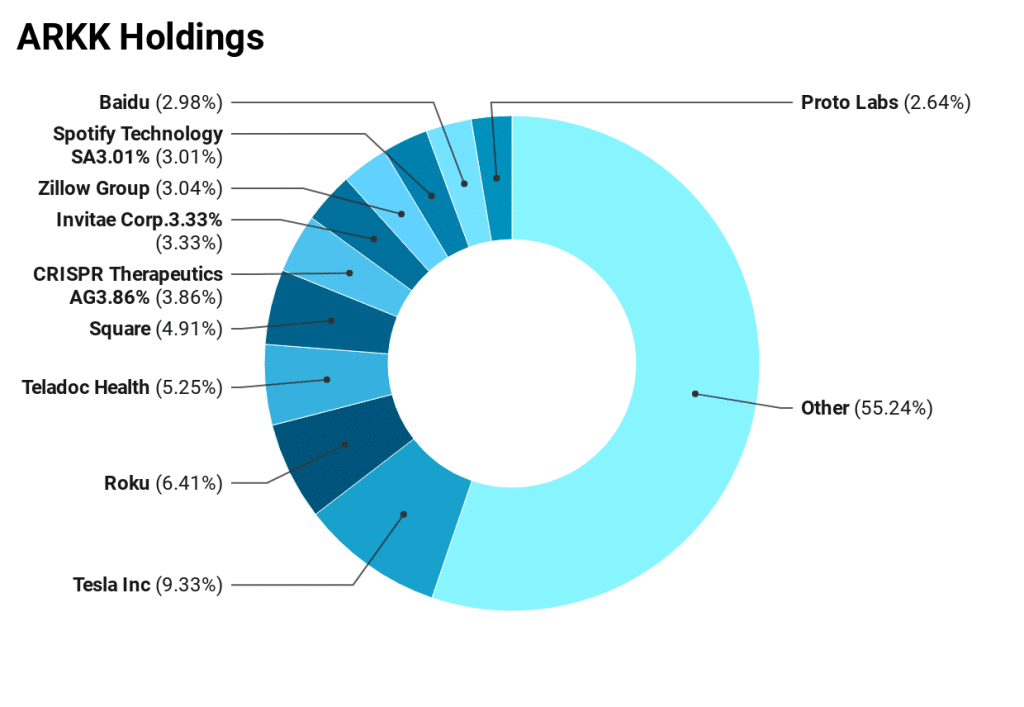

ARKK Top Holdings

Among the equities ARKK offers exposure to are such innovative technology giants as Tesla Motors, Intuitive Surgical, and Alibaba. Disney and Charles Schwab are also on the list, along with other niche technology companies that show high resilience to the new environmental, social, and governance disruptions of the last few years and the pandemic period, in particular.

ARKK is North America-centric while also reaching Asia-Pacific and Europe. 88.8% of the fund holdings operate or have their main headquarters in the US (see the top ten fund holdings in the chart below).

Recent Performance

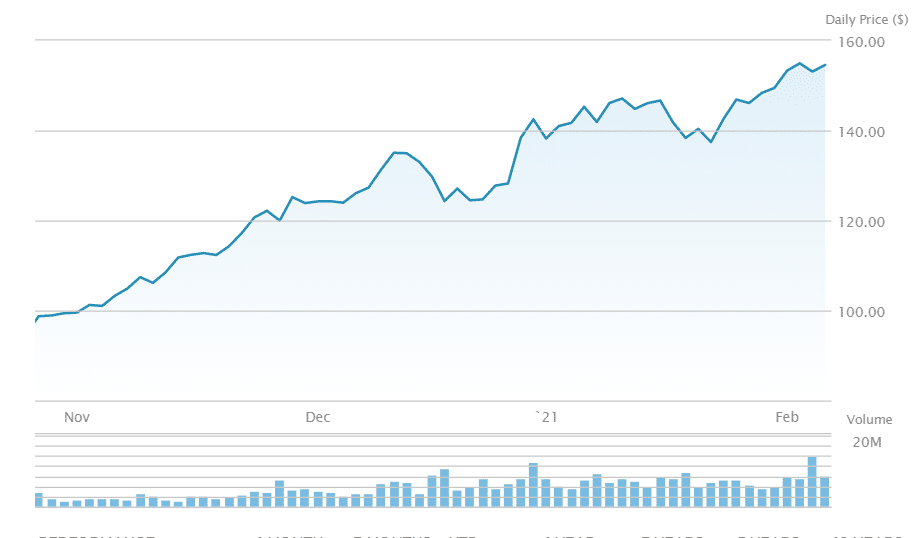

As of February 2021, ARKK has $27.56 bln of assets under management, and its performance has improved in the last three months since November 2020 by 54.64%.

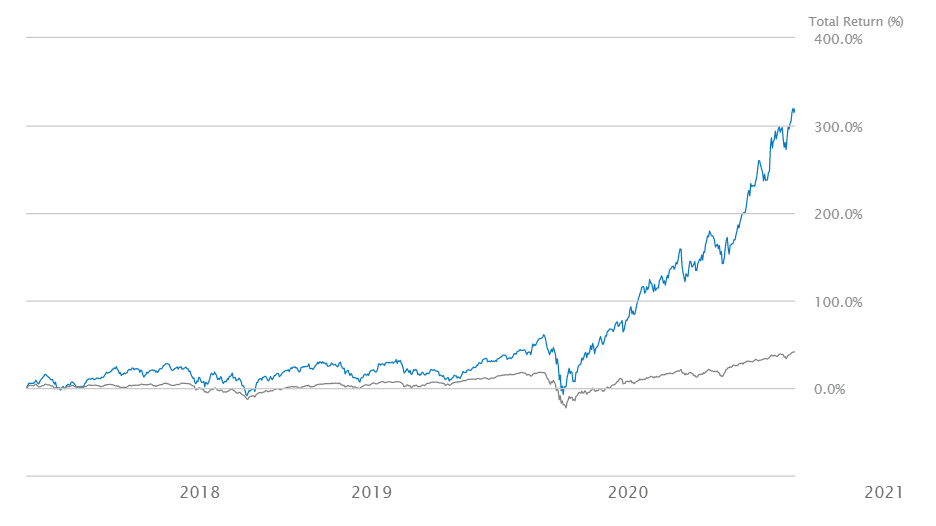

While the daily price looks stable in the long run, with the underlying assets price changing by 57.75% and 57.13% within the last three and five years, respectively, it leaped 167.74% during the period of lockdowns.

The dramatic uprise of the stock prices is evident on the 3-year chart, beginning in late 2019, simultaneous to the spread of the coronavirus pandemic. Still, it has vast unrealized growth potential. Its price is expected to reach $218.485 within a year and $471.006 in the next five years.

2021 Innovations Market Overview

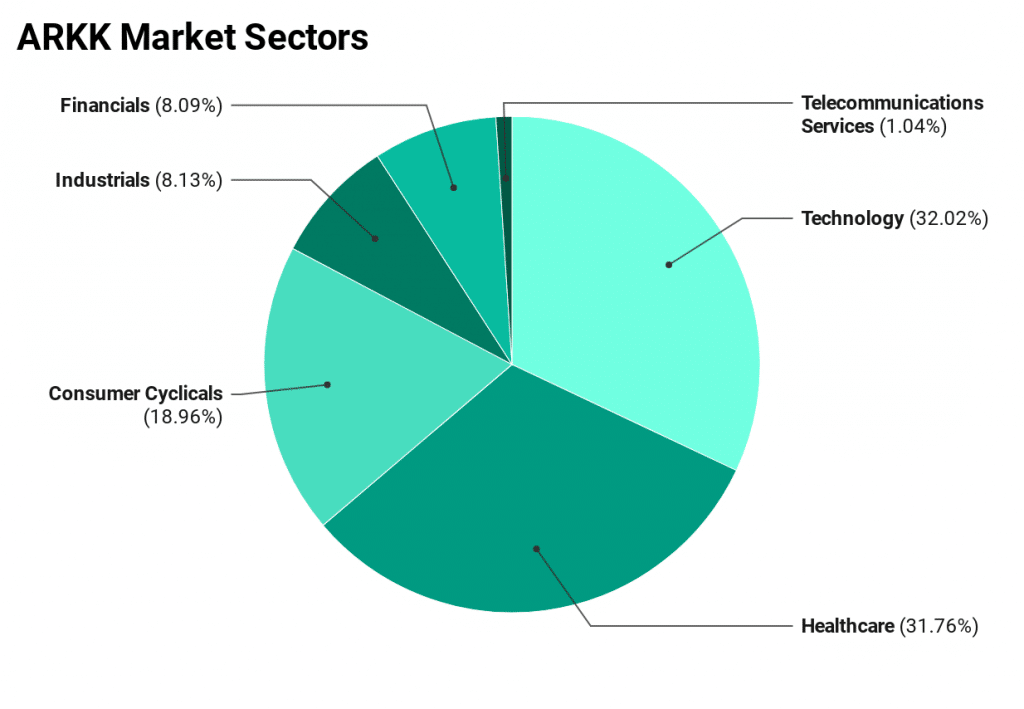

ARKK ETF stocks reach six innovative markets, technology, healthcare, and consumer cyclicals making up the largest of sectors of its holdings. The P/E ratio of each sector in the USA is 42.04, 26.80, and 25.22, respectively.

In the wake of the COVID-19 pandemic, the technology companies that reassessed

their products and operations to forge stronger and more direct relationships with customers were able to adjust their strategies to the new market. The ARK Innovation ETF stocks not only recovered from the pandemic-ensued crisis but were also able to thrive in it.

Such success was due to the fact they focused on three development areas:

- Increasing transparency and responsiveness, and, hence, growing resiliency.

- Cloud, XaaS, and edge computing adoption helping in modernizing capabilities, in general.

- Capitalization on asset valuations with mergers and acquisitions.

While the disruptive technology continues penetrating the market and reshaping the industry, all ARKK with its underlying companies is the tool to get exposed to the hottest 2021 business trends:

- Artificial intelligence

- Human augmentation and extended reality

- Edge, fog, and cloud computing

- Network and connectivity

- Advanced robotics

- Internet of everything

- Big data and analytics

- Security, transparency, and privacy