- AUDUSD is on a rebound after hitting its lowest level YTD in the past week.

- Aussie has been boosted by the rising iron ore price amid hopes of the recovery of Chinese economic growth.

- The US dollar is on a decline with no fundamental justification for further appreciation.

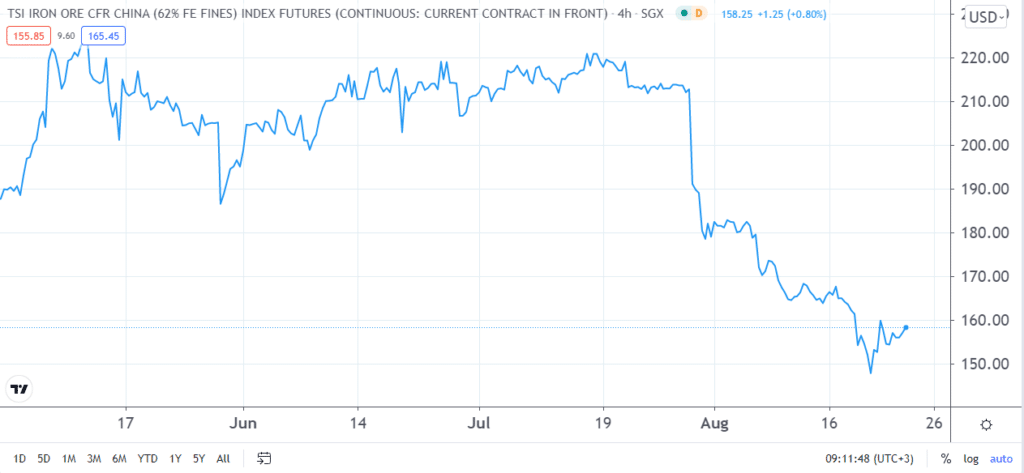

Iron ore prices

As a commodity currency, the Australian dollar tends to react to iron ore price movements. This is founded on the fact that Australia is a key producer of industrial commodities globally. In particular, it is the source of about 60% of iron ore consumed in China’s steel industry. Notably, the Middle Kingdom is the leading producer of steel in the world.

In the past week, the plunging of iron ore prices pushed AUDUSD to its lowest level year-to-date. At that level, it had fallen by about 40% since mid-July. The move was a reaction to heightened concerns over Chinese demand. Based on Morgan Stanley’s observations, the commodity has never recorded such a fast and deep fall since the establishment of its spot price 13 years ago.

While the demand concerns continue to curb its gains, the iron ore price is on a rebound amid hopes on the recovery of Chinese economic growth. The country’s central bank – The People’s Bank of China (PBOC), has pledged to stabilize the supply of money and credit in an attempt to boost businesses and the economy at large. Subsequently, iron ore futures in Singapore have rebounded by close to 7% since Thursday to the current $158.25 per tonne.

Besides, Australia’s retail sales are scheduled for release on Friday. Analysts expect a reading of -2.3%, which is lower than the previous month -1.8%. A lower-than-expected figure will likely act as a bearish catalyst for AUDUSD.

Weakening US dollar

AUDUSD is also reacting to the declining US dollar. After hitting its highest level YTD on Friday, the dollar index has plunged by 0.79% to its current level of 92.98. Analysts at Commerzbank have indicated that based on the fundamentals, the US dollar does not have much room for further appreciation.

In the ensuing sessions, AUDUSD will be reacting to details from the Fed’s Jackson Hole meeting scheduled to start virtually on Thursday. Investors will be looking for cues on when and how the US central bank will taper its asset purchases.

Last week, FOMC meeting minutes highlighted the Fed’s plans to start tapering the asset purchases before the end of 2021. However, the reduction will not be a precursor of hiking interest rates. At the same time, Wednesday’s data on US durable goods orders will impact the pair. For the remainder of the week, investors will also be keen on the US GDP preliminary data, initial jobless claims, and PCE price index.

AUDUSD technical outlook

AUDUSD is consolidating around 0.7250 after the three-day surge. In the previous week, the currency pair was on a downtrend that saw it hit its lowest level year-to-date of 0.7106. At that level, it was in the oversold territory with an RSI of 22.

However, in the new week, both the fundamentals and technicals have helped boost the pair. Notably, it has rebounded by about 1.92% since hitting Friday’s low. At the time of writing, it was down by 0.2% at 0.7243. On a two-hour chart, it is trading slightly above the 25 and 50-day Exponential Moving Averages with an RSI of 58.

In the near term, AUDUSD will likely trade within a rather tight range as investors await further cues from the Fed Chair’s speech during the annual Jackson Hole meeting. If that happens, the horizontal channel’s borders can probably be along with the 25-day EMA at 0.7224 and Tuesday’s high of 0.7269.

The bears may manage to push the prices past the lower border to 0.7200 before rebounding to the 25-day EMA. On the flip side, the bulls should be eyeing the prior resistance level at 0.7300.