Automation of Forex workflow is gaining traction as traders continue to explore ways of remaining competitive in the 4 trillion dollar market. The automation has been made possible by forex expert advisors, among other tools, and comes hot on the heels of equity traders upgrading their trading tools as well.

An automated approach to the management of FX workflow is already proving to be transformational to companies and traders around the world. Automated systems are making it easy for firms and traders to keep track of cash flow, let alone engage in forex trading or monitor bank accounts.

Modern treasuries are also increasingly automating FX workflows through the integration of execution management systems to internal systems. Likewise, Forex exposures are electronically uploaded into execution platforms whereby forex expert advisors automate the entire process of orders execution.

Systems and tools designed to automate the entire forex trading process are increasingly taking over as traders seek to remain competitive and generate a significant amount of profits in the FX market. Likewise, FX Expert advisers used in automating FX workflow have made it possible for traders to automate order staging.

Gone are the days when traders had to spend hours glued to the screen in pursuit of trading opportunities. Automated trading made possible by FX EA has come into play, consequently automating trade orders execution as well as post-trade processes.

New Technologies For Automation

Emerging technologies such as machine learning and artificial intelligence are also finding their way into the forex market. A good number of automated forex trading systems are leveraging the two revolutionary technologies, all in the effort of enhancing accuracy when it comes to detecting trade opportunities in the forex market.

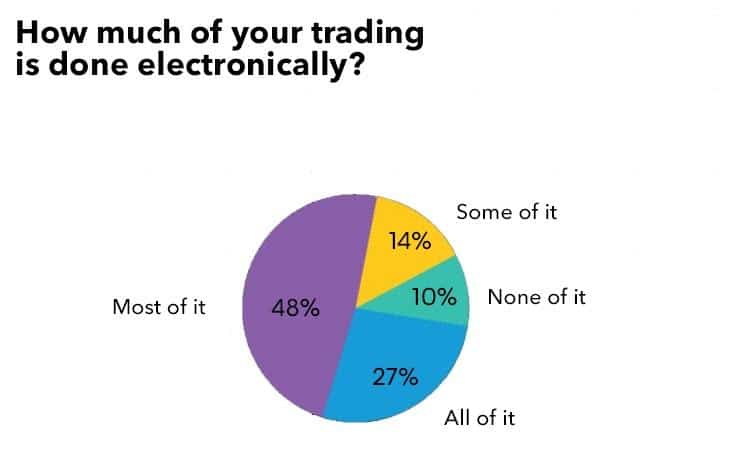

With more than three-quarters of forex investors trading electronically, competition among platforms is increasingly heating up. In a bid to stay competitive and attract a huge clientele base, platforms are having to add support for various systems and tools that automate FX workflow.

Currency traders are opting for platforms that allow them to leverage various automated FX trading tools as they seek to gain an edge in the market. The adoption of new technology should continue to gain traction, especially among firms saddled with older legacy systems.

By leveraging new technology in a bid to automate FX workflow, currency traders and companies are increasingly gaining a distinct advantage over competitors. Likewise, the traders and companies are finding it easy to interact with the market in addition to gaining a more accurate view of market conditions. Consequently, traders are finding it easy to make precise investment decisions when it comes to trading currency pairs.

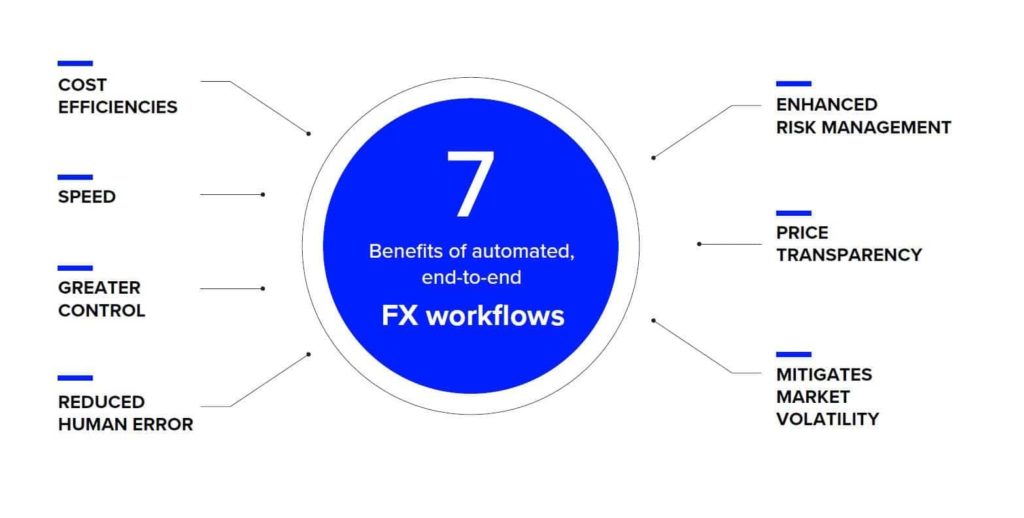

Benefits of Automating FX Workflow

Automating FX workflow goes a long way in accelerating the pace of operations. The result is improved cost efficiencies and reduced risk. In this case, traders and treasuries can quicken how forex trades are managed and executed. Similarly, automation can help fuel, operational efficiencies, crucial to bringing about gains as well as double figures ideal for eliminating human errors, among other risks.

Automated trading also takes away emotions when it comes to trading, consequently allowing traders to make decisions that are devoid of feelings. Conversely, automation will enable traders to continue participating in the market even when they are dead asleep.

Automating FX workflow has allowed traders and treasuries to free up time instead of having to spend hours glued on the screen. By freeing up time, traders can focus on other activities that add value while also pursuing opportunities in the forex market, thanks to automated trading.

Automation of FX workflow through tools such as f FX Expert Advisors allows traders and treasuries engaged in forex trading to get real-time pricing updates ideal for supporting trading decisions. The automated real-time pricing updates may include information on spot rates across various currencies. The availability of real-time information makes it possible for traders to anticipate market movements and sentiments.

The use of electronic trading platforms has allowed treasurers engaged in forex matters to issue multi-bank Request for Quote across multiple currencies. By doing so, treasurers are not only able to access the best Forex rates, but the same prompts banks to be more competitive and transparent when it comes to pricing.

Likewise, sophisticated traders can leverage advanced order types as well as leverage algorithmic trading to match the pricing of various instruments. Also, a trader can set trade limits, consequently limiting the amount of loss that a trader can generate on a given trade.

Automation with the help of Forex Expert advisors has, to a great extent, reduced the pressure on treasurers as well as traders. The two no longer have to prove that they have gone with the best available execution price when carrying forex trades. Automated forex trading systems have simplified the process of having to scan the markets for the best prices to enter trades.