It is almost cliché now, but the phrase “investing for posterity” will never stop making sense. From Benjamin Graham to Warren Buffet, the mantra never changes; you have to invest but learn to invest smartly. Smart investments are what distinguish investors who end up with fatter bank accounts from those who stagnate. One of the best ways to stay on top of the game is to put your money in mutual funds.

Here is a little primer on mutual funds

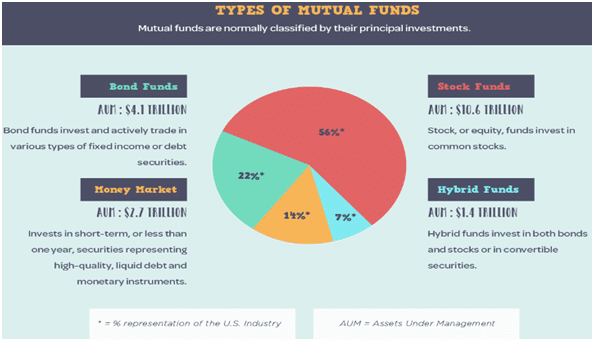

A mutual fund is an arrangement where investors pool their money to buy securities. Usually, this arrangement benefits small-scale investors who would not be able to make such purchases single handedly. The pooled funds provide enough liquidity to take more significant positions of securities such as bonds, stocks, corporate bonds, and more. Interestingly, the pooled funds go into a managed account monitored by a professional portfolio manager.

The individual securities that a particular mutual fund buys add up to form the fund’s portfolio. Specifically, the total value of the portfolio is just the sum of the individual securities. Since the fund simply buys the securities of an exchange, it is safe to say that none of them belong to the fund. Therefore, instead of you buying individual stocks, bonds, or any other security, all you need to do is buy a stake in the fund.

Why should you invest in mutual funds?

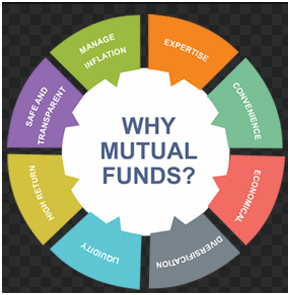

Mutual funds offer the safest investment vehicle, particularly for retail investors. It is because they lack enough funds to diversify their portfolio sufficiently. Further, retail investors may not have enough time and resources to dig into the market for the best trading opportunities.

Fortuitously, mutual funds have portfolio managers that make critical decisions concerning trades. Usually, the portfolio managers are highly trained, highly skilled professionals that have long years of experience in the market. Besides, each portfolio manager has a battery of researchers to back up whatever decision that goes down.

In addition to the professional supervision of the managed accounts, investors access convenience, and unprecedented liquidity. Often, funds allow investors to sell or buy a share into the fund based on the prevailing net asset value (NAV).

The kind of liquidity in mutual funds is close to that in the forex. Usually, automated forex trading allows you to enter and exit the market whenever you want, even in just minutes. It makes mutual funds a safer bet for investors who are not ready for the volatility of forex.

The methodology of our best picks

As you may be aware by now, there are many types of mutual funds to invest in out there. Each of the funds has its upside, whose suitability depends on your objectives. In this case, we picked funds that have exposure to long-term high-growth industries like biotech and healthcare, and technology and software. The third group of funds we picked give exposure to large-cap growth stocks. Lastly, we picked the best balanced mutual funds for this year.

Technology and software funds

1. Fidelity Select Software & IT Services Portfolio

It is one of the best performing funds in the market. Interestingly, this fund has topped the market since it went live. It would help if you were excited because this stellar performance will only improve given the centrality of technology in future transformations in all industries. More interestingly, conglomerates like Apple, Adobe, Visa, and Microsoft are part of this fund’s portfolio. In the last one year, the fund returned 38.87% and has an average return of 16.24% since inception. Besides, you will experience expenses of just 0.72%.

2. Columbia Global Technology Growth Fund Class A

The fund stands out right next to Fidelity Select Technology based on its performance. Also, the fund has a return of 3.06% since 2020 started. Further, Columbia Global Technology has outperformed the technology market consistently in the last decade. The most recent expense ratio was a mere 1.24%.

Funds with exposure to long-term high-growth industries

1. Vanguard Health Care Fund Investor Shares

Except for the slump experienced in 2007/2009 during the Great Recession, this fund has provided incremental returns since inception. The entire portfolio of this fund consists of healthcare stocks but with a strong bias towards biotech. Notably, the fund has outperformed the S&P 500 for decades, with an average annual return of 16.18%. However, the shorter-term return of the fund is lower at 8.8% against the S&P 500’s 11.7%.

Balanced mutual funds

1. Hussman Strategic Total Return Fund

The minimum capital outlay needed for investing in this fund may be high, but it is the best for less risky investors but who have an appetite for high returns. John Hussman, the man behind the fund and its principal manager are legendary for constructing portfolios that consistently beat inflation. Mostly, this fund is a hedge fund of sorts, given its reputation. However, you need at least $1,000 to buy into the fund.

2. Vanguard Balanced Index Fund Admiral Shares

This fund invests in bonds and stocks where bonds take up 40%, while stocks take up 60%. Notably, the moderate allocation of funds ensures that the portfolio can beat inflation in the long term. Willing investors must arm themselves with at least $3,000 in initial investment.