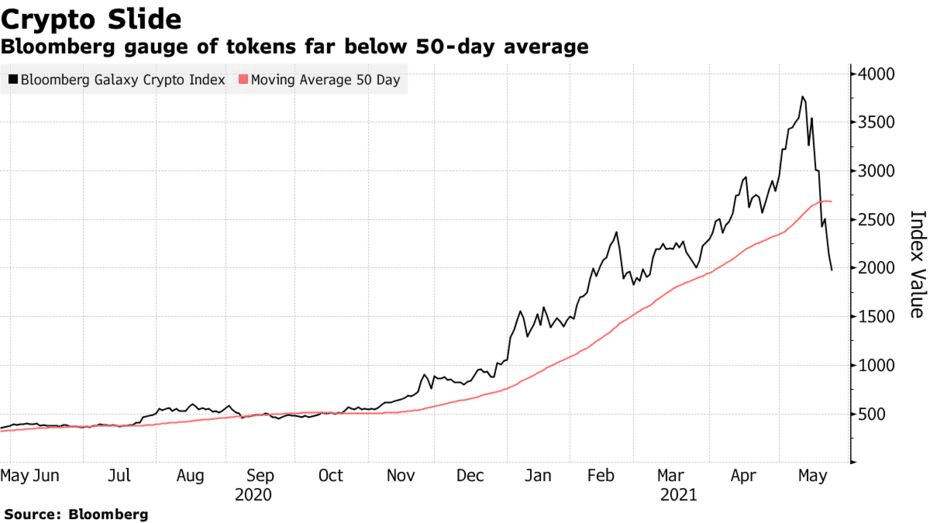

The world’s largest digital coin could continue to slide as the selloff is not yet definitively over, Bloomberg reported.

- For JPMorgan Chase & Co., it is still too early to call the end of the selloff due to the confounding movement and the shortage of buying in Bitcoin funds and regulated futures.

- Goldman Sachs strategists pointed out an assortment of trends such as the ‘flippening’ or Ethereum taking over from Bitcoin, which could prove to be a challenge for institutional investors.

- Goldman’s Global Head of Digital Assets Mathew McDermott said the firm is eyeing offerings related to the crypto space, such as “fund or structured note-like products.”

- Medley Global Advisors Managing Director Ben Emons said Bitcoin is now cementing its position in markets through volatility, liquidity, and correlation.

- RBC Derivatives Strategist Amy Wu Silverman said that Bitcoin had performed better than Tesla Inc., the SPDR S&P 500 ETF Trust, or Invesco QQQ Trust Series 1 in terms of risk-adjusted returns.

BTC/USD is up 8.85%, while ETH/USD is up 18.04%.